2020 SME Finance Accessibility Survey and Research

Table of Contents

Linkflow Capital operates a SME loan comparison portal for users to compare their business financing options online instantly.

We have been aggregating data collated from our business loan comparison portal from 2017. This article summarizes the data research findings from January to December 2020.

Below is a quick rundown on the statistics and sample size collated:

- Total sample size of 4281 users

- Duplicate and spam entries are scrubbed off database

- No manual verification was conducted for every user, data used "as is" provided by users

Our key takeaway from 2020’s survey data:

“Our data suggests that 52%of SMEs were eligible for business financing in 2020 compared to 39% in 2019, a significant increase.”

Our data suggests that more than half (52%) of SMEs have enjoyed better access to financing in 2020. This figure improved significantly from the financing eligibility of 39% in 2019 and 34% in 2018.

Based on our internal dataset, we opinioned that the key reason why the financing eligibility index spiked up in 2020 is due to the improved credit profile of users last year.

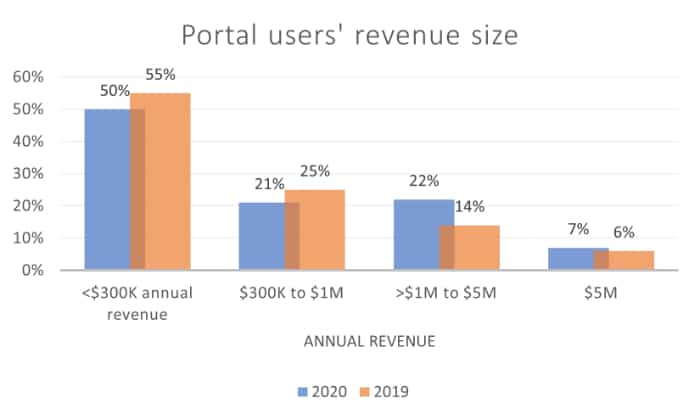

More companies with higher revenue seeking financing in 2020

In 2020, there were more users with higher revenue size compared to 2019. A total of 29% of users reported annual revenue above $1M, compared to 20% in 2019. Smaller businesses with reported revenue of $300K also decreased from 55% in 2019 to 50%.

Due to the onset of Covid-19, we inferred that stronger and bigger SMEs took firm and decisive action to load up on credit very early on to brace for forecasted business impact.

Various government financing schemes such as the Temporary Bridging Loan and the SME Working Capital Loan with lowered interest rates and higher government risk sharing could also be pull factors influencing the borrowing decisions of these SMEs.

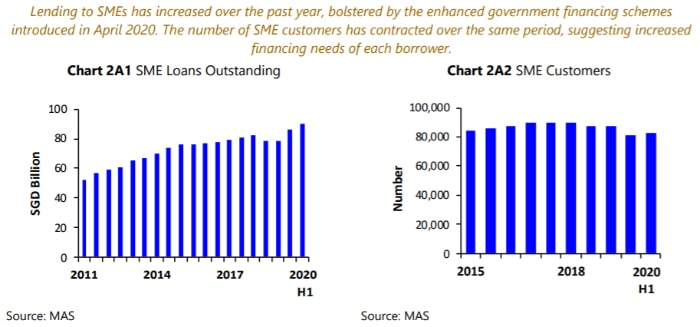

According to data from MAS’s Financial Stability Review 2020 [1], the number of SME borrowers has contracted in 1st half 2020 while total lending to SMEs increased over the same period. This could suggest increased financing needs of each borrower.

Higher loan quantum in 2020

Diving further into our internal figures, loan quantum originated from within our platform has seen an outsized increase of over more than 134% in 2020 compared to 2019.

Average loan quantum in all loan originations within our platform in 2020 more than doubled to $310,909 compared to $132,500 in 2019.

Taken in context with the other data points highlighted prior, the increase in average loan quantum in 2020 could potentially be attributed to a consolidated spike in SMEs with stronger credit profile seeking financing earlier on in the pandemic.

On the supply side of the equilibrium, participating financial institutions in the various government business loan schemes might have exercised more flexibility in granting higher loan quantum to bankable borrowers with the enhanced 90% risk sharing mechanism introduced earlier during the Solidarity Budget [2] in April 2020.

Reasons why SMEs fail to access financing

Although results for our financing eligibility index and average loan quantum improved considerably in 2020, there are still many SMEs who are not able to qualify for financing.

For those users within our platform that were unable to avail of financing in 2020, these are some of the common reasons:

- 36% due to smallish low revenue and weak bank balances

- 30% due to newly incorporated startups with no or minimal revenue

- 16% due to weak financials performance (loss making, negative equity)

- 17% due to lack of minimum 30% local shareholdings require by most banks

- 1% - Other credit adverse reasons

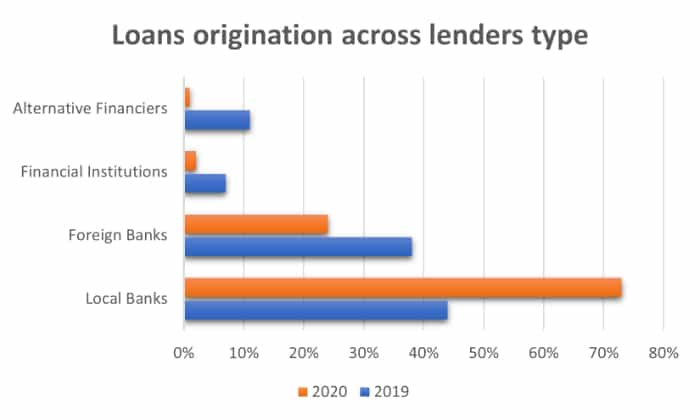

Loans origination sources across lender types

In 2020, loans originated within our platform were overwhelmingly underwritten by the local banks, with a 73% share of all loans originated versus 44% in 2019.

Alternative financiers such as P2P financiers and private lenders saw the biggest drop from 11% loan share in 2019 to 1% in 2020.

This could be due to the popularity and wide spread awareness of the various government supported schemes such as the Enterprise Financing Scheme, with Enterprise Singapore and participating banks approving over $18B in such loans to over 21,000 SMEs in 2020. [3]

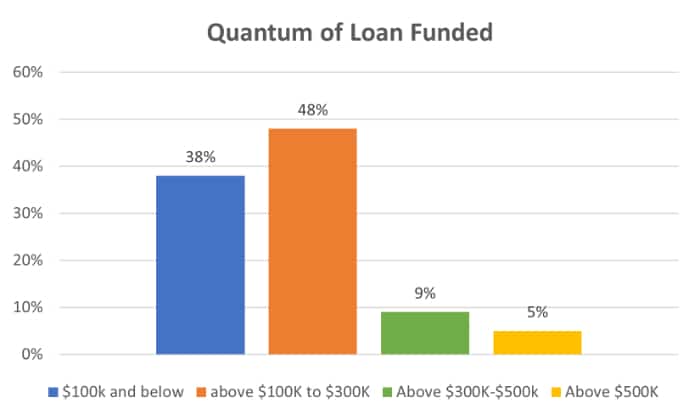

Breakdown of approved loan quantum

48% of SME borrowers within our platform obtained loan amounts between $100K to $300K, the most common range of financing quantum.

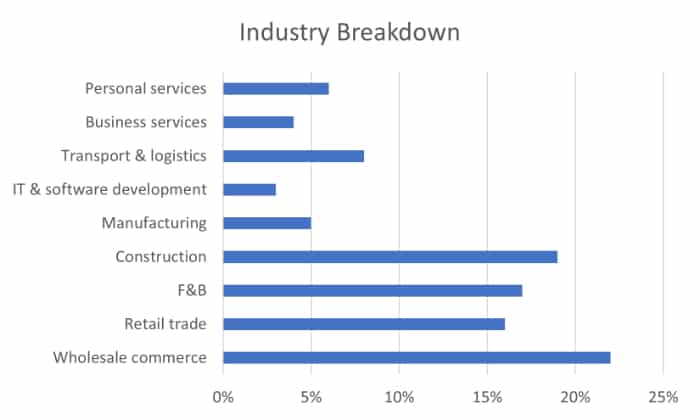

Industry breakdown

Above chart illustrates the various industries and business segments the users of our SME loan comparison platform falls into.

Results from the MAS Financial Stability Review 2020 indicated that the building and construction sector continued to account for majority of SME loans system wide as of 1st half 2002.

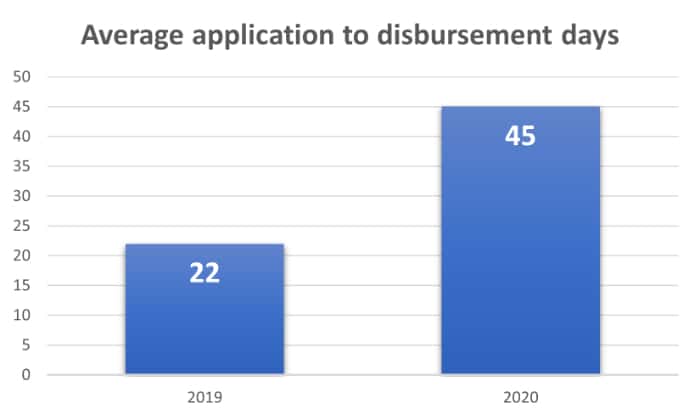

Surge in loan applications during Covid-19

Based on Google Trends data, online search interest for SME loan related topics spiked in 2020 and intensified during the circuit breaker period between April to May.

This resulted in a deluge of business loan applications overwhelming most banks. With the circuit breaker upending the banks and all businesses’ SOPs, application processing and funds disbursement time slowed further.

Based on our internal date, average application-to-approval-to-disbursement turnaround time more than doubled, from average of 22 days in 2019 to 45 days in 2020.

Approval rate percentage dropped in 2020

Average approval rate for loan applications initiated from within our platform dropped to 71% approval rate, versus 87% in 2019.

We attribute this to a more defensive posture and selective sector specific credit underwriting by lenders amid the pandemic.

Some lenders prioritized existing borrowers while new-to-bank borrowers were side-lined. SMEs in hard hit sectors such as tourism, aviation and construction also found it tough to avail of financing. [4]

Interestingly, approval rate within our platform in 2020 is at the lowest for past 3 years while loan quantum more than doubled over past year.

Corroborating with the previous data points highlighted, we opined that overall, lenders are financing less SMEs in 2020 while granting higher credit quantum to those who made the underwriting mark.

Also, SMEs with stronger credit profile who naturally are eligible for higher loan quantum could also make up a larger share of financing applications versus smaller micro-SMEs who might have held off financing applications until late 2020.

Forecast of SME financing landscape moving into 2021

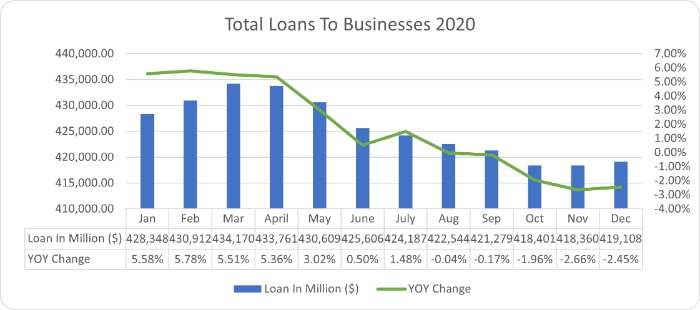

According to MAS data on total loans to businesses in 2020, business lending declined for consecutive 8 months in the period between April to November 2020. [5]

Loans to businesses also started to slide to negative growth in year-on-year basis from August to December.

Loans to business finally bucked the month on month decline in December with preliminary total loans of $419.1 billion.

With general business sentiment picking up from phase 3 of reopening, demand for SME financing from businesses should gradually improve throughout 2021.

However, with the government-imposed loan moratoriums support to businesses winding down from December 2020 [6], banks might still wait and observe if NPL (non-performing loans) ratios might start inching up.

MAS’s Financial Stability Review highlighted that the SME NPL ratio improved to 4.3% in first half 2020. The direction in which this key statistic moves from first quarter 2021 will likely set the tone in banks’ credit underwriting for the rest of the year.

From our observations, banks will continue to adopt a measured approach in credit underwriting amidst the challenging economic environment in 2021.

The various government support schemes and Covid-19 (Temporary Measures) Act has cushioned the worst of impact for most SMEs in 2020.

The mixed fortunes of different business industries affirm to the K-shaped nature of the ongoing recovery. Moving ahead, we expect lenders to be extremely selective and sector-specific in terms of financing support for SMEs adversely impacted by the pandemic.

Sources and references:

[1] https://www.mas.gov.sg/-/media/MAS/resource/publications/fsr/Financial-Stability-Review-2020.pdf

[5] https://eservices.mas.gov.sg/statistics/msb-xml/Report.aspx?tableSetID=I&tableID=I.5A

[6] https://www.mas.gov.sg/regulation/covid-19/supporting-businesses-through-covid-19/support-for-smes

2019 SME finance accessibility survey

2018 SME finance accessibility survey