Why Most SMEs Choose Debt Over Equity Financing

Table of Contents

If you're exploring financing to expand your business, there are generally 2 broad channels you can consider. Equity financing or debt financing.

Equity financing involves selling shares of your business to external investors in exchange for funding, the value of which is usually determined by mutually agreed business valuation of your company.

For high growth potential startups in deep tech segments, equity financing would be more appropriate to raise funding during initial stages as such businesses would typically not qualify for a startup business loan.

More commonly in Singapore, most businesses would opt for debt financing via SME loan applications. Here are some reasons why SMEs would usually finance their working capital and expansion via debt.

No ownership dilution

Equity financing is a way for you to sell shares of your company to investors. In exchange for the funds they’ve infused in your business, investors become co-owners. The extent of co-ownership varies, depending on how much funding invested and the valuation of the business.

With loan financing, you don't accede control over your business. You take up a loan and you just service it with interest, based on the terms of the loan agreement.

Generally, some banks will request for an acceptable property, equipment, or receivables as collateral. For SME financing, many banks offer unsecured loan facilities.

Shorter waiting time

The time it takes for a business loan to get approved is typically two weeks to a month, depending on bank credit criteria, requested loan amount, and other considerations.

Equity financing does take much longer. Closing a deal with investors may take months, including related due diligence checks required and pitching presentations to potential investors. These could rob you of your precious time allotted for running the business.

Full operational control

In equity financing, new investors might request for a board seat as director and will have a say on how on operational aspects of the business. Business decisions will now be subject to the approval of the board.

If there’s a new business idea you wish to test or adopt, you’ll might have to obtain the consensus of everyone who has an interest in the business.

For debt financing, creditors have no say in the business directions of your company. Their biggest concern is solely on the business repaying the loan extended promptly.

Wider accessibility

Banks and other financiers accommodate a wider range of businesses. In terms of size, there’s opportunity for both small and large-scale business owners to avail of a loan.

Investors, on the other hand, prefer to invest in companies with high scalability and potential for explosive growth. Therefore, small traditional brick and mortar businesses usually don’t stand a chance with such investors despite proven profitability and stability.

There are also many banks active in the SME banking space in Singapore. As an SME, it’s easier to access loan facilities through the banks’ extensive consumer touch points then to source to VCs to pitch for funding.

Although banks with retail presence are easily accessible, there’s no guarantee that banks will approve your loan applications. Therefore, you need to know how to improve chances of loan approval.

Positive impact on credit history

Obtaining debts and conducting repayment promptly creates a positive impact on your credit rating.

Maintaining a satisfactory payment record for debt that you’ve obtained will also improve the chances for a loan top up offer and additional financing with better loan terms.

Tax deductible

All business loan interest rate paid is tax deductible and can be treated as an expense on your Profit & Loss.

The interest you’ve paid will form part of your tax deductible business expenses which you’ll deduct from your company’s earnings before tax. By doing so, you reduce the amount of income that is subject to tax, eventually realizing some savings for the business.

Risk of debt financing

By default, all unsecured business loan facilities requires business owners to provide their personal guarantee (PG). In the event of a loan default, you'll run the risk of the banks exercising the PG and in the worst case scenario, face potential bankruptcy.

For equity financing, most deals are structured without need for PG and liability of the business owner is typically limited.

Government financing schemes such as SME Working Capital Loan bears certain risk sharing by Enterprise Singapore to the banks, but ultimately, the borrower is still liable and responsible to make good loan repayments.

Late payment penalties

Missed repayments could result in penalty charges. Late payment penalty is often a related loan fee and charge that most SME owners omit to look out for.

Different banks and financial institutions have different ways to classify a loan default event. Your loan contract specifies which conditions or acts constitute a default.

While different creditors may have slightly different takes on classifying a default event, what is common is that they all charge penalties for late payments. Late interest is charged as well and is typically a certain percentage above the loan's interest rate.

Most banks would classify a borrower whom is behind payment by 90 days or more as a serious event of default.

What happens in event of default

Creditors will send a notice once a borrower is in default (based on the provisions of the loan contract). The first notice will likely be a short reminder urging prompt settlement of past dues including late payment charges.

The second and subsequent notices will most likely be the similar, but with a firm directive to settle obligations, probably a reminder about the consequences of default and possible legal actions.

Even if the defaulted loan falls under government financing schemes like the Temporary Bridging Loan with certain percentage of risk sharing by the Enterprise Singapore, the borrower will still be legally liable for the full loan amount outstanding.

When to discuss the problem?

Talk to the bank's loan officer right away. Don’t let late payment charges and interest accumulate.

Other options may include restructuring of the loan outstanding, but be prepared to pay a significant portion of past due obligation before banks recommend any loan restructuring proposals.

Lender’s rights in the event of default

One of the lender’s options, in this case, is to foreclose on the asset you have mortgaged or assigned as security for the loan. So if your loan is secured by a business property loan, machinery/equipment, accounts receivable, or a bank account, expect your lender to recover the default amount (including interest and penalties) through these mortgaged assets which is common in asset based lending.

The security documents as well as the loan contract you signed bear the provisions about recovery rights in the event of a default and foreclosure.

For example, if your loan is secured by a real estate mortgage, the lender has the right to foreclose on this property. Eventually, the lender will sell the property to recover the loan amount outstanding. Excess cash from the sale goes to the borrower provided there are no other liens on the property.

Impact of a personal guarantee on a business loan?

A personal guarantee doesn’t create a lien on a specific asset owned by the business.

Generally, there are two types of personal guarantee. For unlimited personal guarantee in favor of your lender, the lender may fully recover the debt in question including related costs by taking over personal assets owned.

On the other hand, a limited personal guarantee allows the lender to claim after assets up to the amount mutually agreed upon in the guarantee documents. This amount typically is the original loan amount extended to borrowers.

Most banks will require the key directors or major shareholders to furnish personal guarantee with the liability capped at the principal amount of unsecured business loan extended.

There are some assets such as CPF balances and HDB flat that banks are not able to foreclose even with personal guarantees.

If the guarantors are not able to furnish any personal assets that can offset the outstanding business loans outstanding, the banks might in the worst case scenario proceed with bankruptcy proceedings against the guarantors.

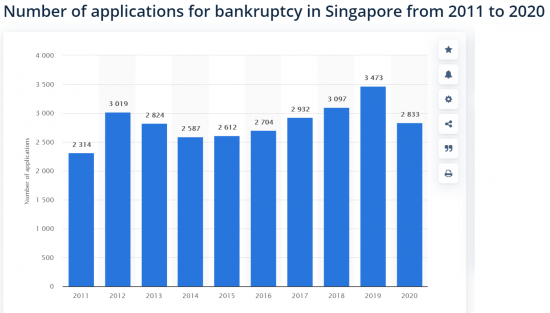

Increasing number of bankrupts

Based on Ministry of Law’s statistics, the number of applications for bankruptcy increased consecutively for 6 years from 2014 to 2019. However, the number of bankruptcy applications reversed the trend in 2020, decreasing to 2833. This is likely due to debt moratoriums the government enacted to cope with Covid-19's impact on the economy.

There are no detailed statistics on the actual reasons for bankruptcy applications, but according to this Straits Times article, CCS (Credit Counselling Singapore) cited that about 22% of debtors mentioned business troubles as key reason for filing bankruptcy.

Joint and several guarantees

If you have other partners in the business, all other partners will usually have to furnish their personal guarantees for unsecured business loans.

In the event if there’s more than one guarantor to a business loan, the joint and several guarantee executed by all guarantors will bind all legally liable for the outstanding business loan in the event of a company default.

Some business owners misunderstand that if there are 2 directors in a company and both furnished their personal guarantees to a company loan, the liability of the loan is shared equally between both guarantors. This is not the case.

In a joint and several guarantee agreement, the bank reserves the legal right to claim against any guarantors for the full amount of the loan outstanding in the event of company’s default.

Avoiding loan defaults

Don’t bite more than you can chew. Run through the figures again to make sure you don’t accept a much bigger loan then what you require, especially when you’re applying for multiple banks loans concurrently.

Prioritize payment of your debts. Put off unnecessary purchases for your business. Your debts should come first and your goal is to promptly settle all loan payments due to protect your credit grading.

Before throwing in the towel, do not give up communicating and negotiating with your creditors. This is a painful process but do try your best to propose some workable repayment proposals that can all parties can agree to.

The final verdict

Despite the apparent advantages offered by a debt facility versus equity financing, the final decision rests in your hands. You are in the best position to weight the risk versus return ratio and if financing your business via debt financing bears a positive ROI eventually.