SME Business Loan Consultant Broker In Singapore

Getting a business loan in Singapore often feels like hitting a brick wall. Banks might reject your application with no explanation. Credit requirements are not disclosed, financial jargon is confusing, and you’ve no idea which is the best bank to go to.

Worse, you're spending precious hours gathering documents and applying through multiple banks, only to risk rejection after all the time spent. Meanwhile, your business needs urgent funding for upcoming projects or working capital to tide through slow periods.

A professional business loan consultant could help. Someone who knows the banking landscape, speaks their language, and can help improve your loan approval chances.

Role of SME loan consultants

SME loan consultants serve as professional intermediaries between SMEs and banks in Singapore. Also often addressed as business loan brokers or agents.

Their primary focus is to facilitate successful SME loan applications by managing the entire process from initial assessment to final approval.

Core functions of business loan consultants

- Identifying appropriate loan products tailored to your financing needs

- Thorough review and preparation of all required documentation

- Sourcing multiple banks suitable for your business’s credit profile

- Strategic presentation of business’s profile and financials to banks

- Preparing mitigation and justification replies to banks’ credit concerns

- Active tracking and management of timelines

- Negotiating terms with lenders to secure favorable rates and conditions

- Advisory on improving financing accessibility

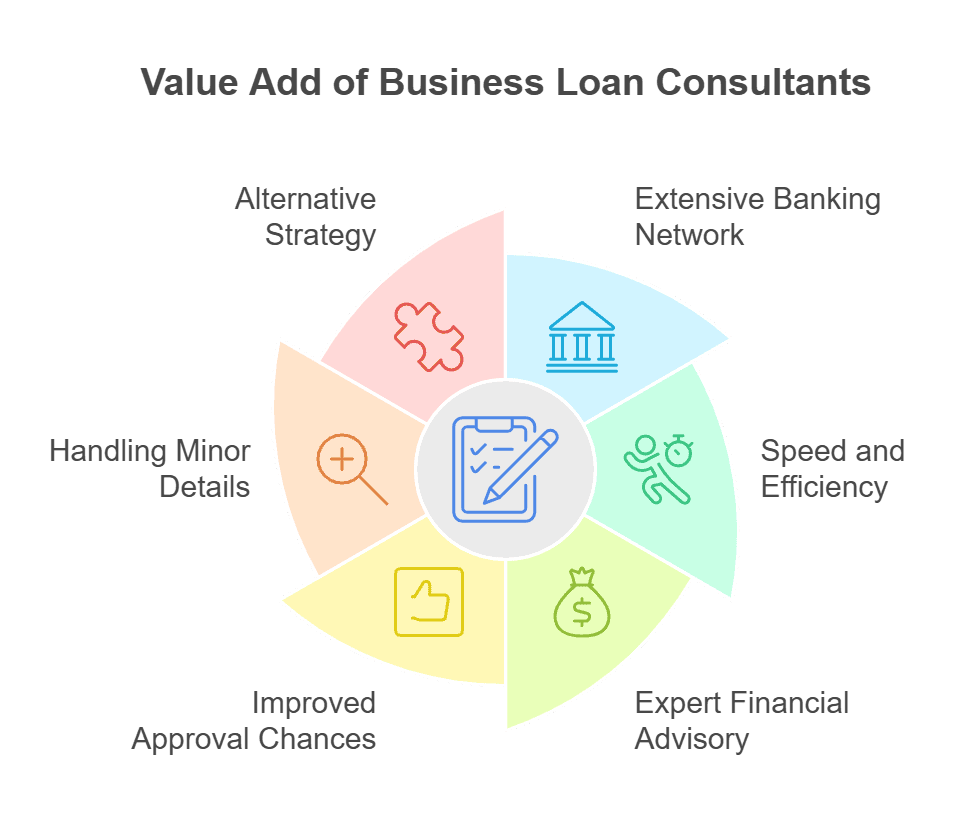

Why pay for a loan consultant?

Extensive banking network

Professional brokers, especially those who’ve been in the business for years, have cultivated relationships with a wide range of financiers and bankers.

You’re paying for the extensive contacts of a business financing specialist. Your broker can cast the net wider, tilting approval chances and higher loan quantums in your favor.

Your applications will land straight up in the right department and personnel, without all the "ding-dong" to-and-fro if you were to call the bank's hotline instead.

Via their wide network of banks, seasoned brokers also have access to the latest loan products and banks’ promotional rates.

Speed and efficiency

You are busy. Time wasted on financing applications you’re not familiar with is much better spent working on your business.

This is especially true if you urgently require funds fast due to time sensitive reasons, such as fulfilling contractual obligations or to seize a business opportunity.

SME loan consultants can turn around applications faster, not because they can work some “magic” or have “special connections”.

A faster turnaround time can be achieved due to the consultant’s familiarity with documentations required and banks’ processes. This minimizes back-and-forth with banks for additional information or missing documents

Expertise and experience

Professional SME financing consultants provide valuable insights beyond basic loan applications.

An experienced consultant can provide detailed assessment of a company's indicative approval chances with just some basic information.

Experienced consultants can advise you on well established strategies for optimizing credit profiles and improving your business’s credit accessibility.

An experienced consultant can walk you through each provision in loan contracts, and highlight any business loan fees or covenants to look out for.

Personalized service

Consultants who are client-centric, working in firms that take a long term view of the business, will typically provide a much better service experience than most bankers.

This is for a simple reason; all business loan consultants are remunerated by clients. Bankers are employees of the banks, and there’s nothing wrong with them acting in the best interest of their employer.

Loan consultants however, have fiduciary responsibilities and loyalties to their clients only, as banks don’t remunerate brokers.

Very experienced brokers with over 10 years of experience typically have 30% to 50% of their business portfolio from existing clients who return. It just makes basic business sense for them to continue delivering an exceptional and personalized service experience for their clients.

Higher approval chances

Working with competent consultants could significantly improve the success rate of your business loan applications through:

- Professional presentation of business case to financial institutions

- Access to multiple banks’ for more financing options

- Strategic mitigation and justifications of potential credit issues

Despite a higher chance of approval, brokers can only influence, but not guarantee a loan approval.

In the event of banks’ rejection, your broker can still propose alternative financing solutions aside from mainstream options such as the Enterprise Financing Scheme.

Alternative Plan B options might include non-bank financiers, merchant cash advance, invoice financing, personal loans from banks or other solutions.

Watch out for red flags

While there are credible loan consultants who do right by their clients, there are also unethical brokers who bring a bad name to the industry.

Some are fly-by-night one-man operators, some do not come from a banking background, while others could be outright fraudulent scammers.

Here’s a quick list of “red flags” to watch out for when selecting brokers to work with.

No contact information or proper business premise

A reputable loan consultant should maintain a proper business presence. Be wary of loan brokers operating solely through mobile numbers, non-corporate emails, with a residential address.

Legitimate consultants typically have registered office addresses and complete contact information available for verification.

Look for consultancies with at least five to seven years of operating history, as this could indicate stability and experience in the industry.

Lacks transparency

Professional consultants communicate clearly about their processes, fees, and banking relationships. Be cautious of consultants who are vague about their banking connections or hesitant to explain their process in detail.

During your initial consultation, the consultant should provide you with a realistic assessment of your loan approval chances based on your business profile.

They should also clearly explain their role and limitations, as well as their fee structure in detail.

Over promises

Beware of brokers who guarantee you loan approval. Don’t get blinded by these guarantees.

Outlandish claims and unrealistic guarantees despite glaring issues that could stall your loan application raises doubts about a broker’s credibility.

The truth is, no third party can guarantee assured loan approval as the final decision lies with the bank’s credit approver.

A responsible broker can advise you on approval chances after preliminary assessment of your financials. But it’s definitely impossible to "guarantee" approval.

A broker who talks up his banking contacts and assures 100% guarantee loan approval are just after a quick deal.

Fraud and scams

Loan brokering is an unregulated industry. The entry barrier is low, inevitably attracting black sheep that taints the industry.

There have been reported cases of self-styled brokers forging documents and deceiving financial institutions with fraudulent applications.

Do not proceed with the engagement if you sense anything amiss.

Consider engaging a professional consultancy firm with:

- Minimally 5 to 7 year operating history, the longer the better

- Authentic reviews from multiple clients on Google or Facebook reviews

- Verifiable testimonials from satisfied clients vouching for their proficiency

- Mainstream media mentions that are not promotional or advertorial

Cost of engaging a loan broker

Most loan consultants in Singapore operate on a success-based fee model, aligning their interests with yours. Fees are only applicable if the consultant successfully procures loan offers for your business.

Brokers usually do not require upfront payments. This is common industry practice. This success-based model minimizes your risk, shifting the risk to the broker who has to first invest effort and time.

Fee Components and Considerations

Market fee ranges from 3% to 6% of the approved loan amount. Fee quotes vary based on several factors.

- Loan quantum - Fee is usually at the lower end of the scale when you’re targeting and can qualify for a higher loan quantum ($500K and above).

- Complexity of case - Businesses with challenging credit profiles; previous loan rejections, highly leveraged, or complex business structures, will require longer man-hours and effort to address these issues to banks.

- Experience of consultancy firm - Established consultancy firms with more than 10 years of industry experience might deliver better outcomes and service. Usually quotes at higher end of the market range, but value for money overall.

There are outliers to this market rate range. We’ve seen brokers quoting eyewatering fees of 10% or higher. They are usually preying on less savvy SMEs in a difficult credit situation.

There are also brokers with rock bottom fees of 1% to 2%. They could be smaller one-man-shows working from home with no support team, or inexperienced brokers with little banking knowledge.

At this price point, the broker has minimal resources to put in a strong application to the banks.

They could be just forwarding your documents to banks without further value add. You are better off doing this yourself and save on the fees.

On a success fee model, there’s no point going for a cheaper quote if the broker turns out to be incompetent and fails to secure financing.

Most established loan consultancies bear overheads to support the success of their consultants and clients.

These include credit analysts and ex-bankers staffed internally. They assist consultants with credit writeups for loan applications to banks. They also analyze industry trends to provide mitigations to credit approvers’ credit concerns.

Reputable and bigger loan consultancy firms have higher and regular case volume with banks. This might help them negotiate better terms for their clients, compared to smaller firms with less deal flow.

Should I engage a loan consultant?

Let’s be honest, any business owner can just walk into a bank and submit a business loan application directly.

Most banks now have digital channels and business banking hotlines, saving you that trip. So why get a loan consultant to assist anyway?

Same reason why some will pay for an aircon technician to clean their aircon. It is not rocket science to remove the cover of an air-conditioner and do a basic wash up of the aircon filter.

In certain situations, it is just far more efficient outsourcing to a subject matter expert and specialist to help.

You should definitely consider engaging a SME loan consultant in the below scenarios:

- First time applying for a business loan and not familiar with the process

- No time or resource to compare across multiple banks and dealing with the application details

- Funding is mission critical - you need to commit to projects/orders for expansion, and require external funds to finance this commitment

- Cash flow issue - you anticipate upcoming cash flow issues due to a slow season and need funds to plug working capital gaps

- Time sensitive - you need funding urgently to meet certain obligations or seize a business opportunity with a tight deadline

- Challenging credit profile - you have already faced rejection from a bank

When you do not need a broker

If the purpose of financing is not critical, i.e. you can live with a potential loan rejection, business still goes on. Or if you just like to find out your business’s credit standing, and able to spare time to handle the application details, a broker will not have much value-add in this case.

If your business revenue is above $20M and you already have multiple banking relationships with banks, a broker will not bring much to the table as well.

In short, it might be better to apply directly with the banks if you do not require financing urgently nor critically. If you do face any issues with the banks, then consider bringing in an expert SME loan specialist to assist.

But do note if an initial application is rejected, it’s usually not possible, even with a broker’s representation, to submit a subsequent application to the same banks again in the short term (6 to 9 months).

Bankers soliciting for tie-ups with brokers

If you’re a bank or financial institution’s representative exploring loan consultancies to partner with for deal flow, do read on.

Beyond serving SMEs, professional loan consultants’ function as intermediaries benefits both borrowers and lenders, creating efficient channels for loan origination and processing.

For lenders, working with established consultants brings several advantages. First, consultants pre-screen applications, ensuring only qualified borrowers reach the bank's credit desk. This saves significant processing time and resources.

Professional consultants also provide complete, well-organized applications, reducing the back-and-forth typically needed to gather missing information, streamlining the assessment process.

Linkflow Capital's Partnership Approach

We are an experienced loan consultancy in Singapore's SME financing landscape, operating since 2012.

We’re probably the only consultancy firm to be featured and interviewed in both television and radio media. This reflects our thought leadership and expertise.

We’re empaneled with all major banks, most financial institutions and non-bank lenders. We built strong relationships with our banking partners by maintaining professional standards, emphasizing thorough documentation, compliance with banking requirements, and transparent communication with all parties.

Feel free to send an introductory email to us at info@linkflow.com.sg. We are always looking out to share more financing options with our clients via our platform.