2019 SME Finance Accessibility Survey and Research

Table of Contents

Linkflow Capital operates a SME loan comparison portal for users to compare their financing options online instantly.

Our corporate financing comparison portal is powered by proprietary algorithm that targets to mirror as closely as possible, common credit criteria of lenders.

We have been aggregating data collated from our business loan comparison portal from 2017. This article will summarize the data and findings for research collated for the period January to December 2019.

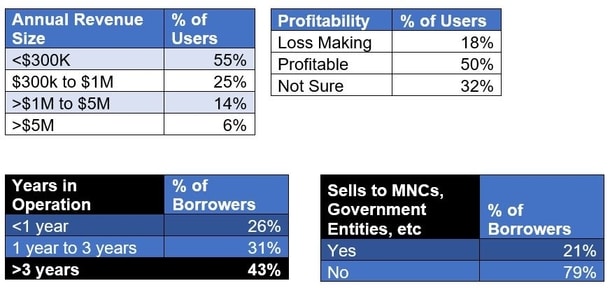

Here’s a quick rundown on the statistics and sample size collated:

- Total sample size of 2436 unique users

- Duplicate and spam entries are scrubbed off database

- Users that indicated they are foreign companies are not included in the survey

- No manual verification was conducted for every user, data used “as is” provided by users

Our main key takeaway from 2019’s survey data:

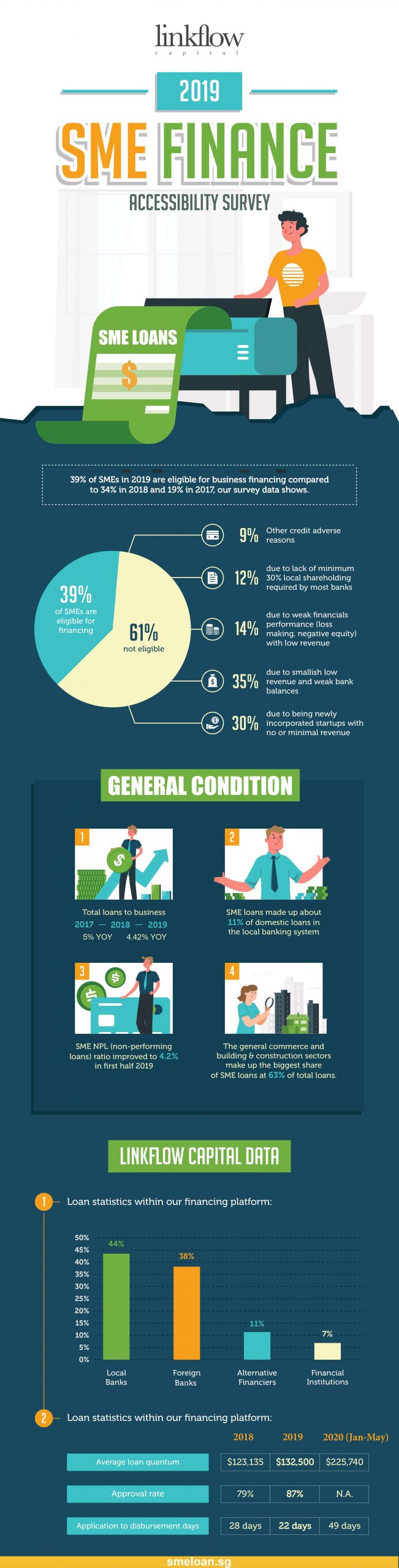

39% of SMEs in 2019 are eligible for business financing compared to 34% in 2018 and 19% in 2017, our survey data shows.

The uptick in SMEs’ accessibility to financing continues to improve in 2019, according to our data.

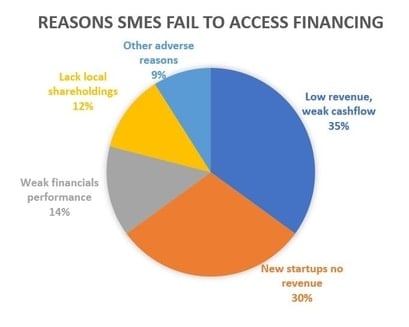

For those users within our platform that find themselves unable to avail of financing, these are some of the common reasons:

- 35% due to smallish low revenue and weak bank balances

- 30% due to being newly incorporated startups with no or minimal revenue

- 14% due to weak financials performance (loss making, negative equity) with low revenue

- 12% due to lack of minimum 30% local shareholdings required by most banks

- 9% – Other credit adverse reasons

SME financing is the key bloodline for small and mid-sized businesses. Linkflow Capital has been closely following various financial metrics in the local SME loans market. We are committed to produce yearly reports for SME borrowers to understand the market.

The previous year of 2019 was marked by notable global events such as the US-China trade war and Brexit, the former which weighted down on Singapore’s economic performance.

General banking conditions

There will always be different sources of tension globally every year. Singapore is an international air and seaport widely exposed to international trade, so global tensions will always affect our economy one way or another.

Despite the challenges 2019 poses to the macro economy, it was a fairly good year for our 3 local banks with NPL (non-performing loans) ratio remaining at 1.5%, [1] similar to 2018.

Source: MAS

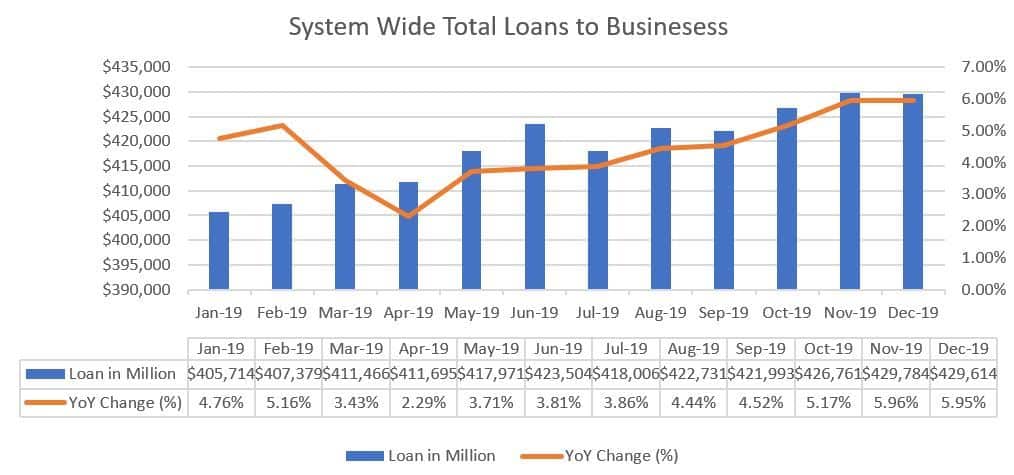

Despite the uncertainties in 2019, financial institutions in Singapore underwritten over S$502.67 billion total loans to businesses. It represented a 4.42% increase over year 2018, vs 5% growth from 2017-2018.

Source: MAS

However, bank lending to SMEs and the number of SME customers have declined slightly over the past year, against the backdrop of the slowing economy.

SME loans made up about 11% of domestic loans for the local banking system as of June 2019.

Source: MAS

Notably, the SME NPL (non-performing loans) ratio improved to 4.2% in first half 2019 after a sharp spike in 2017 related to the oil and gas sector. Analysts predict [2] the NPL ratio will spike up further in 2020 as Covid-19 wrecks its damage to the global economy.

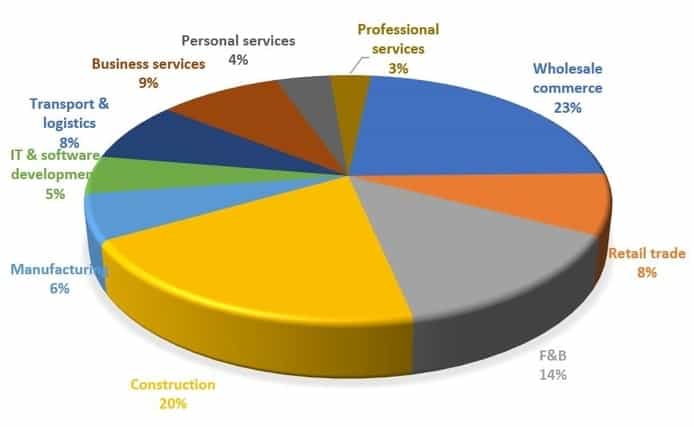

The general commerce and building & construction sectors make up the biggest share of SME loans and both sectors are at risk if economic conditions continue to deteriorate further in 2020.

Linkflow Capital’s Internal dataset

While the broad data from our loan portal suggests that SMEs’ access to financing improved in 2019, let us take a more granular look on the breakdown of financing facilities procured via our platform.

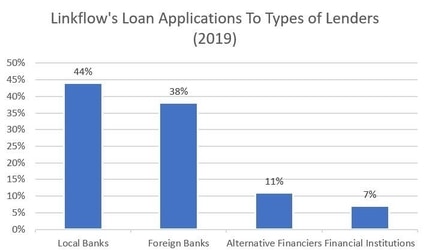

Within our platform, we originate SME business loans to various lending partners. Our focus is on matching clients to the most suitable and appropriate lender, within the context of client’s credit profile, funding requirement, requested loan size amongst other such factors.

- Local banks form the largest share at 44% of total loans originated. These include DBS, OCBC and UOB.

- Foreign banks form a close second at 38% of total loans origination, and could include Citibank, Maybank, SCB, HSBC, RHB, CIMB etc.

- Alternative financiers include P2P platforms such as Capital Match and Moolahsense as well as direct financiers such as Grab Finance & Aspire Capital.

- Financial institutions form 7% of our total loan origination and could include lenders such as Hong Leong Finance, Orix Leasing, IFS etc.

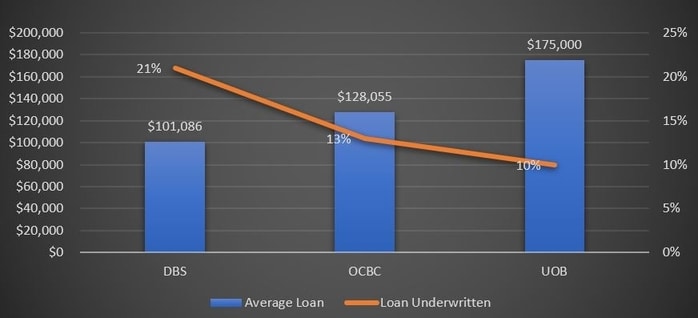

Here is a breakdown for the 3 local banks, on the percentage of total loans referred within our platform and the average loan ticket size underwritten.

In 2019, 21% of total loans originated within our platform were from DBS with average loan ticket size of $101,086 underwritten. 13% of total loans origination from OCBC with $128,055 average loan ticket size and 10% to UOB, with the highest average loan ticket size of $175,000.

Aggregated profile of users within our portal

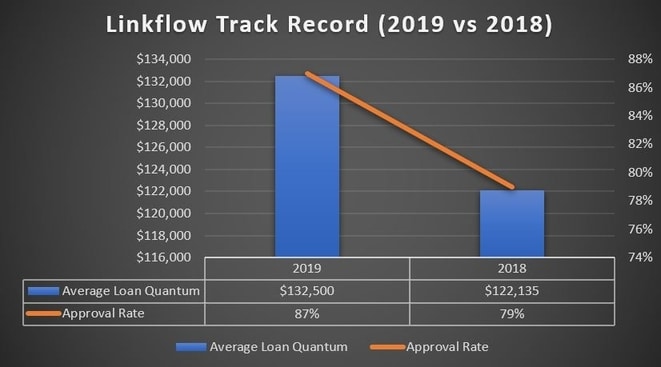

Below data on our approval rate and average loan quantum procured per company per bank for 2019 and 2018.

Approval rate is derived from total number of applications approved by banks/lenders versus total number of applications submitted. Note our approval rate figure of 87% in 2019 seems to contradict the headline figure (39% of SMEs eligible for financing) mentioned at the start of this article.

The financing applications Linkflow Capital eventually refers to banking partners would have gone through an internal pre-screen of eligibility and credit assessment checks by our professional financing consultants. This would explain the seemingly higher approval rate percentage.

Users in our loan portal are more representative of a broader spectrum of SMEs who are sourcing for financing options and might not have undertaken formal applications to banks yet.

It is therefore prudent not to take certain financing approval rate figures at face value without dissecting how the statistics are represented. Example, a news article [3] highlighted that the approval rate for government assisted SME financing schemes are between 90%-95%.

Most banks’ SME lending models are programme based. For applications that don’t meet certain banks’ minimum credit criteria, it might not be even processed as a formal application in their system. If these applications were also factored into the denominator of total applications count, the headline ‘approval rate’ figure might paint a different picture.

Below business industry chart breakdown of users within our SME loan platform in 2019:

Outlook for Year 2020

The US-China trade war weighted heavily on Singapore’s economy in 2019 as global trade slowed. The obvious source of stress this year would be the impact of Covid-19.

Economists have predicted massive job losses [4] of over 150,000 to 200,000 and business closures will continue to rise in 2020 as bankruptcies soared [5] to a record high in Q1 2020.

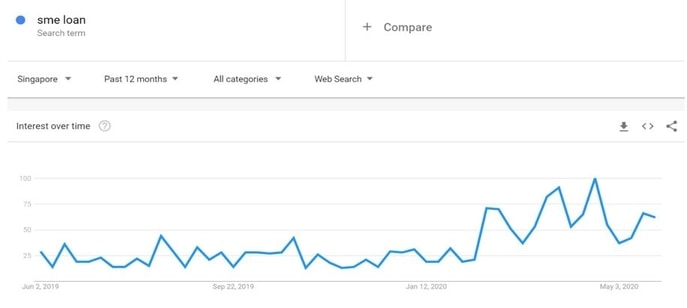

These conditions might have resulted in a huge spike in SME financing requests as banks get flooded [6] with surge in applications.

Data from Google trend corroborated with the surge in loan applications as online searches for SME loans peaked in February to April 2020.

The huge spike in financing demand is likely caused by the business impact the ‘circuit breaker’ partial lockdown imposed in that period as well as uncertainties over the broad economy as 2020’s GDP growth forecast was further downgraded to -7% to -4%, [7] possibly the worst showing since independence.

Another related cause in demand could be due to the introduction of various government financing schemes such as the Temporary Bridging Loan Programme and Enhanced SME Working Capital Loan SMEs can tap into.

Below is a representation of the average interest rates granted by participating financial institutions within our platform for government assisted financing schemes:

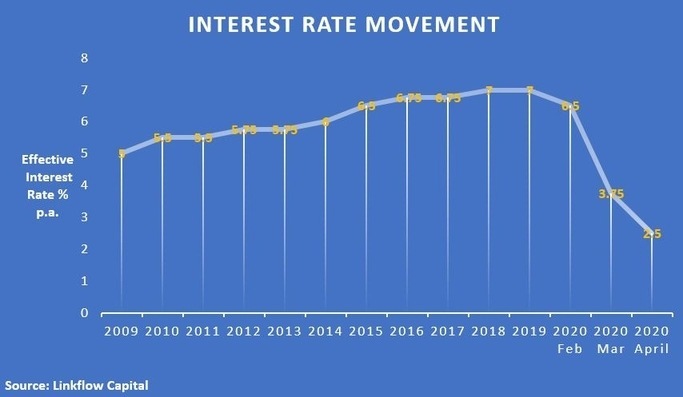

From 2009, we observed that average interest rates have been trending on an upward trajectory from 5% p.a. effective rate in 2009 to 7% in 2019. These rates tracked are specifically for government financing schemes offered by participating banks and includes the SME Micro Loan which is now defunct. Commercial business loan interest rates are typically higher.

At this time of writing, average effective interest rate dipped to an all-time low of 2.5% p.a. in April 2020 according to our data. This is unprecedented and the lowest rate we have observed for past 11 years.

This could be driven by the government’s extraordinary measures in the combined S$139 billion 2020 budget including an ultra-low 0.1% funding by MAS [8] to participating financial institutions and 90% risk sharing to loosen credit conditions.

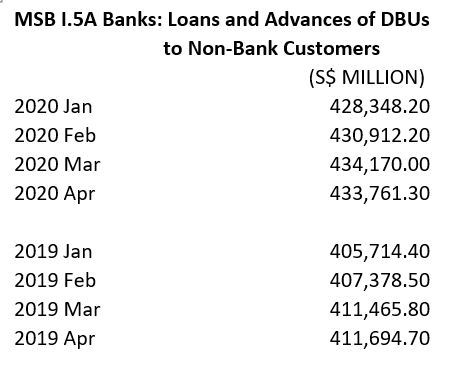

Total loans to business system wide dipped only slightly by 0.1% from March to April 2020. The support from MAS and Enterprise Singapore might have helped cushion the impact on business loans and cash flow pressure of SMEs.

Source: MAS

From our internal data, figures from January to May 2020 indicated average loan quantum we have raised within our platform increased to $225,740 per company, per bank application. This is an almost 70% increase from our average loan quantum of $132,500 in 2019.

However, due to the overwhelming surge in applications, the average application to disbursement period from banks had increased to 49 days in this same period (Jan-May’20) versus 22 days in 2019.

Due to Covid-19, banks are expecting their Non-Performing Loans (NPL) to double from 2% to 4.2% which is the highest since the 2009 Global Financial Crisis.

How will this counteract MAS support for the banking system and other financial institutions? We foresee greater complexity for SMEs in obtaining credit in later half 2020 and beyond. We will provide further insights in our review next year for 2020.

Sources and references:

[1] www.sgx.com

[2] www.sbr.com.sg

[5] www.dnb.com.sg

[7] www.mti.gov.sg