SME Financing Ultimate Guide -

Insider’s Tips To Secure Funding

In this comprehensive SME financing Singapore guide, you will find practical information on how to secure a SME loan easily.

You can compare over 20+ banks and financial institutions SME business loans products and view all your eligible funding options instantly!

Use our free loan assessment tool to check your company’s indicative loan eligibility and see all available financing options instantly.

Compare All Business Loans

See All Loan Options Instantly!

We have been featured in

When To Apply For SME Financing?

There is an old adage:

This is true. The best time to apply for SME financing is when you can prove that you don’t need it. The worst time to seek financing is when you need it the most.

Unfortunately…

Many SME owners will only start sourcing for financing when they face a cash flow crunch.

Many of these applications will regrettably be declined by banks. Banks are in the business of managing risk and will not indiscriminately offer SME financing to companies with no clear demonstration of repayment ability.

Therefore, it is always a good practice to plan ahead and start initiating your loan applications when your company is in its best financial shape.

Where to apply for SME financing?

Banks

Banks will most certainly be the first port of call for most SMEs when it comes to financing.

Banks have well-structured and regulated credit lending functions. They provide almost all forms of SME financing instruments.

There are many banks with SME presence locally:

Aside from the three local banks DBS, UOB and OCBC, many foreign banks active in SME financing in Singapore include:

Maybank, Standard Chartered Bank, Citibank, HSBC, RHB and many others. Newer digital banks include Anext, Maribank and Greenlink.

All banks have varying credit criteria.

Interest rates, financing quantum and terms differ across these banks as well. It would be prudent to compare all bank products as widely as possible.

Business loans from banks are generally the cheapest financing option. However, securing an approval is tough and can be a long strenuous process for many SMEs.

Due to the perceived higher risk and default rate in SME lending, most banks’ credit assessment is stringent and robust.

Banks do not publicize their SME loan application approval rates. From a study conducted by Visa and Deloitte [3], it was found that 40% of SMEs do not have any banking support.

If your company has sound financials, healthy cash flow and prepared to wait few weeks to a month on the assessment process, business loans from banks would be the best choice.

Credit image: visa.com.sg

Financial institutions

Financial institutions (FIs) also conduct lending activities to SMEs but operate without a full banking license.

There are many FIs serving the SME market:

Hong Leong Finance, Singapura Finance, Sing Investments & Finance and many others.

Although FIs provide unsecured SME loans too like banks, most FIs are specialist lenders and usually focus on asset based lending such as factoring or equipment loan.

In February 2017, MAS announced new regulation [4] allowing finance companies to offer larger amount of unsecured SME financing up to 25% of their of their capital funds from previous cap of 10%.

This is expected to free up an estimated $550 million of SME loans finance companies can potentially provide.

In Q3 2018, Singapore’s largest finance company Hong Leong Finance saw it’s loan book to SMEs increased to S$10.3B from year to date, the highest record in it’s 57 year history [5] following the relaxing of lending rules in Feb 2017.

P2P crowdfunding

Peer to peer crowdfunding is one of the latest fin-tech trend that’s gaining traction. P2P crowdfunding provides debt financing to companies via pooling of funds from a group of investors, facilitated via an online crowdfunding platform.

Such platforms bring together borrowers (SMEs) and lenders (individual investors) and facilitate financing between them.

These platforms originate business loans by listing potential borrowers on their platform. Individual investors of these platforms can view basic financial profile of these listings and participate in the funding process.

Crowdfunding is a viable option for SMEs not qualified for traditional bank loans, as the credit criteria is usually less stringent.

However, to compensate investors for taking a higher capital risk, interest rates for such loans are also higher than bank loans.

Most P2P small business loans bear short term tenure ranging from one month to a year.

As of June 2016, P2P platforms operating locally must be regulated by MAS and be issued a Capital Market Service license to operate.

Alternative lenders

There are also many alternative lenders operating in the SME financing sphere. Most of these alternative lenders operate on a smaller scale and serves a niche market.

Some of these lenders are private investors whom lend directly to SMEs. Some are online lending platforms operating as direct lenders.

Interest rates for these alternative lenders tend to be the highest among all funding options. These are usually considered lenders of last resort for SMEs.

Best bank for SME financing in Singapore?

Most SMEs are banking with the 3 local banks due to their wide retail banking network and brand name familiarity.

The 3 local banks are undoubtedly dominant players in Singapore’s SME financing space. With strong branding and sturdy balance sheets, our 3 homegrown banks continue to dominate Asia’s safest banks rankings year after year.

DBS, OCBC & UOB are ranked the top 3 safest banks in Asia respectively for 2024. [7]

SME Financing Interest Rate

Unsecured business term loan interest rates range between 8% to 12% p.a. effective rate.

Government financing schemes bears interest of about 7% to 9% p.a. effective rate.

Secured loans for equipment and machinery loans interest ranges between 2% to 7% p.a. flat rate.

Revolving facilities such as trade financing and factoring interest is between 6% to 9% p.a. effective rate.

Property financing is the cheapest form of financing with interest between 2% to 4% p.a. effective rate

Interest rates varies between different banks. Generally, interest is determined by the credit profile of the borrower, the loan quantum and whether if loan is collateralize.

Most Singapore business loan interest rates are calculated via monthly reducing rest basis, with principal loan amortized over the loan tenure on monthly rest.

For a more detailed guide on how to derive effective interest rate, do check out our business loan interest rate page.

SME financing criteria

Industry and business nature

Some banks have specific industries that they don’t finance due to existing heavy credit exposure or high default rates in their books.

Macro-economic issues and negative sentiments will also affect bank’s financing on particular industries.

The negative outlook for the offshore and marine sector in 2016-2018 has been well documented [6] and this affects all companies operating in the industry when applying for financing during that period.

If your company does not qualify for a loan with one bank due to your industry nature, it is not necessary that all other banks will follow suit. Different banks may have varying outlook on the same industries.

Years of operating history

Most banks and financial institutions will require two to three years of operating history before considering extending financing.

Therefore, new startups are usually not able to qualify for traditional business loans. Startup business loans are not common in Singapore and loan options are usually very limited.

Annual revenue

You will need to have a recommended minimum annual revenue of at least $200k.

Your annual revenue will also determine your eligible loan quantum.

Financial report analysis

Most banks will require to assess your company’s financial reports.

There are many factors banks will analyze when scoring your financial report. Without going into an accounting 101 lecture, the most important figures to note in your financial report is your net profit/loss in your Profit & Loss statement and your total equity figure in your Balance Sheet.

In general, if your company is reporting a net loss or reflects negative equity, it will be challenging convincing the banks to extend a small business loan.

However, in certain situations, an experienced SME loan broker might be able to help mitigate weakness in your financials if there are other mitigating factors to help support the application.

Bank statement analysis

Your company’s bank statement is very important for banks’ loan evaluation.

Factors such as the average cash float maintained, crediting and debiting amounts, month end balances and cash flow fluctuations will affect loan eligibility.

Returned cheques are detrimental to business loan assessment. The banks weight this heavily as it indicates signs of credit unworthiness and tardiness in managing cash flow.

It is recommended to maintain bare minimally $10k to $20k in your average daily balances and month end balances for the last 3 to 6 months prior to SME financing application.

Director’s personal income and credit history

Banks will also consider director’s personal income and personal credit history for a business loan.

Most banks require directors with minimum $30k personal income reported in Notice of Assessment.

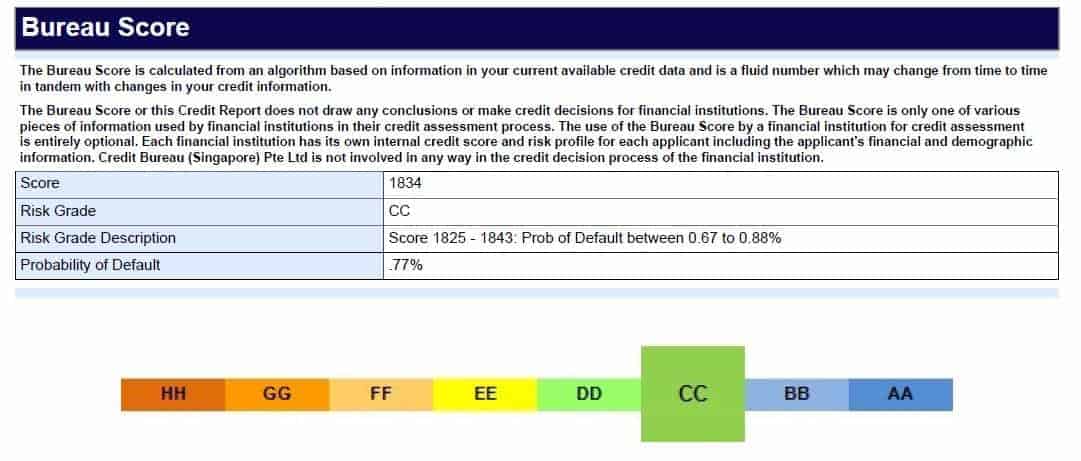

Director’s personal credit bureau checks will be conducted as well. You can check your personal credit bureau score by purchasing it at www.creditbureau.com.sg.

In your credit bureau report, the overall credit grading is at the end of the report. This grading ranges from AA which is the best grading to HH.

Not all banks will solely base their credit assessment on this credit bureau score but you should target for overall score between AA to DD and avoid GG to HH scores.

To improve your credit score, ensure prompt payments on all your personal credit facilities. Making full payment on your credit cards instead of rolling over balances will also improve scoring.

Documents and information required for SME financing application

Financial reports

Most banks require latest 2 years financial report for SME financing assessment. The latest financial year report should be within 18 months from loan application.

If your accountant has not prepared the full set financial report yet, you can supplement the application with a set of internal draft management accounts which minimally should reflect the Profit and Loss Statement plus Balance Sheet.

Bank statements

Most banks will require latest 3 to 6 months bank statements for business loan assessment.

Tip: If you anticipate an upcoming cash flow crunch or large payments out, try to plan ahead and apply for a loan earlier. Your bank statements will score better if most recent months’ cash balances are healthy.

Debtor’s and creditor’s ageing list

You might need to furnish your latest debtor’s and creditor’s ageing payment list if available.

Director’s IC and Notice of Assessment

Director’s IC copy to verify identity and personal Notice of Assessment (NOA) for latest 2 years are required.

GST Form F5

If your company is GST registered, some banks might also require last 4 quarters of GST form F5 returns.

Existing loan facilities

If you have existing SME financing facilities from other banks, you would need to furnish the details.

Information required would be the names of the lenders, type of facilities, outstanding loan amount, outstanding tenure, interest rate, and monthly installment.

Site visit photos

Some banks might require to conduct a site visit to your company’s operating premises.

The purpose of this is to verify the company’s operating address and to conduct due diligence. If you don’t have a proper operating premises, it might affect the application.

Brief write up on company’s information

Not compulsory, but a loan application that comes with a brief 1-2 page write up on company’s business nature, key customers, management team profile, working capital requirements and projected future plans might be useful to improve approval chances.

Optimize SME financing applications

Misconceptions about SME Financing

New startups can obtain financing as long as it has a great product or service

A new business is exciting — perhaps your product reinvents the wheel, or your service is incomparable to competitors. However, regardless of the projected growth potential of your new business, banks generally do not finance newly incorporated startups.

Most banks require a track record of at least one to two years of operational history and attributable revenue.

For new startups in pre-revenue phase, it is advisable to source for equity financing or venture capitalists rather than debt financing from banks.

If loan application is rejected from one bank, it will be rejected from other banks as well

There are many banks providing business loans and each has different credit criteria and risk appetite. Your application may not have satisfied the criteria for one bank, but that doesn’t mean it won’t meet the criteria for others.

Some banks may, in fact, favor one industry over another or prefer an industry that other banks often shun.

Of course, there are exceptions. Certain adverse factors, such as pending bankruptcy or a dormant company, will often result in a declined loan application.

Applying for loans with multiple banks increases the chances of approval

Even if an SME has the time and resources to submit applications to multiple banks concurrently, it does not necessarily increase loan approval chances. Conversely, it might even backfire.

Banks conduct personal credit searches on the directors of a company during the application process. Too many searches in a short period of time may reduce the credit grading of the director, which could adversely affect approval chances.

Consider consulting with a SME loan specialist to help narrow down the banks that suit your company’s profile. This not only reduces the number of loan applications made — cutting down on time and costs — but it also increases the chances of approval.

A company should seek financing only when it requires to do so

Some business owners will only apply for financing when they run into cash flow difficulties. It is harder to convince banks to fund a business that is already experiencing cash flow crunch. Banks are in the business of managing risk.

Plan ahead at least one to three months in terms of your finances. If you expect to experience growth or a slow period, begin the business loan application process as soon as possible before your financial situation deteriorates.

Bonus Content

Thank you for making it so far. Here’s a bonus content to thank you for staying with us:

Resources and references:

1. SME financing survey 2023

3. www2.deloitte.com

4. mas.gov.sg

5. businesstimes.com.sg

6. straitstimes.com

7. www.gfmag.com/

What should you do next?

Now you have a clear understanding on the business loan landscape and assessment process, it would be much easier when you next apply for funding.

If you would like to compare all banks loan products, try our SME financing comparison tool and see your loan options instantly!

Compare All Business Loans

See All Loan Options Instantly!