Commercial Business Property Loan

There are over 50+ banks and financial institutions offering business commercial property loans in Singapore. Your business can finance the purchase of a commercial or industrial property with a property loan, or to refinance an existing loan with better terms.

How much can you borrow for a business property loan?

Maximum LTV (loan to valuation) for most banks is typically between 80% to 90% of the property’s valuation or purchase price, whichever is lower. This is subjected to banks’ credit assessment.

For residential property loans, MAS (Monetary Authority of Singapore) has prescribed a standard set of TDSR (total debt servicing ratio) and LTV regulations all FIs (financial institutions) have to comply with when underwriting residential property loans.

For industrial and commercial property loans, credit assessment is more subjective compared to residential property loans. MAS does not mandate lenders adhere to a specific industry lending guideline. Banks can apply their respective credit criteria when assessing business loans for property.

Factors that lenders consider when determining your maximum loan limit include business's operating history, annual revenue, financial figures, profile of property being financed, as well as cash flow strength.

Tip: Some banks can extend 100% or even up to 120% LTV financing. This is done via a package of mortgage loan (usually 80% LTV) and unsecured business term loan to finance additional 20% to 40% LTV.

Businesses can also apply for an unsecured loan from another bank concurrently with a mortgage application with their main bank, to finance up to 100% of property’s purchase price.

This essentially does not require the business to put down any deposit for the purchase.

We do not encourage excessive borrowing and leverage should be exercised prudently. Speak with a competent SME loan consultant for risk management planning.

Banks usually grant a higher LTV for properties (80% to 90% LTV) intended for business’s own usage. For investment properties (i.e. leasing out for rental income), maximum LTV is usually 60% to 70%.

Commercial property loan interest rate

Commercial property loan interest rate is between 2.8% to 3.2% p.a.

Banks usually offer floating rate packages, also known as variable rates. Rates quoted typically consist of a reference rate or benchmark rate, plus bank’s margin or spread.

This reference rate is transparent and published publicly. Examples include banks’ fixed deposit rate, cost of funds rate, board rate or the more commonly used 3-month SORA rate.

A common variable rate offer could look like this:

Year 1: 3-month SORA + 1%

Year 2: 3-month SORA + 2%

3-month SORA would be the reference/benchmark rate in this case, and 1% in the first year would be the bank’s margin/spread. If assuming the 3-month SORA at the point of application is 2.5%, your total interest would be 3.5% p.a. In the first year of the loan.

Aside from floating rates, there are also fixed rates packages where interest rates are fixed throughout the lock in period (usually 2 to 3 years). Due to the impending cuts in US Fed rates, fixed rates packages have come down to as long as 3.2% p.a. and lower than most floating rate packages.

Usually, fixed rate loans would be higher than floating variable rate loans, due to the certainty provided. The current situation where fixed rate loans are lower than floating rates is not common. This is somewhat similar to an inverted yield curve situation, and likely triggered by the US Fed's rate hikes few years back.

Loan tenure and repayment period

The maximum loan tenure repayment period for commercial property loans is 20 to 30 years.

However, the remaining lease left on the commercial/industrial property if it’s leasehold will affect banks’ loan tenure granted.

Most financial institutions will require a minimum of 5 to 10 years leasehold remaining after the end of loan tenure.

If the property’s lease remaining at the point of purchase is 20 years, then most banks will only be able to extend a maximum loan repayment period of 10 to 15 years.

Commercial and industry property buyers should factor in the remaining leasehold of their properties when planning financing. A shorter repayment period due to short leasehold tenure remaining will result in higher monthly loan servicing installments.

Benefits of purchasing your own property for business owners

Owning the property where one operates can be a valuable asset for a SME. While this investment entails high upfront CAPEX costs, businesses that own their properties might benefit in the long run.

Improved liquidity and cash flow

Property ownership could benefit businesses by functioning as equity loan collateral, which then allows them to obtain more working capital loans if there is sufficient loan-to-valuation buffer.

SME loans with property backed as collateral is also one of the cheapest forms of financing in Singapore. Interest rate is lower for asset backed loans compared to unsecured loans.

This additional cash flow can be used to address various business needs such as expanding staff count, upgrading equipment, or investing in productive technologies.

More control over property usage

While renting can give businesses more flexibility and lower CAPEX, SMEs can find themselves having to deal with strict rules set by landlords when using rented commercial spaces. Restrictions could be imposed for renovations, changing utility companies, or on inventory storage.

Owning your business property grants you more autonomy to equip and modify your workspace to serve your business purpose.

Tax savings

Businesses should consider the impact of corporate tax in Singapore on their property holdings, as Singapore's tax policies offer deductions on interest and property-related expenses, helping companies optimize their tax position.

Mortgage interest is tax deductible expenses and property depreciation could be eligible for capital allowances claims.

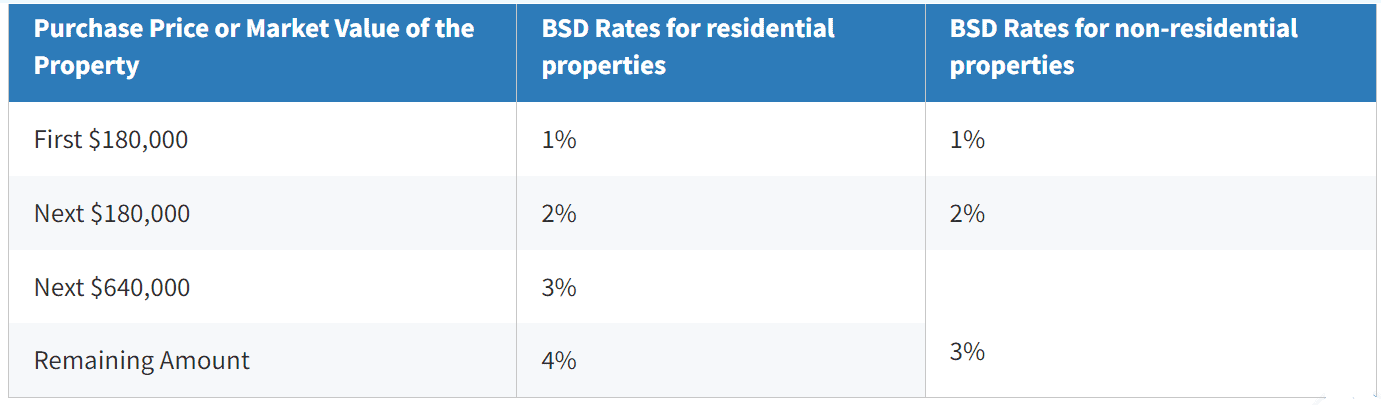

Buyers of non-residential properties pay up to a max of 3% stamp duty, while this goes up to a max of 4% for residential properties. Further, unlike residential properties, there is no additional buyer’s stamp duty imposed for purchases of the second or subsequent non-residential property.

Types of industrial and commercial properties

Retail Properties - Typically strata title retail properties in older shopping malls and HDB heartland shops.

Industrial Properties - Industrial properties are mainly factory and warehouse spaces (under B1 classification), heavy industry factory spaces zoned B2, and industrial parks.

Commercial Properties - Includes properties used for offices, retail, business parks, etc.

There are also other niche non-residential properties subsets such as medical suites, HDB shophouses with residential areas and conservation shophouses.

There are certain niche subset of property types that some banks are not able to finance, such as JTC properties. Shophouses zoned as mixed commercial and residential are also tricky, as the residential component might trigger relevant additional buyer's stamp duty and regulatory lending restrictions.

Different banks have varying credit policies and risk appetite for various asset types.

Investment holding company

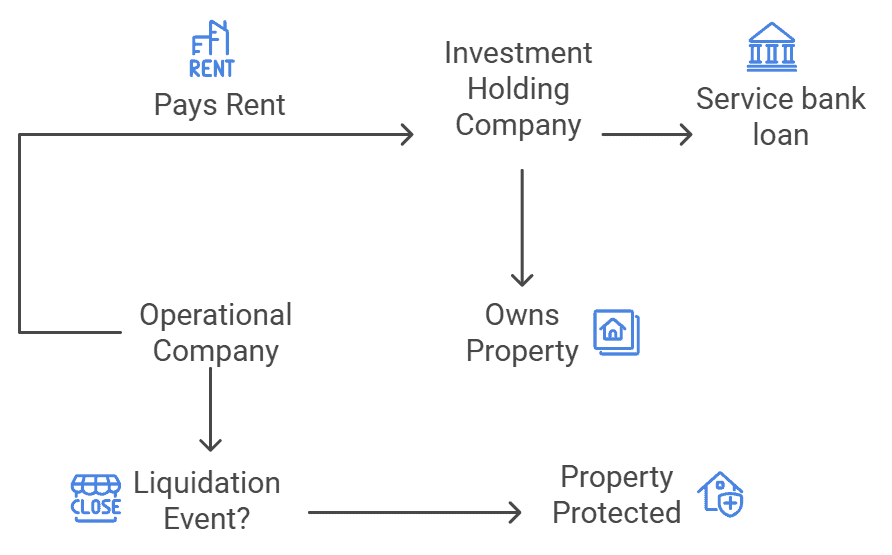

To reduce risk of assets being subjected to liquidation in the event of adverse litigations, some business owners might choose to incorporate an investment holding company to purchase and hold the property.

Banks will usually not finance new setup holding companies with no operational records. To mitigate this, the operating parent company could provide corporate guarantee to the bank as support.

Credit assessment in this case would be based on the operating parent company’s financial performance and track records.

The acquired property could then be parked under a holding company that acts as a layer of protection from unexpected liquidation events. This arrangement is subject to respective banks' credit policies.

If borrowing entity is a pure investment holding company with no active business, banks are required to apply TDSR (total debt servicing ratio) calculations on the individual shareholders of the holding company.

If the individual shareholder of the holding company already has heavy personal liabilities or residential property loan being serviced, there might be issue passing TDSR requirements.

This should be factored into consideration when deciding whether to hold the property under an investment holding company or operational entity.

Refinancing

Most commercial/industrial business property loans have a lock-in period of 1 to 3 years. After the lock in period, rates will typically be increased significantly.

SMEs with existing property loans that are out of lock-in period could first consider requesting a repricing application with their current lender to a package with lower interest rates. This saves you hassle and legal conveyancing fees to refinance the loan to another bank.

If you the repricing rate your current bank offers is still higher than current market rates, try refinancing the loan to another bank to save on interest.

Target to go through this process three to four months before your loan’s lock-in period is due. Legal conveyancing by law firm to refinance property loan to another bank typically takes between two to three months.

Speak to an experienced SME loan consultant if you need help sourcing for the lowest refinancing rates and best commercial property loan comparison.