2018 SME Finance Accessibility Survey And Research

Table of Contents

Linkflow Capital operates a SME loan comparison portal that allows users to compare their financing options online. The portal also comes with a free business loan assessment that provides an indicative financing eligibility result together with the loan comparison function.

Our business loan comparison portal is powered by proprietary algorithm that targets to mirror as closely as possible common credit criteria of lenders.

We’ve been aggregating data collated from our loan comparison portal from 2017. This article will summarize the data and findings for research collated for the period January to December 2018.

Here’s a quick rundown on the statistics and sample size collated:

- Total sample size of 2771 unique users

- Duplicate and spam entries are scrubbed off database

- Users that indicated they are foreign companies are not included in the survey

- No manual verification were conducted to each and every user, data used “as is” provided

Key Findings

Survey results for 2018 indicated that financing accessibility for SMEs seemed to improved significantly from 2017’s data-set.

34% of SMEs in 2018 are eligible for business financing compared to just 19% in 2017. This is an increase of almost 2x from our 2017’s results.

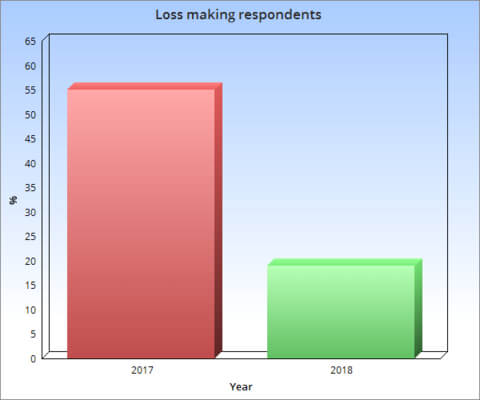

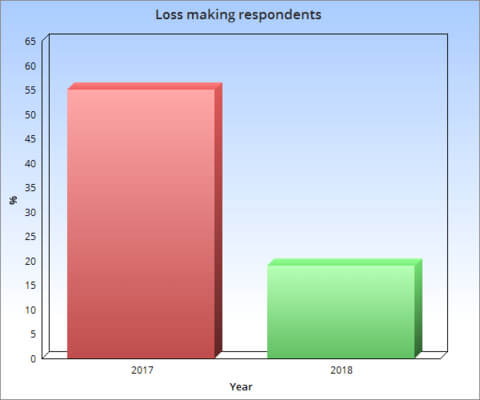

From our findings, the main reason attributable to this figure is due to respondents’ improvement in profitability in 2018. In our 2017 survey, 55% of users indicated they were loss making and that figure decreased to only 19% for 2018.

Financial profitability is one of the most important criteria affecting the financing eligibility of a business. Companies whom are in the red operationally would usually find it very difficult to obtain SME financing.

The improvement in profitability would likely be due to slower GDP growth rate of 2% in 2016 as compared to the higher expansion rate of 3.6% in 2017 and 3.2% in 2018.

Annual Revenue

Consistent with 2017’s survey, the biggest reason attributed to inability for SMEs to secure financing is a combination of smallish annual revenue size (less than $300K) and weak cash flow position (less than $10K average cash balances).

From our 2018 findings, 51% of users might not be qualified for business financing due to the above reasons. We note that majority of our portal’s users are in the range of micro SMEs with a rather smallish annual revenue of $300K and below.

Coupled with weak capitalization and no steady cash flow, the chances of qualifying for a bank business loan might be adversely impacted.

Below is a graphical representation of the annual revenue reported by our users in 2018.

New Startups

Another notable statistic for 2018’s findings is the increase in new startups seeking financing. In 2018’s data, 26% of users are businesses less than a year old, compared to 21% in 2017.

Thanks to entrepreneurs like Mark Zuckerberg and Evan Spiegel (founder of Snapchat, networth $2.2B) whom are elevated to rock stars status, the trend of founding a startup by fresh graduates and young millennial has been on a upward trajectory.

However, young startups with no prior operational track record and proven profitable business model are advised not to explore mainstream business loans application first.

For traditional SME business loans, most banks credit underwriters might not be too keen to support young businesses with less than a year old as the risk of failure is too high.

New companies with a focus on technology might find VCs (venture capitalists) and private equity investors a more appropriate funding channel.

Government Financing Schemes

In Budget 2019 announced in February this year, one of the key government financing scheme, the SME Working Capital Loan, was slated to be extended for another 2 years till 2021.

Another notable announcement was most existing government financing schemes including the SME Working Capital Loan and SME Micro Loan will have their existing risk sharing increased from 50% to 70%, for companies that are below 5 years old.

This essentially means that participating financial institutions might be encouraged to extend ease of financing for younger companies, whom traditionally face more hurdles to obtaining loan approval.

Selling to Large Corporates

In our 2018 survey, we also found that 22% of respondents whom are selling and serving large corporates and MNCs.

For such SMEs, they could also consider utilizing financing facilities such as factoring or invoice financing to tap onto the strength of their debtors.

There are plenty of alternative financiers, finance firms and factoring houses here that can structure some form of invoice financing for SMEs whom have bigger companies listed as their debtors.

Instead of waiting for what could be a potentially long payment cycle to materialize, SMEs could turn to factoring instead to unlock cash flow in their invoices.

For factoring arrangements, financiers does take the credit profile of debtors into consideration, aside from just assessing the borrower’s profile.

Total Business Lending Figures

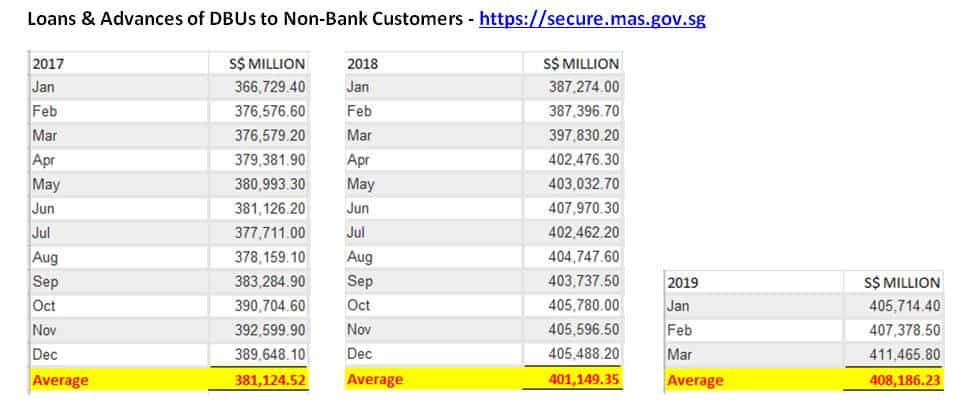

Here’s an extrapolation of some statistics derived from MAS at secure.mas.gov.sg.

The above figures are breakdown of total loans to businesses in Singapore’s financial systems.

Average business lending have improved by about 5% year-on-year from 2017 to 2018. For the first quarter of 2019, overall system business lending continues to improve month on month.

However, with the increasingly volatile global trade supply chain disruptions caused by the US-China trade war, Singapore’s extremely trade reliant economy has taken a beating.

MAS have stated that 2019’s GDP growth could be weaker than earlier forecasts, which was between 1.5% to 2.5%.

In the event of a sharp deterioration in our economy outlook and challenging macro environment, banks might slow down lending to the SME sector. Business loan interest rates might also rise and further exacerbate the woes of SMEs with higher financing costs.

In this uncertain environment, SME owners should be mindful of their short to mid term financing requirements. This might also be an opportune time to seek out and lock in financing facilities first as a buffer to future working capital needs.