How US Rates Hike Affect SMEs

Table of Contents

The US Federal Reserve (Fed) is expected to start "rates tapering" before the end of 2021.

This essentially signals the rolling back of massive fiscal stimulus during the Covid-19 pandemic which saw the Fed propping up support to financial markets with bond purchases of at least $120 billion each month.

How does this affect local SMEs? For one, cost of business loan in Singapore is expected to increase.

There are several other ripple effects the Fed rates hikes might have on our SMEs which we’ll discuss below. Before that, why would US increase their federal fund rates when the pandemic is still roiling public health and financial markets despite?

The committed bond purchases which added more than $4 trillion to the Fed's balance sheet helped keep interest rates low via quantitative easing throughout the pandemic. This helped to support credit markets and coincided with a stock market bull run.

However, with the US job market's employment situation stabilizing and coupled with inflation fears, the Fed targets to gradually unwind the massive quantitative easing exercise from end of 2021 through to mid 2022.

The multiple rounds of QE from the US and later the central banks of some of the world’s developed economies flushed the global market with cheap money by lowering borrowing costs.

This monetary policy was pursued to kick start the free falling economy amidst the economic wreckage caused by Covid-19. Assets valuation soared during this period as money supply flooded financial markets.

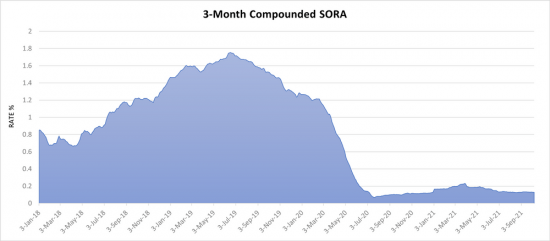

Closer to home, our domestic benchmark interest rate SORA (Singapore Overnight Rate Average) has largely moved in tandem with US rates.

Source: MAS

If the Fed deems that jobs growth indicators are positive in the near to mid-term, there would be no impetus for them to continue keeping rates low which was intended to encourage US businesses to borrow for investment and expansion, creating jobs in the process.

The Fed’s move to increase rates was not an unexpected one and most financial analysts were expecting the tapering announcement.

A common policy tool that central banks will adjust levers on to keep inflation fears in check is increasing benchmark interest rates. By gradually increasing rates, central banks attempt to slow down inflation and prevent over heating of the economy.

As the world’s biggest economy and Singapore’s third largest trading partner as of 2020, how will the Fed rates hike affect SMEs in Singapore? And how should small businesses react to these impacts?

Higher business and property loan interest rate

The most obvious and direct impact US rates hike would have on local businesses would be an expected increase in SME loan cost of borrowing. As our domestic SORA rate is closely correlated with the movement in US interest rates, it does not take an economics professor to deduce higher business loan interest rate locally.

For SMEs whom are servicing business property loans for their business premises, they might find their mortgage instalments increasing from 2022.

Most companies’ property loans are variable rates package tied to bank’s board rates or SORA rates as reference rates. These variable rates packages would have served the companies well for the past 2 years as interest rates remain subdued at historical lows.

If interest rates begin to “normalize”, companies might see their property loan instalments spike up significantly in the near future. In perspective, the 3-month compounded SORA rate was at 1.75% as recent as July 2019. In October 2021, 3-month compounded SORA was about 0.13%.

The Temporary Bridging Loan introduced in Budget 2020 provided a bridging facility for SMEs to tap into low interest funding during the pandemic. This program is expected to end in March 2022 and cost of financing for SME loans will be expected to increase significantly by then.

SORA rate

A note about SORA rate. SORA (Singapore Overnight Rate Average) is the volume-weighted average rate of actual borrowing transactions in the unsecured overnight interbank SGD cash market in Singapore.

It is commonly used as a reference rate to benchmark domestic loan products such as property loans.

SORA will be the new benchmark rate to replace SIBOR (Singapore Interbank Offer Rate) when it is eventually phased out in 2024.

In view of the expected increase in property loan interest, SMEs whom are still servicing commercial/industrial property loans pegged to SORA can explore fixed rates property loan packages when their current property loan is out of the current financier’s lock in period.

Although banks will generally place a premium on fixed rates packages which is priced higher than variable rates, SMEs might consider refinancing their property loans to fixed rates to hedge against rates volatility and uncertain times ahead.

A fixed monthly instalment with assured rates will enable the SME owner to plan and manage cash flow ahead. Receiving letters from the bank informing of property loan instalment increase every quarter will only add to uncertainty.

Apart from property loans, unsecured business loan interest rates might trend upwards as well. With increase in interest rates, SMEs face a double whammy of higher financing costs amidst an uncertain and volatile market post Covid-19.

We encourage eligible businesses to lock in financing under government assisted financing schemes such as the SME Working Capital Loan which typically bears lower interest rate.

Facing higher interest rates and restrictive access to financing, SMEs can instead tap on other non-mainstream ways to access financing including crowd funding and government aided financing schemes.

Alternatively, SMEs can make direct comparisons through loan comparison portals to source for the most optimized loan options available.

Slower VC funding for startups

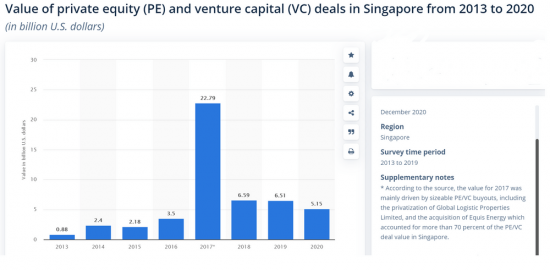

The startup scene is Singapore has been heating up in recent years. Singapore is a leader within South East Asia region in attracting venture capital investments.

Singapore startups attracted over three quarters of the region's venture capital in 2019. In 2020, despite the challenges posed by Covid-19, Singapore managed to draw in $5.5 billon of venture capital investments.

Picture source: Statista.com

The impending interest rates hike however could slow down the growth of VC funding in the region. Traditional brick and mortar SMEs rely on business loans as main source of financing while startups typically raise financing via VCs due to the dearth of business loan for startup available in Singapore. They should be slightly more insulated against interest rates hike but the ripple effect will play a factor in the VC fraternity as well.

It’s no coincidence that most of the billion dollar technology firms in recent history like Uber and Snapchat existed only after the 2008 financial crisis where benchmark interest rates were at almost zero.

In the low interest, low yield environment from 2008-2015, technology startups attract hot money like bees to honey. Startups have the potential to grow fast with a prospective high yield exit and are an attractive option in an environment where attractive yield finds are barren.

However, with the prospect of an interest rate increase, speculative hot money flowing into startups will likely slow down. Investors might also channel funds into fixed income or dividend paying equities which offers a more attractive alternative to riskier startup bets.

This will all mean that SME startups that have no problem raising multiple series of funding previously during the boom years might see capital liquidity drying up. To deal with this potential market correction, startups can try to cut non-core expenses, turn cash flow positive in a shorter time or raise funds at lower valuations.

Another alternative to VC money is seeking funding through startup grants from the government such as the ACE startup grant, PSG grant or other government assisted financing schemes.

Ultimately, there is no stopping the technology revolution worldwide that is at full momentum now. Startups that can demonstrate the potential to deliver a viable product with means to scale substantially will find no lack of funding suitors.

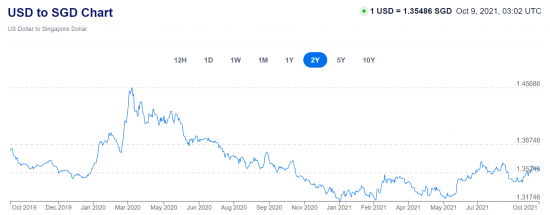

US dollar appreciation against Singapore dollar

Forex markets have started to price in the Fed's tapering and US dollar begun appreciating against the Sing dollar from July to August 2021.

At this time of writing (9 October 2021), USD/SGD is at 1.354.

Photo credit: XE.com

If the Singapore dollar weakens as a result of the appreciating USD, local exporters can find some relief from the current economic slowdown. Our exports will become more competitive and manufacturing activities might see some tailwinds.

Inversely, for the smaller number of SMEs whom are net importers of goods priced in USD, the depreciating SGD against USD would be negative for trade. The adverse effects of USD’s appreciation would be negated for these companies however, if they are selling their end products overseas also in USD, forming a natural currency hedge.

But for SMEs whom import in USD and sells locally in SGD or overseas in other currencies, the stronger USD might affect gross margins and profitability as it cost more per unit of purchase now.

For businesses that might be affected by such foreign exchange movements, it is best to hedge against their forex exposure to minimize volatility. Most banks will provide FX (forex) line for companies with trade financing (LC/TR) credit lines to hedge against cross currency exposure.

Companies whom buy and sell in different currencies can utilize the FX line to purchase forward or spot contracts to hedge against their foreign currency purchases. Alternatively, non-bank service providers such as Western Union can also offer FX hedging solutions.

Domestic sector slow down

SMEs that are narrowly focused and reliant on the domestic sector might experience a slight slowdown in their revenue figures following the Fed rates hike.

An increase in domestic interest rates will have an indirect impact on local retailers and F&B players in the mid to high end segment.

When the banks move to increase interest rates, property loans which form the largest component of household debt will see an increase in monthly mortgage servicing. With a higher property loan instalment, households will have lower disposable income at the end of the month and discretionary purchases might drop.

Local retailers and F&B restaurateurs might see a further drop in revenue and lower demand of consumption could lead to a slight contraction in domestic economy activity.

SMEs in the construction trade will likely be affected as well by the rates hike. With higher borrowing costs, local property purchases which are usually leveraged with mortgages might go south.

Property investors buying for rental yield might also defer their investment decisions as property yields are compressed with higher interest. These investors might divert their resources instead to fixed income bonds or securities as bond prices typically have an inverse relationship with interest rate.

With the real estate industry and developers in a doldrums, SMEs in the construction industry further down the supply chain such as sub-contractors and building materials distributors will be negatively impacted.

What can SMEs do?

For SMEs in these segments, all is not doom and gloom. During lean times, SMEs can take this opportunity to further improve their productivity and undertake simple cost rationalization exercises.

Small retailers could move part of their business onto e-commerce platforms or create their own web stores to reach out to more consumers. Available off-the-shelf technologies such as RFID and inventory management software could also help identify product trends and prevent overstock.

F&B restaurant owners can tie up with food delivery app players to reach out to a bigger consumer market. Certain manual processes in the kitchen could be eliminated with investment in automated kitchen equipment. Self –ordering menu software or apps and digital payment options could also reduce the number of waiting staff and shorten ordering to kitchen turnaround time.

Similarly, SMEs in the construction industry could also relook into their current workflow and think up of new process that could reduce reliance of manual manpower. Prefabrication is one area where the authorities are investing much resource on for the local construction industry. Certain tools and equipment could be deployed to reduce manual labor.

Summary

In conclusion, the impending US rates hike is not an entirely negative event for Singapore SMEs. By moving benchmark interest up, the US is confident its economy has moved on from the malaise of the pandemic.

If the world’s biggest economy is recovering, there would be higher aggregate demand for Asia’s goods and services. Should the US economy could take on the key engine driver role for the global economy’s recovery which remains sluggish now, Singapore’s economy might benefit from the spill over effects. There are still opportunities in a slowdown for nimble SMEs to take advantage of.

Also, it remains uncertain if the Fed would phase in the proposed rates hikes. This is especially so if another major external event such as a debt crisis in China’s economy occurs or if US job market falls short of the Fed’s target.