Trade Financing For Singapore SMEs

Trade financing refers to credit facilities and banking instruments for businesses to manage international trade transactions, mitigate risks, and improve cash flow.

Singapore is a leading regional trade-finance hub, supported by local and international banks, fintechs, and government schemes such as the Enterprise Financing Scheme – Trade Loan (EFS-TL)

Trade finance serves as the bridge between international imports/exports transactions. Trade finance works well for both buyers and sellers to mitigate cross border trade risks via trade financing bank instruments such as payments by LC (Letter of Credit), a globally accepted form of payment for international trade.

After buyer issues a trade finance payment instrument such as a Letter of Credit (discussed later) to the exporter, the exporter can only receive funds after furnishing transport documents such as Bills Of Lading to verify goods have been shipped to importer.

Import Loan Financing

Import financing helps buyers procure goods and inventory from overseas sources. Buyers are able to tap onto the vast marketplace globally without being restrained only to local suppliers. Import financing is a form of business loan financing facility and commonly offered by most banks.

The key benefit of import financing is that trades between the exporter and importer are secure via banking trade instruments.

Cross-border trades can be made based on the confidence and trust developed between the importer and exporter from years of business relationship. However, it takes time to build the same sort of relationship between the new vendors and is impractical and inefficient to reply on such relationships for global trade.

Under import financing, goods are imported on the basis of a Letter of Credit which is a bank instrument that helps to mitigate risk of cross border trading.

Some would consider import financing as the opposite of factoring, another common financing instrument. Factoring finances the receivables portion of the trade cycle while import financing helps with the payables portion of the trade cycle.

For businesses with long trade cycle, consider using a combination of trade financing and factoring to finance both import and export leg. This helps shorten cash flow gaps.

Letter Of Credit (LC)

An irrevocable letter of credit, it is basically an instrument of guarantee from the bank of the buyer (importer), ensuring that the buyer will pay seller for goods sold. The bank guarantees that the seller would receive the correct amount at the right time.

If buyer defaults in making the payment, the bank will be responsible for the purchase amount. Bank issues a Letter of Credit after obtaining the pledge of securities or cash as collateral from buyer. Further, banks also charge a fee for such a service, normally a percentage of the size of the credit letter.

Trust Receipt (TR)

Trust Receipt (TR) is a financing method where a bank allows the buyer to take physical possession of goods (typically imported with same bank's Letter of Credit), but the ownership title to the merchandise still rests with the bank.

Under this arrangement, the bank provides the buyer with a short-term import loan to pay for the goods imported under the Letter of Credit. The TR credit terms granted by the banks typically ranges between 60 to 120 days.

Trust Receipt loan offers several benefits to the buyer as they do not need to make payment for imported goods immediately, when the documents are presented under the documentary credit. Further, a buyer can get up to 100% finance of the documentary credit, invoice value or documentary collection.

Also, Trust Receipts help the buyer to take benefit of the bank's credit terms, and buyer only need to pay the outstanding principal and interest on maturity of the credit term from the proceeds of sale of goods. Further, it also frees up working capital, which can then be used for various other business purposes.

A LC facility together with TR (trust receipt loan) is structured as a revolving business line of credit line for the user.

EFS Trade Loan

Enterprise Singapore, a government entity that supports SMEs' growth, provides a Trade Loan facility together with participating financial institutions. This facility falls under the Enterprise Financing Scheme. The Trade Loan can be used to finance SMEs' trade requirements, primarily with stock and inventory financing.

Under the Trade Loan facility, Enterprise Singapore would provide up to 70% risk sharing with participating financial institutions. This would help encourage financial institutions to provide more credit liquidity to qualifying SMEs by reducing credit risk exposure.

Traditionally, most banks would require some form of collateral when underwriting trade financing facilities for SMEs. However, most SMEs are not able to provide securities such as fixed deposits or properties, resulting in difficulty for SMEs to access trade financing.

With the Trade Loan program, banks are able to extend trade financing credit to SMEs while businesses have the option to secure an unsecured trade line facility without putting up hard assets as collateral.

Local suppliers inventory financing loan

If you do not trade or import from overseas supplier and only purchase from local suppliers, you can also use trade financing facility to finance your inventory.

Banks' trade financing facility can also be drawn down for local suppliers' invoice financing. Instead of using LC (letter of credit), payments can be made directly to your local suppliers via bank transfer within T+1 working day from submission of suppliers' invoices and transport documents (delivery order).

The amount you can draw down for financing suppliers' invoices is within the credit limit of your trade financing facility. Banks will then extend 90 to 120 days credit terms, with interest, for you to make full repayment of invoices financed.

It's common for local suppliers to extend credit terms as well. Note if banks extend 90 days credit terms for invoice financing, and suppliers invoices submitted reflects example 30 days credit term, banks will deduct suppliers' 30 days credit terms from their 90 days terms. This will result in a net 60 days credit terms from banks. Suppliers' credit terms does not stack with banks' for trade financing.

How Trade Financing improve cash flow of small business?

One of the biggest challenges that small businesses face is cash flow crunch. Trade financing can help improve working capital cycles. It provides buyers with a revolving credit line instrument to pay for goods and inventory, and for the seller, it secures the payment of the goods exported.

On paper, the importer would be able to improve their inventory and revenue turnover cycle with trade financing instruments. Without trade financing credit facilities from banks, a SME importer might have to wait till inventory are sold and customers pay them before having enough funds to procure next shipment from suppliers.

Another alternative is to obtain a SME loan for cash flow but it’s not the best financing solution as most business term loans bear tenure between 3 to 5 years. You should try to match the financing tenure of the financing facility with the intended financing purpose duration.

If it’s not possible to obtain a trade financing facility and there’s an urgent need to conclude purchase orders due for fulfillment to customers, next best alternatives would be to go for non-revolving term loans that does not bear early redemption penalties. Such term loans include the SME Working Capital Loan and the Temporary Bridging Loan.

With trade financing, importers would be able to make purchases with credit facilities without upfront payment to suppliers. Assuming constant flow of demand for their goods from their customers, importers would then be able to improve the turnover of their inventory and improve their top line revenue.

Trade Finance Products

Standby Letter of Credit (SBLC) or Banker’s Guarantee

A stand by letter of credit (SBLC) or banker’s guarantee (BG) and performance bond (PB) are also common trade finance instruments. Some refer to a banker’s guarantee as a performance bond, but they are essentially similar.

A SBLC or BG are commonly used as a form of guarantee or collateral, with the issuing bank guaranteeing payment to the beneficiary of the SBLC/BG based on certain conditions being fulfilled.

The construction industry commonly require a BG as form of contract fulfillment guarantee. For SBLC, it’s more frequently used by international traders and is essentially a guarantee of payment issued by banks on behalf of their client (usually the importer).

SBLC can be called upon by the beneficiary in the event of failure to honor a contractual obligation. To issue a SBLC, banks will require to underwrite the credit of the issuer and assessing the quality of security the issuer pledges as collateral.

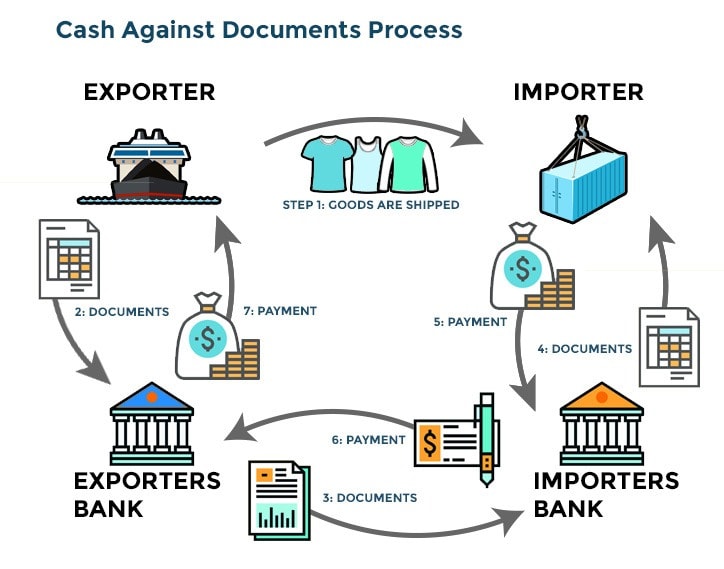

Documents against acceptance (DA) / Documents against payment (DP)

Documents against payment (DA) and documents against payment (DP) are also common trade finance instruments. However, most banks will usually not require credit underwriting for DA/DP unlike LC/TR facility.

DA/DP allows the exporter to extend some form of credit terms to importer but is considered generally less secure than LC documentary credit.

In a DA arrangement, the seller will hand over shipping documents & ownership title of the goods exported only if the buyer accepts the accompanying bills of exchange. In DP arrangement, seller will give instruction to the bank to release shipping documents & ownership title of the goods only if buyer makes full payment on the accompanying bills of exchange.

In DA/DP, the banks are acting as intermediary from which payments & shipping documents for cross border transactions are routed through but does not provide guarantee of payment, unlike a LC arrangement.

Export Financing

Export financing helps Singapore sellers get paid faster and reduce non-payment risk on overseas shipments, by funding working capital before shipment (pre-shipment credit) and after shipment (post-shipment/receivables finance).

Banks typically secure repayment from the export LC or the buyer’s invoice proceeds. Common export financing instruments:

-

Pre-shipment / Packing Credit: Short-term working capital to buy raw materials, manufacture and ship against a confirmed export order or LC; the LC proceeds retire the advance on presentation.

-

Export bills negotiation / LC discounting: Sell (discount) compliant LC documents to the bank for immediate cash; the bank collects from the issuing bank.

-

Export invoice financing / bill discounting (open account): Advance against overseas invoices once goods are shipped; repaid when the buyer pays. Often referred as “export factoring” or “invoice discounting.”

Industries suitable for Trade Financing

All industries which purchase physical goods, materials and inventory would be suitable for trade financing. These include business in manufacturing, construction, wholesale trading and engineering.

For businesses that grant credit sales terms to customers, trade financing is also a useful working capital loan tool to smooth out cash flow as TR credit terms granted by banks would ensure payments need not be made upfront to suppliers.

Most businesses cannot rely purely on their trade receivable cycle for working capital for the simple reason that the manufacturing process in the factories, payment for labor and other overhead expenses have to be paid for before delivery of finished good and receiving customer's payment. Funds are required at every business stage and this need of flexible SME financing is met by trade financing facilities.

Trade financing covenant

It is a common in trade financing finance for banks to impose a covenant that restricts related company financing.

Borrowing entities cannot utilize trade finance instruments to finance related entities where the beneficial owner also have an interest in. This is to adhere to regulatory compliance concerns, and reduce the risk of fraudulent transactions.

Exemptions and prior approvals should be sought from your financial institution for related entities financing.

There have been multiple cases of trade finance frauds in Singapore. Notable cases shared below. One involved a company inducing a bank to disburse up USD$112M originating from fraudulent transactions and false invoices.

https://www.channelnewsasia.com/singapore/ok-lim-hin-leong-trading-sentence-jail-4754016

Trade financing is a revolving credit facility used for import financing or purchase financing. Businesses can utilize their trade financing credit lines to finance their imports/purchases with credit terms from banks. This will improve working capital and cash flow trade cycle.

Trade financing interest rate typically ranges between 6% to 8% p.a. Credit terms granted by banks are usually between 90 to 120 days, and interest rates is prorated accordingly to credit terms granted.

Most banks will prefer collateral pledged for trade financing facilities. Preferred securities include properties, fixed deposits or keyman insurance policies. Trade financing facilities can also be granted on unsecured basis with credit insurance provided.