SME Business Loan Interest Rate in Singapore

Business loan interest rate in Singapore differs across various banks and types of financing products.

For unsecured loans without collateral, interest is usually higher compared to secured loans with collateral pledged to the banks.

Here are the indicative range of business loans interest rates for various SME loan products:

| Loan Type | Interest Rate (EIR) |

|---|---|

| Unsecured Business Term Loan | 7.5% – 10% p.a. |

| Temporary Bridging Loan (ceased) | 2.75% – 5.5% p.a. |

| SME Working Capital Loan | 7.5% – 9% p.a. |

| Trade Financing Line | 6.5% – 8% p.a. |

| Factoring / Invoice financing | 7% – 12% p.a. |

| Overdraft | 9% – 12% p.a. |

| Equipment/Machinery Loan | 4% – 7% p.a. |

| Commercial/Industrial Property Loan | 2.8% – 3.2% p.a. |

| P2P Crowdfunding / Alternative lenders | 1% – 5% /month |

To know more about the various loan products and facilities listed above, do take look at our SME financing guide.

There are also government assisted loan scheme such as the SME Working Capital Loan introduced to help SMEs improve financing accessibility and lower SME loan interest cost.

Government assisted loans tend to have lower interest rate compared to banks' standard commercial loans.

There is usually a government risk sharing mechanism with participating financial institutions for such schemes. This reduces the risk exposure of lenders, which enables them to price the loan at lower rates.

Effective interest rate (EIR)

Business loan interest rates are usually quoted in EIR (effective interest rate) terms.

What does EIR mean?

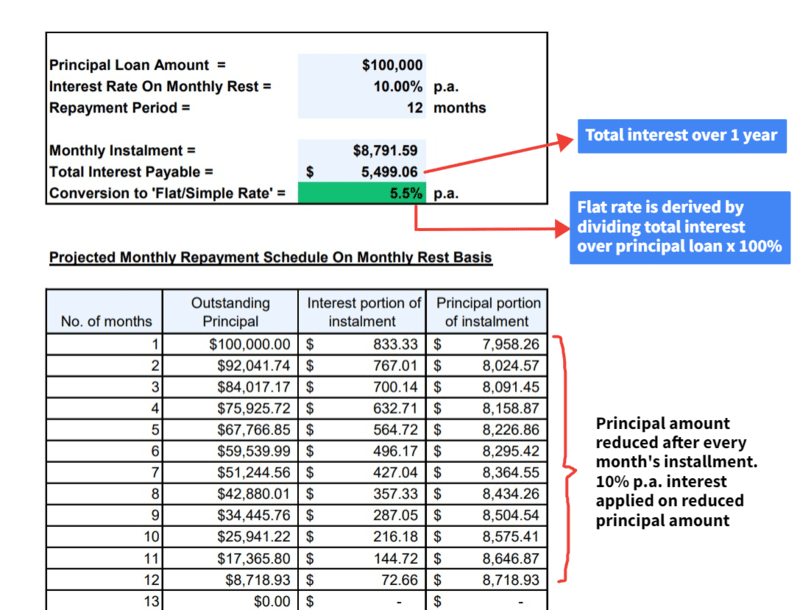

The effective rate is the actual cost of borrowing and is usually amortized on a monthly reducing principal balance basis.

Simply put, the principal (original) loan amount is reduced monthly via the monthly installments paid.

For the initial periods of the loan tenure, a larger portion of the monthly installments will be apportioned towards servicing the interest portion of the loan.

Effective interest rate formula = (1 + (nominal rate / number of compounding periods)) ^ (number of compounding periods) - 1

Most SME owners usually misunderstand the calculation of EIR.

When quoted a 10% p.a. EIR interest rate for loan amount of $100K, most will mentally compute $10K interest cost per year.

The actual net interest paid for a year on the above example is actually only $5,499. That’s why it’s common for financiers to quote the nominal rate (also known as simple or flat rate) for business loan products to simplify calculation.

Using the same example, the nominal interest rate for 10% p.a. EIR will be 5.5% p.a. flat rate. The amortization table below will provide a clearer picture on EIR calculation.

You’ll need either a financial calculator or loan amortization table to derive the figures above. You could still calculate the interest portion of the loan for the 1st month with a simple calculator.

Here’s how it’s done:

10% p.a. = 0.1

0.1 / 12 months = 0.00833 (monthly reducing balance)

$100k (principal amt) x 0.00833 = $833 (that’s the interest portion for the 1st month you see on the table above)

For a easier and faster way, you can just use the business loan calculator in this page to derive monthly installment and total interest. You can also generate an amortization table on the loan details breakdown.

Difference between effective rate and simple rate

Simple/flat interest rate

The simple or flat interest rate is a basic method of calculating interest based on the initial principal loan amount. It is also known as nominal rate.

Simple rate is usually expressed as an annual percentage and remains constant throughout the loan term. Formula to calculate simple interest:

Simple Interest = Principal Amount × Interest Rate × Time

Principal loan amount = $100,000

Interest Rate: 5% per annum

Time (loan period): 1 year

Simple interest would be $100K x 0.05 x 1 = $5,000.

Simple rate vs effective rate

The key difference between the two is that the effective rate considers the principal balance which reduces as instalments are repaid over the loan tenure, while simple interest “front loads” the entire interest onto the initial principal loan amount, with no amortization.

In Singapore, car loans use the flat/simple rate method to calculate interest.

The effective interest rate is quoted for business loans and mortgage loans, which are typically calculated on a monthly reducing balance basis.

The effective rate provides a more accurate representation of the true cost of borrowing.

The Code of Advertising Practice mandate that banks must include the EIR (effective interest rate) in the marketing of loan and credit products.

Business loan interest are sometimes expressed in flat or simple rate. This simplifies and helps SME borrowers visualize the average interest cost of a loan quoted, without an amortization table.

Factors affecting business loan interest rate quoted

In general, the better your company’s credit profile and cash flow financial figures are, the lower the interest rate you might be eligible for.

There are many other factors that might influence your eligible interest rate.

These include the age of the business (3 years or more preferred by banks), the personal credit profile of the director and the industry nature of the business. Loan amount might affect interest rate as well.

It is overtly simplistic to just compare interest rate lenders quote for SME business loans.

The entire loan facility offer from banks must be taken into critical context as well. Some other important conditions to consider when evaluating business loans:

Processing/facility fee

Most banks charge a processing fee to cover cost of loan origination and administration. This should be included into cost of financing.

Bank A might quote slightly lower interest rate vs Bank B. But, if Bank A's processing fee is significantly higher than Bank B, your overall financing costs for Bank A's loan could be higher.

Early redemption penalty clause

You should check if the loan facility you applied for includes an early redemption penalty waiver and if so, the redemption notice period required. Such clause provides borrower flexibility to exit the loan commitment and reduce interest costs.

Some financiers have onerous lock in periods or redemption penalties which should be factored in when evaluating your loan options.

Collateral requirement

Consider if lenders require any specific assets as collateral in their loan offer? For secured loans backed with collateral, interest rates will typically be lower than unsecured loans since the risk to lenders is lower.

Common collateral banks request for are earmarked fixed deposits, account receivables or properties. Banks usually impose a charge for liens on such assets provided as collateral.

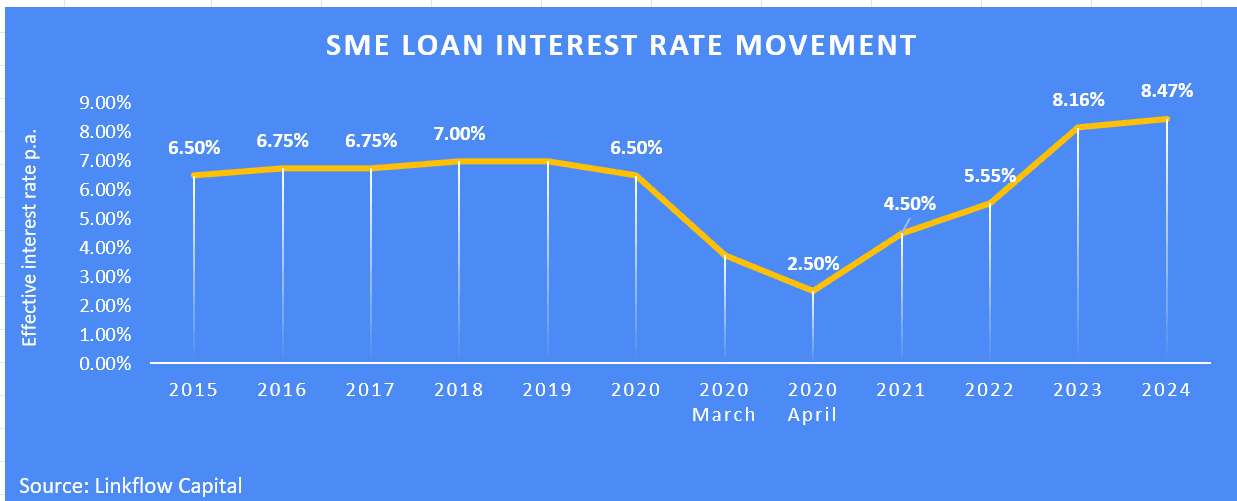

Government assisted loan interest rate

SMEs should also consider first exploring if there's any available government business loan schemes. These facilities generally bear lower interest rate versus commercial loans as the government typically offers participating financial institutions (PFIs) with certain risk sharing mechanisms.

Interest rate for such schemes also vary from time to time. Factors that influence the movement of rate include general credit market conditions, percentage of government risk sharing and PFI's individual credit risk assessment matrix.

Compare widely for best loan options

Compare widely across as many banks' SME loans as possible to get the best deal. Familiarize yourself with the detailed terms and conditions in a loan contract. Consider engaging a professional loan consultant if you need help.

To compare all banks SME loans and business loan interest rates, try our loan assessment tool to review best financing options instantly!