Invoice Financing Singapore

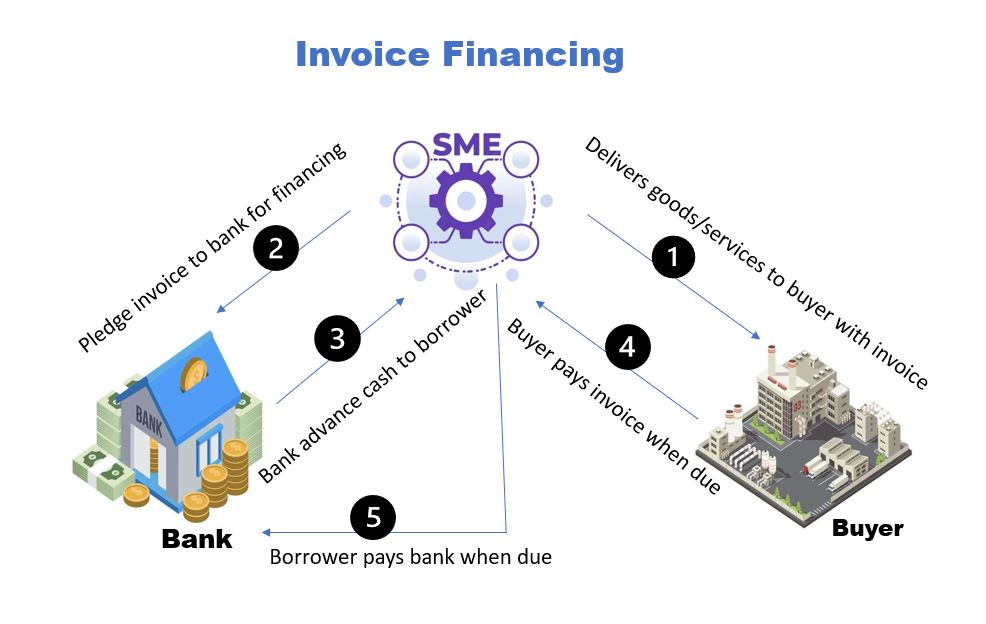

Invoice financing is a short term financing facility where businesses can unlock cash stuck in receivables to improve working capital.

For SMEs that sell on credit terms (i.e. 30 days or 60 days term), invoice financing allows your business to receive cash earlier than credit terms extended. By pledging receivables to financiers, businesses can receive up to 80% to 90% of their unpaid invoice value upfront.

This is a suitable alternative to the usual business loan in Singapore. Borrowers only pay interest as and when they require financing of invoices. It is also a scalable financing instrument, as your financing limits grow in tandem with your revenue.

Invoice financing benefits

Difference between factoring and invoice financing

Invoice financing and factoring are similar. Invoice financing is a loan facility where borrower’s unpaid invoices are pledged to the lender for an advance against invoice value. With factoring, invoices are sold to a factoring company at a discount.

In a factoring arrangement, the factoring company, also known as a factor, will purchase the sales ledger of the borrower. The factor will then advance to the borrower cash, between 70% to 90% on the value of outstanding invoices, similar to invoice financing. Debtors of these invoices will be notified to make full payments to the factor when payment is due, who will in-turn reimburse the borrower with the remaining balance of the invoice, less interest and fees.

The borrower sells their sales ledger to the factor, who will assume debt collection on unpaid invoices and be assigned the legal rights to these receivables. This is the key distinction between invoice finance and factoring, as the borrower retains their sales ledger in invoice financing and assumes payment collection from debtors as normal.

Debtors will not be aware of the invoice financing arrangement as payments due continue to be paid to the borrower. This is also known as non-notification invoice financing.

Some SMEs prefer invoice financing over factoring due to this non-notification nature. There is still some stigma over factoring for SMEs, who might be concerned about their buyers having a negative impression of their business’s financial viability.

Recourse and non-recourse factoring

Factoring with recourse basically means the borrower is ultimately responsible to the factoring financier for invoices that are in default. Borrower will have to make due payment to the factor for invoices that the factor is not able to make collections on, typically by buying back these invoices from the factor.

For non-recourse factoring, the factor will assume full liability for invoices purchased and bears the costs of bad debts. The borrower has no obligation to make good to the factor for invoices that are in default.

Accounting treatment for invoice financing and factoring

Invoice financing is a credit facility and outstanding loan amount would be accounted for as a loan under the liability column of the company’s balance sheet.

Factoring is accounted for as an off-balance sheet item and not treated as a loan liability in the balance sheet. The borrower is technically selling assets (receivables) at a discount, in return for a cash advance. As such, no new loan liability is created in this factoring transaction and the proceeds of the advance are not required to be recorded as a loan under the liability column. However, most accounting standards do require factoring facilities to be disclosed in the notes of the business's financial report.

Due to this off-balance sheet accounting treatment, factoring could be a preferred choice for companies looking to lower their debt-to-equity gearing ratio and avoid excessive leverage with raising new debt.

Invoice financing interest rate

Invoice financing interest rate ranges from 0.5% and up to 2% per month. Interest rate is dependent on credit underwriting risk the financier undertakes. Risk factors include:

Quality of debtors - Debtors with strong profiles such as global MNCs, government statutory boards or established reputational companies will be assumed to have lower payment risk.

Borrower’s creditworthiness - Unlike factoring where the lender bears the credit risk of debtors, the credit worthiness of the borrower is of greater concern to the invoice financing financier.

Notified invoice financing - Financiers assume lower risk if invoice financing is on notified basis as they can instruct debtors to pay them directly on short notice, in the event if the borrower defaults.

Length of trading relationship - The longer the borrower has traded with its buyers, the more comfortable the financier is when assessing underwriting risk. Fulfillment and performance risk of borrower as well as repayment risk of debtors is easier to mitigate if trading relationship has been established for a considerable period.

Purchase invoice financing

Considered the opposite of invoice financing, purchase invoice financing or import invoice financing is a credit facility to finance your business’s purchases of physical inventory or goods. Other commonly used terms for such financing are “supplier financing” and “trade financing”, the latter being the more commonly used term in Singapore.

Invoice financing finances the buyers’ leg of your trade cycle, while trade financing/purchase invoice financing supports the financing of your sellers’ leg.

Companies can utilize both financing tools creatively, by using both invoice financing and trade financing to finance both legs of their trade cycle, thus improving working capital cycle significantly. Downside to this would obviously be financing costs, which might erode your margins.

Industries suitable for invoice financing

Invoice financing is not suitable for B2C businesses as they typically do not sell on credit terms. It is most useful for businesses that have recurring monthly invoices and trade with long credit terms. Some examples are:

Government Contractors

Winning a government contract could be great news for a company because it comes with a high surety of payment. However, government entities are often slow in payment cycles. Vendors awarded tenders via Gebiz portal can factor their invoices with factoring companies via the portal: https://www.vendors.gov.sg/UsefulReferences/ListOfFactoringCompanies.aspx

FMCG suppliers to supermarkets

Big chain supermarkets are known for long payment terms stretching to almost 90 to 120 days. These chains have bargaining power over suppliers due to their wide consumer and retail reach. A new FMCG (fast moving consumer goods) supplier might even have to agree to trade on consignment basis for a start when trying to place goods in the shelves of supermarkets. If the supermarket moves on to make formal purchase orders, expect long credit terms as well.

Employment and labor agencies

These companies need to pay their contracted workers on monthly salaries while their clients typically pay on credit terms with at least 30 days term. These include security guard services firms and construction foreign workers manpower supply companies.

Construction

Construction projects usually have a long gestation period, taking months or years to complete. But employees and subcontractors need to be paid on time. Projects typically involve large initial capital outlay, further stretching cash flow pressures. Payments from developers or main-contractors are usually on progressive claims and it is very common for payment delays in the industry.

Summary

Cash flow is among the most vital components needed to sustain and expand a business, and this is even more so for SMEs who are not as well capitalized.

However, if the company is new and/or too smallish, banks and financial institutions are usually risk adverse to extend financing until the business is able to provide historical track record of operational viability and repayment capability.

The absence of historical performance, inability to provide collateral for secured loans and a dearth of startup business loans in Singapore further compounds SMEs’ difficulty in accessing much needed financing to grow and scale.

Invoice financing and factoring is one of the best alternatives for such SMEs to finance their business and maintain positive cash flow. SMEs can unlock funds at a shorter time, that are otherwise stuck in their receivables.

For factoring facilities, once the invoices are sold to the factoring company, the borrower is free from unproductive administrative tasks such as payment tracking, following up on due invoices, credit collection and assessing credit risk of new buyers.

In summary, invoice financing and factoring is a flexible short term working capital tool for SMEs as an alternative or complement to traditional SME loans.

Both factoring and invoice financing involve an advance by lender on a certain percentage (typically 70% to 80%) of outstanding invoice value to the borrower. However, in a factoring arrangement, the lender takes over administration control of receivables. In invoice financing, borrowers might still retain control over receivables.

Invoice financing interest rate is typically between 7% to 12% p.a. For some non-bank alternative lenders, invoice financing interest could be between 1% to 3% per month.

Any business industries that are B2B and offer credit terms to their buyers are suitable for invoice financing. For businesses that sells B2C or on COD basis, invoice financing would not be suitable.