2024 SME Finance Accessibility Survey and Research

Table of Contents

Linkflow Capital operates a SME loan portal for SME owners to compare their business financing options online instantly.

We have been aggregating data collated from our SME business loan comparison platform since 2017. This report summarizes the data researched from January to December 2024.

Our key takeaway from 2024’s survey data:

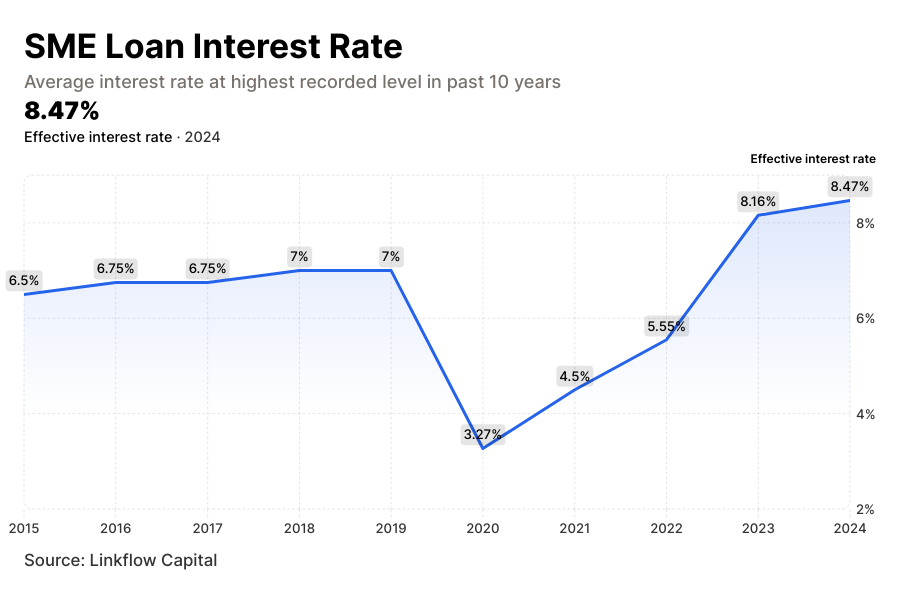

"SMEs Face Double Whammy in 2024: Borrowing Costs Hit 8.47%, Loan Quantum Shrink"

Singapore SMEs endured another challenging year in financing, as borrowing costs surged to an average of 8.47% p.a. in 2024, marking the highest lending rates in recent years. SMEs also had to grapple with increasingly restrictive lending conditions, resulting in reduced loan quantum and tighter access to funding.

SME Borrowing Costs Surge to Multi-Year High at 8.47% p.a. in 2024

According to our internal data at Linkflow Capital, the average interest rate for SME loans remains elevated at 8.47% per annum, marking a notable increase from previous years and reaching the highest level recorded in recent times.

This continued upward trajectory reflects a broader trend of rising financing costs, driven largely by global monetary policy tightening aimed at combating persistent inflation.

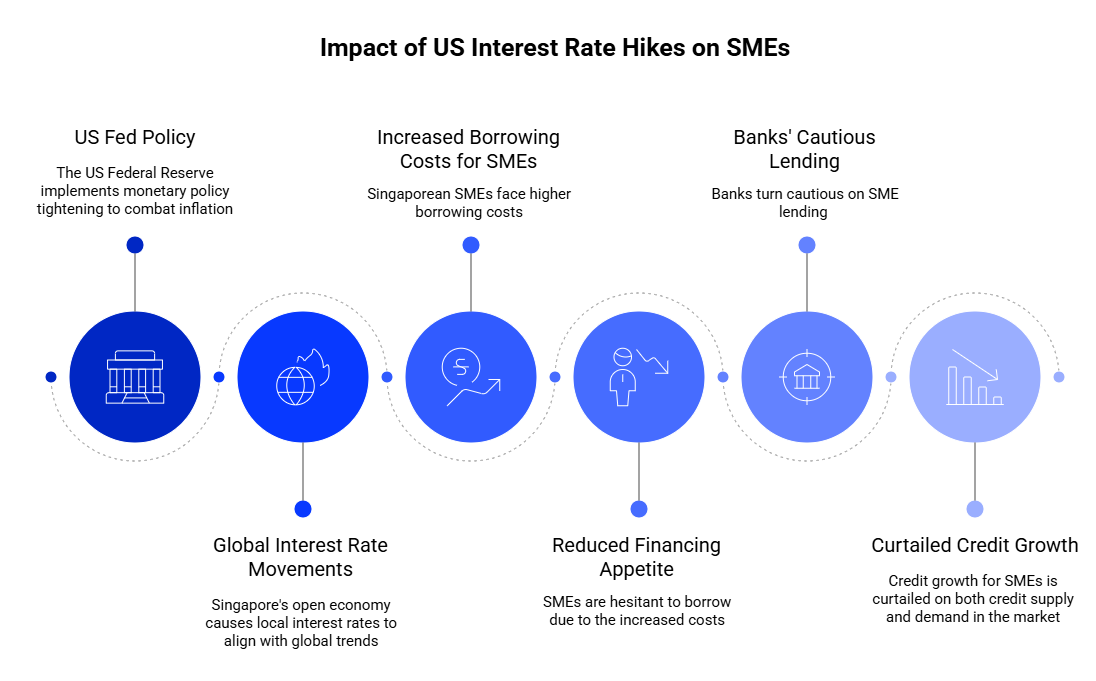

Interest rate elevation underscores how broader macroeconomic dynamics, particularly global interest rate hikes led by the US Federal Reserve, directly influences Singapore's domestic credit environment.

The rise in domestic interest rates is largely attributed to the aggressive monetary policy tightening by the US Federal Reserve throughout 2023 and most of 2024, as they sought to curb persistent inflationary pressures in the US.

Given Singapore's open economy, local interest rates closely track global movements, especially US benchmark rates. Consequently, SMEs faced significantly higher costs of borrowing in 2024.

Higher borrowing costs impacted SMEs' appetite and ability to secure financing. With debt-servicing costs escalating, SMEs prioritized financial prudence, deferring non-essential borrowing or choosing smaller loan quantum to maintain sustainable cash flows.

Banks on the other hand, grew cautious about the resulting higher debt servicing ratio SMEs face in an elevated interest environment. This further curtails credit growth for SMEs in 2024.

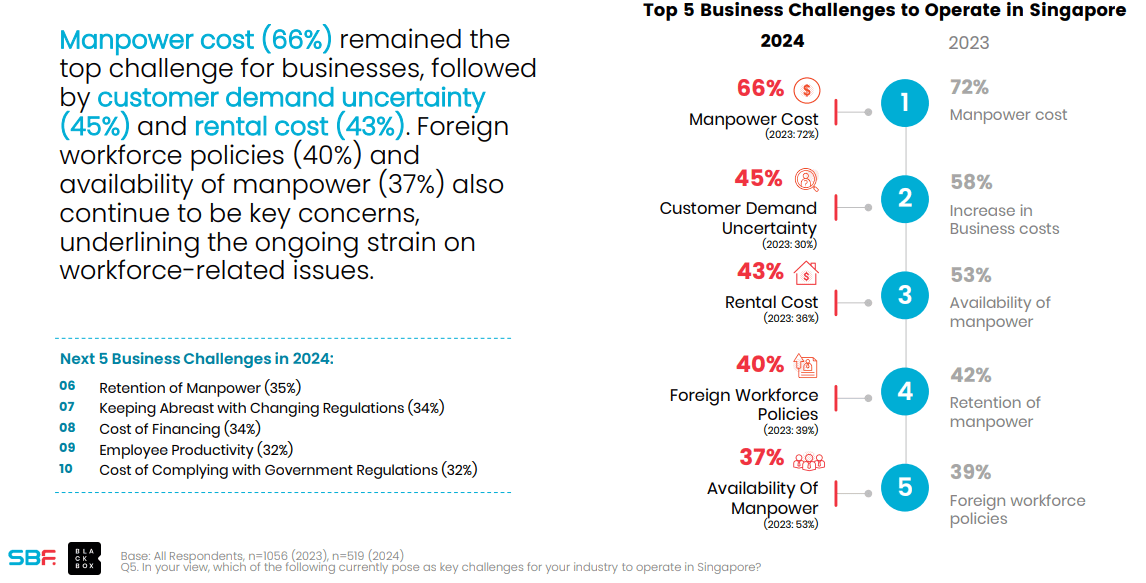

Interestingly, although the cost of credit remains high, a SBF (Singapore Business Federation) business survey for 2024 [8] reveals that ‘cost of financing’ was not a topmost concern for most businesses surveyed. It was in fact ranked 8th out of the top 10 business challenges businesses faced.

On the ground, we observed the same sentiment. Clients were not very much price resistant to the higher interest rate of the credit market. Most SME owners could already be desensitized as borrowing costs started surging in 2023 and maintained the same trajectory throughout most of 2024.

Also, SMEs are usually price takers in the SME banking segment, and higher borrowing costs could have already been factored into the cost of business amidst the high inflationary environment post Covid-19.

Smaller Loan Quantum Reflect Restrictive Lending Environment

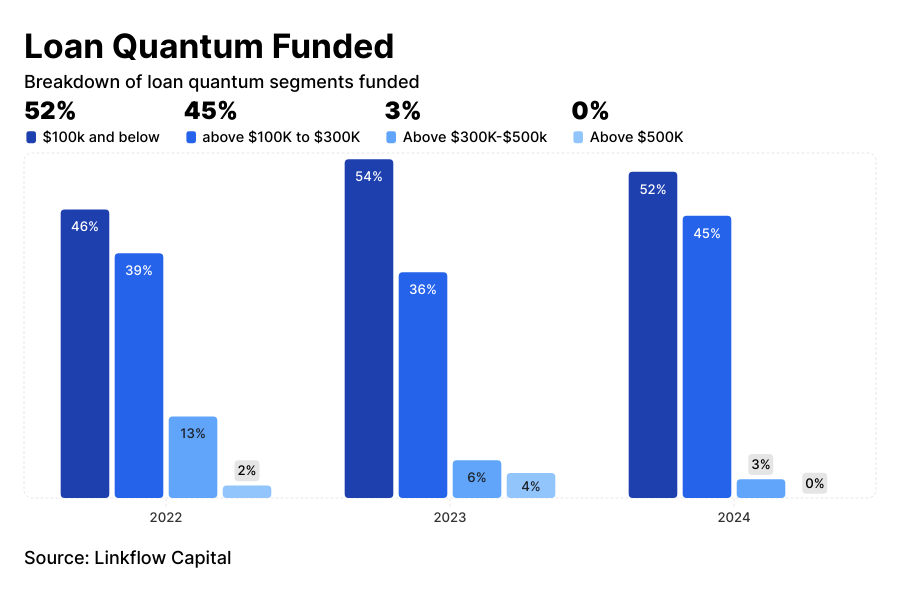

Our internal data revealed a notable drop in approvals of larger ticket-sized SME loans. Loans in the $300K-$500K and above $500K brackets decreased substantially, from a combined 10% of approved loans in 2023 to forming just 3% in 2024. Starkly, approvals for loans exceeding $500K entirely ceased in 2024, compared to forming 4% of approvals in 2023.

Several factors contributed to this decline. Primarily, the rise in borrowing costs led to higher debt servicing ratios, which limited the loan quantum SMEs could comfortably manage.

Additionally, banks exhibited reduced appetite for larger ticket sized unsecured loans, influenced by the tapering of government-backed financing schemes introduced during the pandemic.

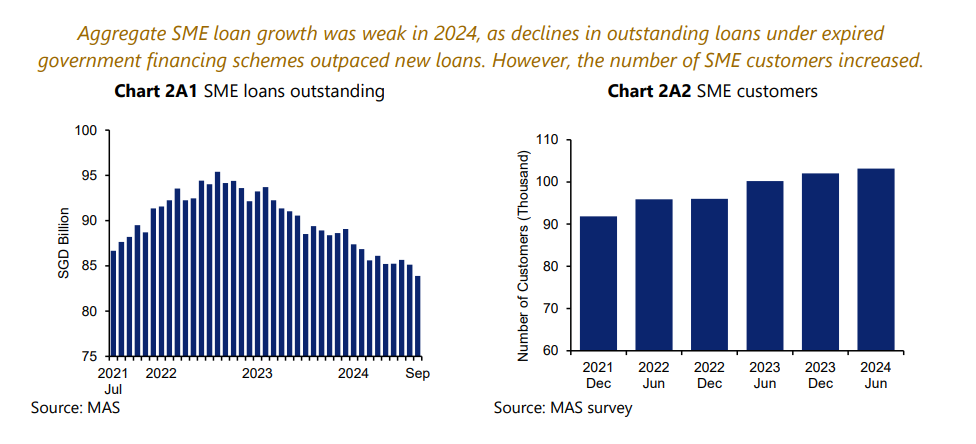

This internal observation aligns closely with findings from the Monetary Authority of Singapore’s Financial Stability Review for 2024 [1] (Charts 2A1 and 2A2).

MAS highlighted a notable reduction in outstanding SME loans which started declining from 2023. This is even though the number of SME borrowers continued to rise.

MAS attributed the loans decline primarily to the natural runoff of enhanced government-backed financing schemes introduced during COVID-19, which ended in the Q3 of 2022.

Additionally, the entry of new digital banks and their acquisition drives likely contributed to the increased number of new SME borrowers onboarded. New loans originated in 2024 bore lower quantum, contributing to a growing borrower base but reduced average loan amounts.

Average approved loan quantum

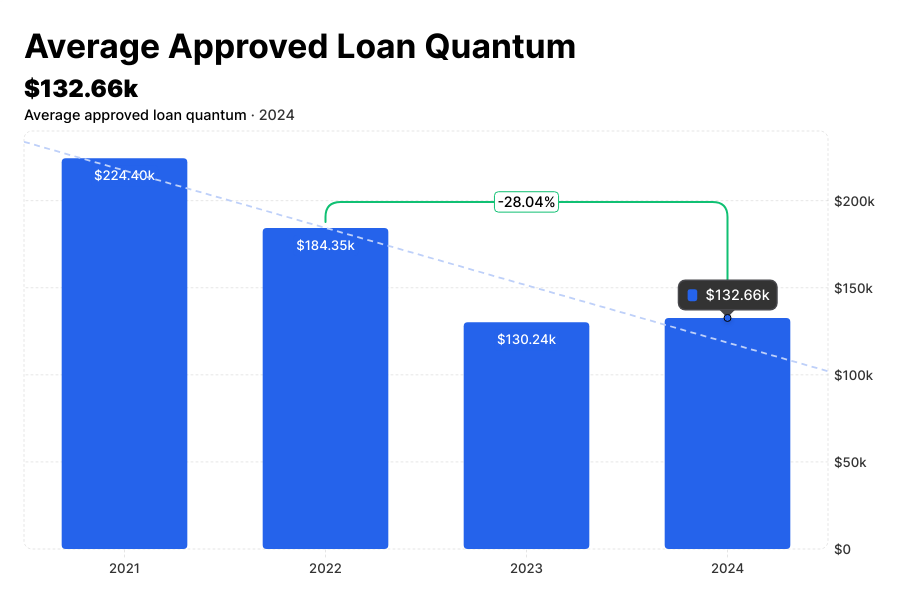

Despite the overall reduction in larger loans, our data indicated that the average approved loan quantum stabilized in 2024 at $132,656, up marginally from $130,236 in 2023. However, this remains significantly below the peak levels observed in 2021 during the pandemic, and a 28% decline from 2022.

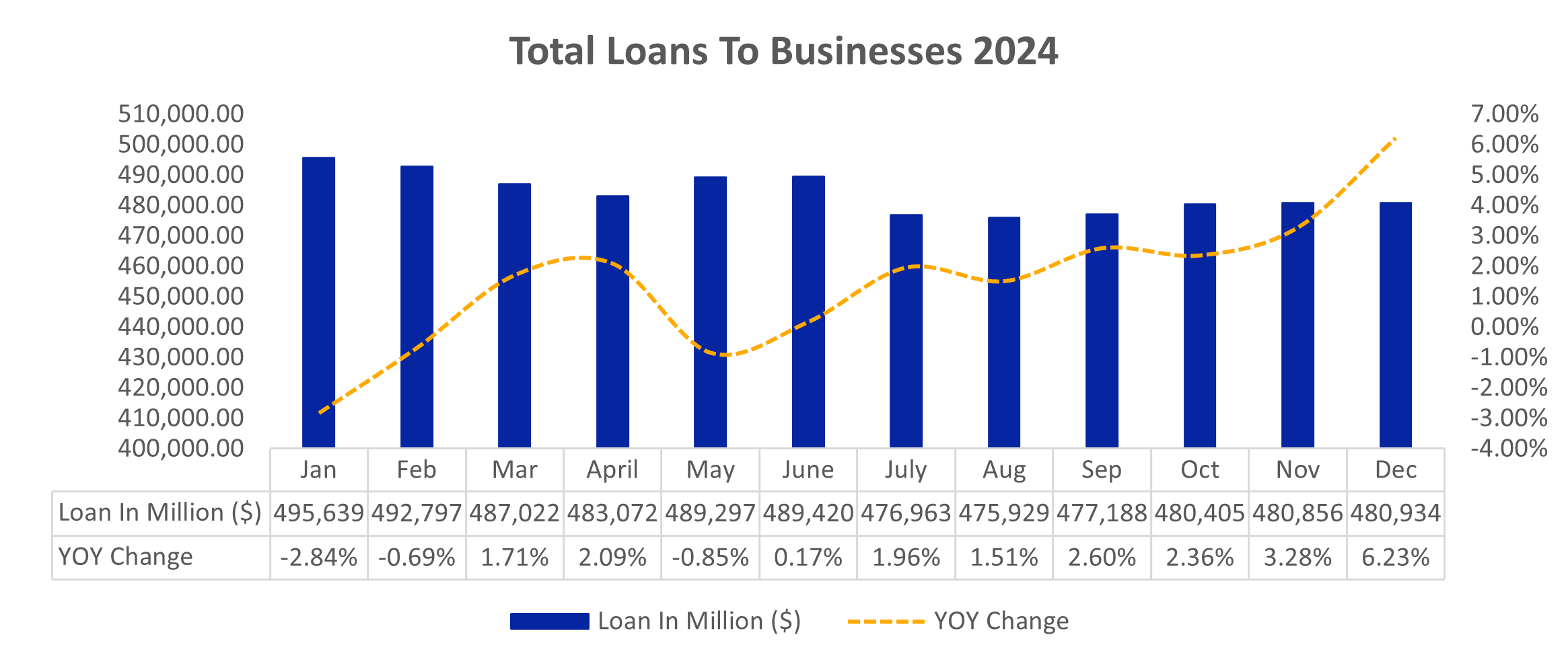

Notably, MAS data on total loans to businesses in 2024 indicated system-wide loan growth of 1.44% year-on-year. This broader systemic growth, which includes larger corporate entities, contrasts with the decline in SME-specific loan growth, underscoring a disproportionate impact on smaller firms.

We posit that SMEs might not have participated equally in the overall credit expansion to all businesses in 2024.

source: https://eservices.mas.gov.sg/statistics/msb-xml/Report.aspx?tableSetID=I&tableID=I.5A

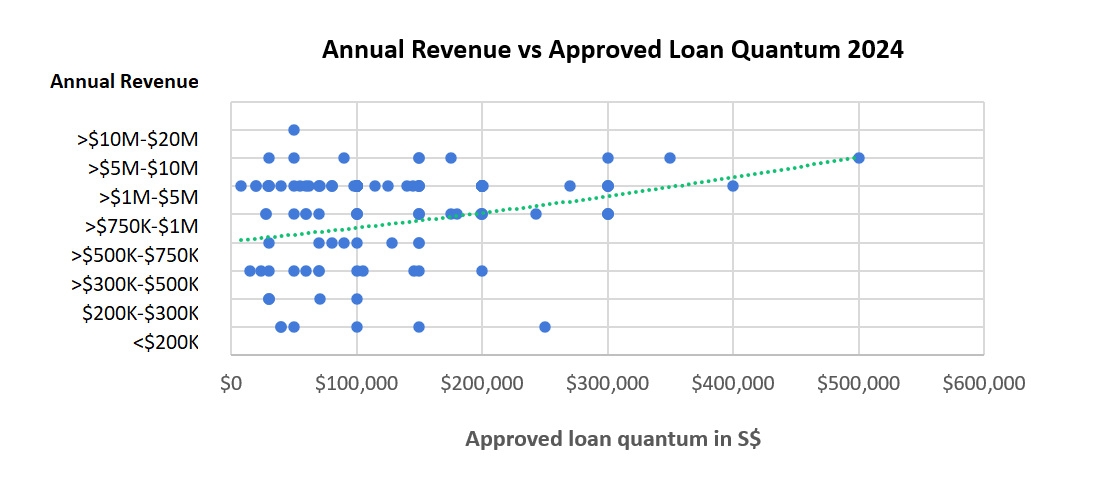

What Influences Loan Size?

Loan quantum approved is determined by many credit factors including credit profile, cash flow, business age, and existing liabilities— but annual revenue stands out as the most significant determinant of approved loan quantum.

In practice, higher revenue generally supports larger loan quantum approvals, as lenders assess repayment capacity based on both historical income and future sustainability.

Our internal data supports this. A review of loan approvals in 2024 shows a clear positive correlation between a business’s annual revenue and approved loan amounts. Businesses with higher revenue tend to be approved higher loan amounts.

The trend line between revenue tier and loan size remained consistent from our previous annual surveys, suggesting that revenue of a borrower remains a stable benchmark in loan underwriting models.

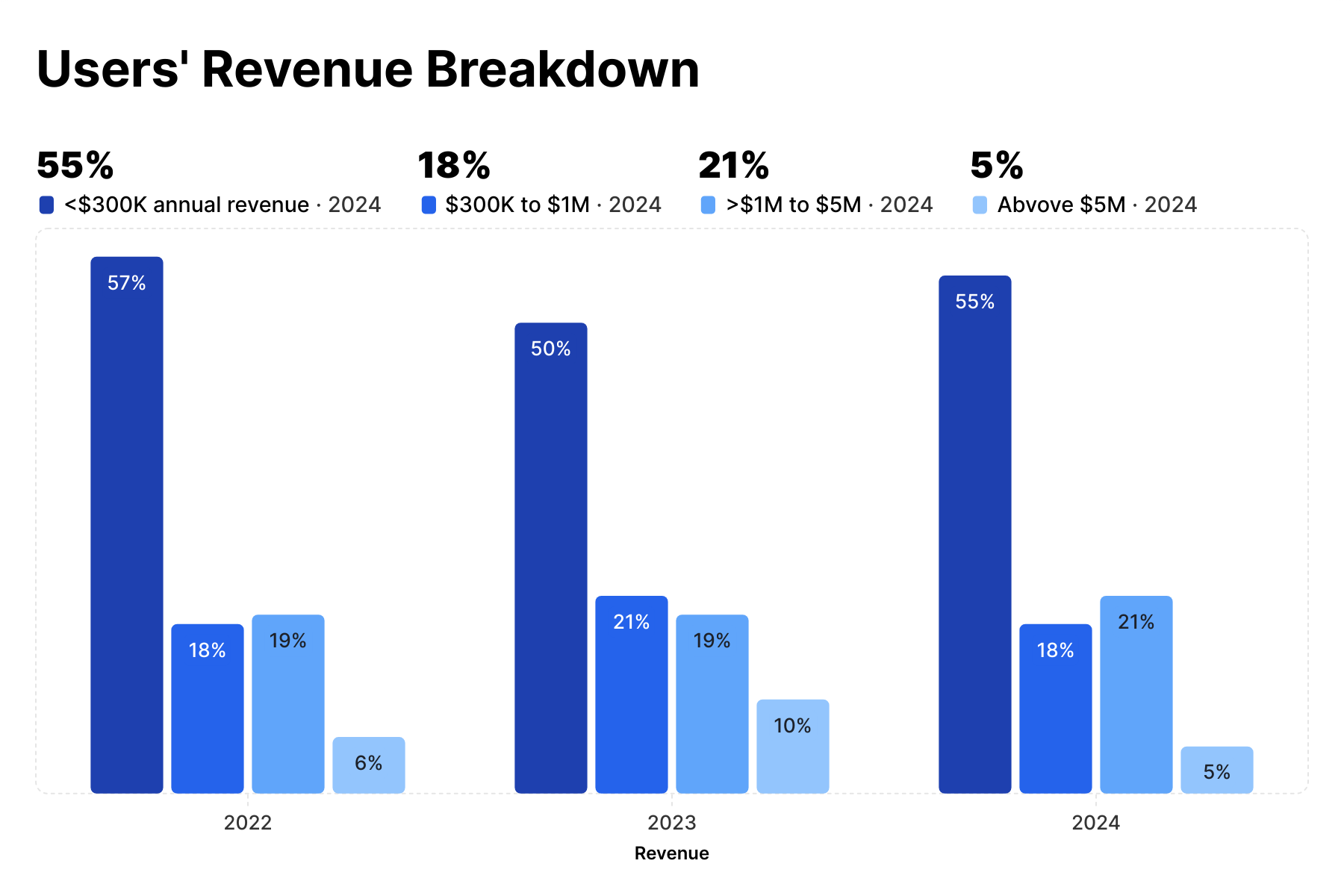

Users’ revenue profile

In terms of users’ revenue profile, most SMEs on our platform in 2024 continued to fall within the lower revenue bands.

Specifically, 55% of applicants reported annual revenue below $300K, a slight uptick from 50% in 2023. The $300K–$1M segment comprised 18% of users, while 21% fell into the $1M–$5M range, and only 5% reported revenue above $5M.

This revenue distribution reflects the demographic of smaller enterprises in Singapore. The concentration in the lower revenue brackets emphasizes on the need for financing solutions tailored to the specific needs and capacities of micro and small enterprises.

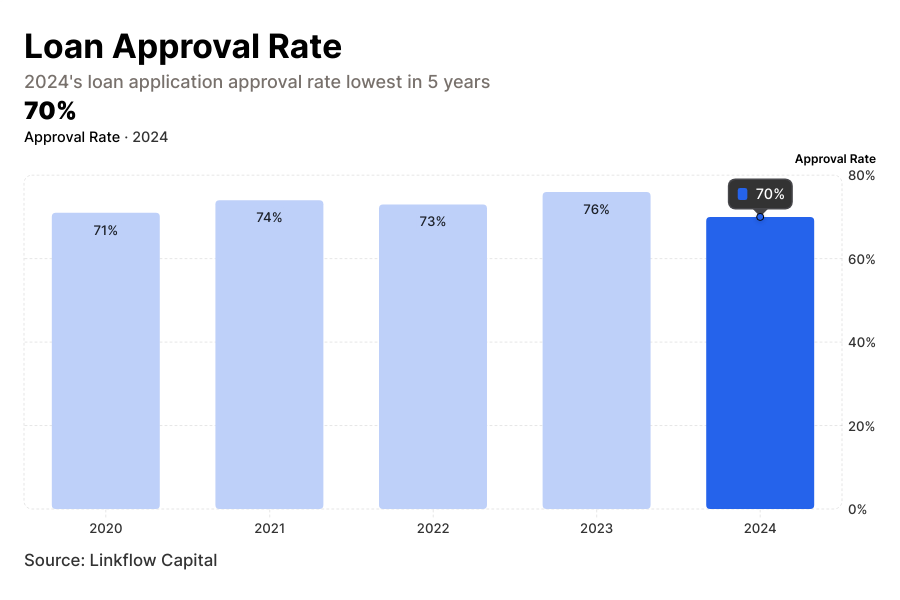

Loan Approval Rate

While topline revenue is a strong determinant of loan size, it’s only one component of credit evaluation.

In practice, credit assessment is also influenced by credit history, financial documentations, industry, and the cash flow of the applicant business. In 2024, these layers of credit scrutiny became more pronounced.

Our survey data reveals a dip in the overall SME loan approval rate to 70% in 2024, down from a relatively stronger 76% recorded in 2023.

This is also the lowest percentage recorded amongst the last 5 years. This decline points towards tighter credit underwriting standards and a more selective lending environment in 2024.

In an environment marked by elevated interest rates, persistent inflation impacting operational costs, and lingering global economic uncertainties, lenders naturally adopted a more cautious stance.

The unwinding of government financing schemes introduced during Covid-19 (Temporary Bridging Loan) could have contributed to the decline in approval rate as well.

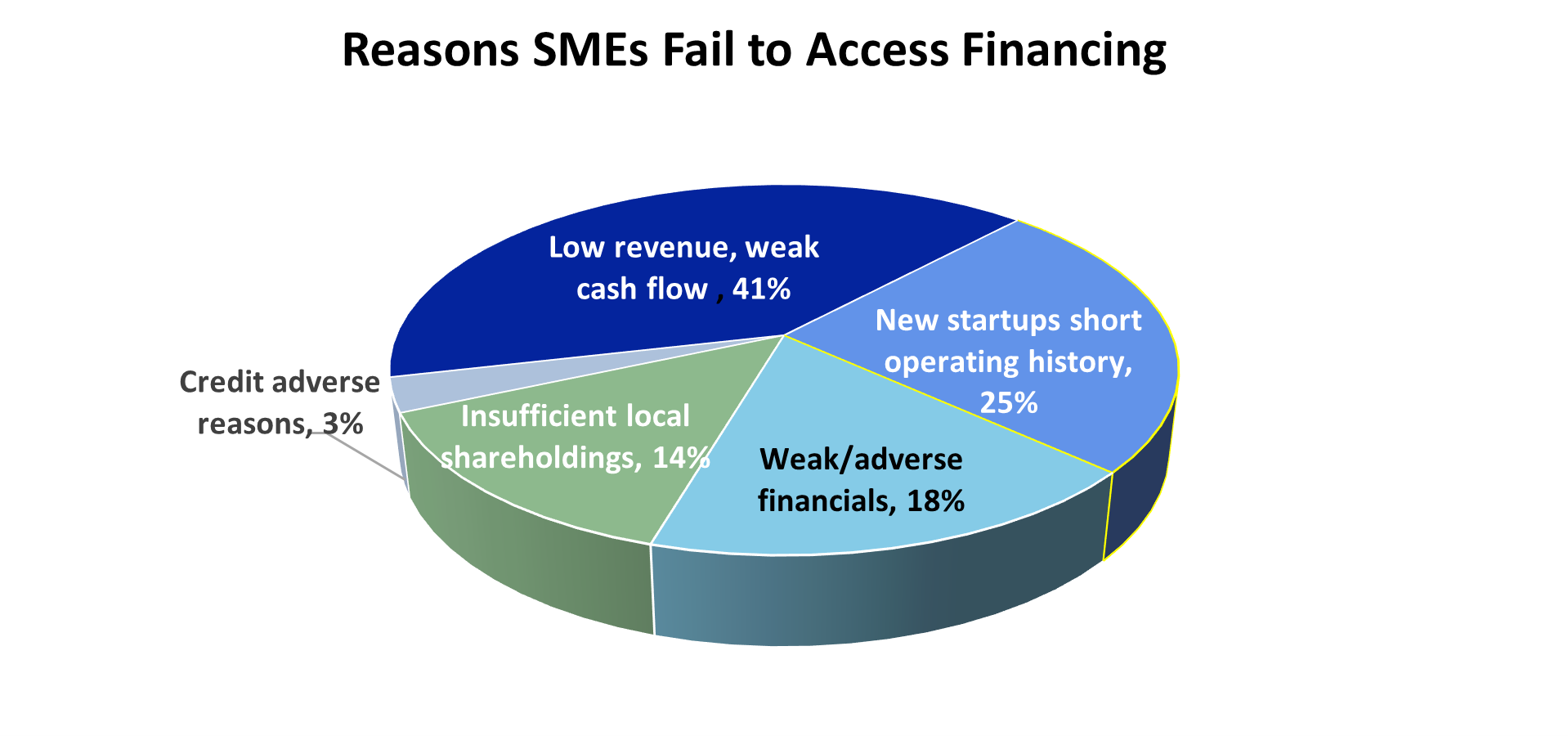

Reasons why SMEs fail to access financing

In 2024, 58% of the users in our platform were not eligible for financing. We studied the data on the most common reasons why SMEs could not qualify for financing:

- 41% were rejected due to low revenue and weak cash flow.

- 25% were new startups with short or no operating track record.

- 18% had weak or adverse financial documentation.

- 14% lacked local shareholding structure, which some lenders require for eligibility under specific programs.

- 3% faced other forms of adverse credit records.

The most common reason SMEs failed to secure financing in 2024 is “low revenue and weak cash flow” at 41%. This is consistent with previous years’ survey.

Almost all lenders require SME borrowers to operate on some minimal revenue requirement and running with healthy cash flow before considering business loan applications.

Different banks have differing credit criteria which will not be publicly published.

While the 5 main reasons shared above for SME financing rejections are commonly corelated with rejected applications, they are not absolute causative nor definitive factors that determine whether an application will be successfully underwritten.

Other variables and unique circumstances can also affect the status of financing applications.

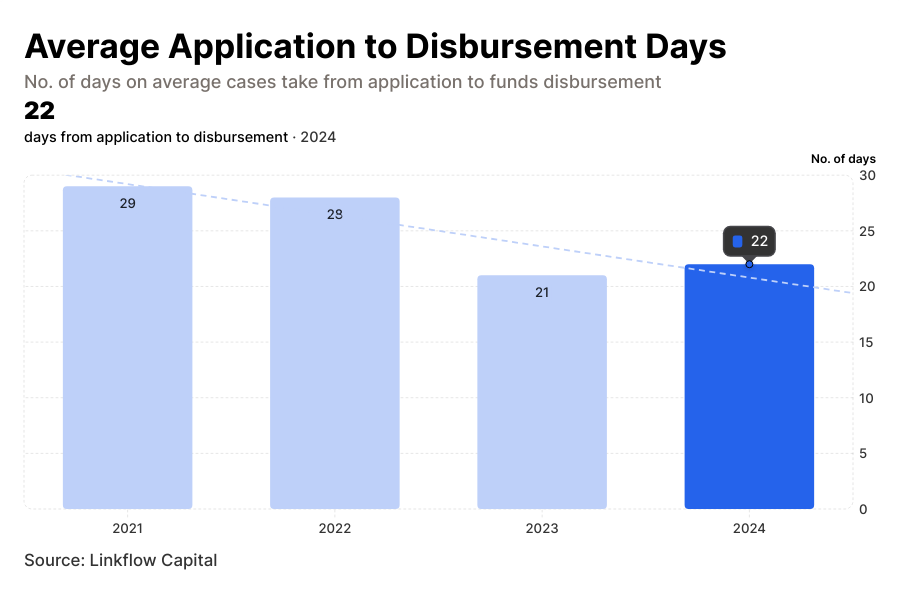

Application turnaround time

Despite the cautious stance by banks in 2024, the speed of loan disbursements remained relatively efficient, for cases which meets the underwriting mark.

The average turnaround time from application to disbursement stood at 22 days in 2024; comparable to 2023’s 21 days, and significantly faster than pre-pandemic norms.

This suggests that while approvals were harder to secure, those that passed credit assessments benefitted from streamlined digital onboarding and faster processing, particularly from newer digital only lenders.

The tightening approval rates, and the consistent nature of rejection reasons paint a clear picture; fundamental business viability - demonstrated through sufficient business maturity, healthy cash flow, and robust cash floats – became even more critical in 2024.

SMEs will need to present a compelling case of financial stability and repayment capacity to secure financing.

The persistent difficulty for startups also highlights the potential need for more specialized early-stage funding mechanisms outside traditional loan structures.

The tougher screening process implemented by lenders naturally leads to the question: for those SMEs who were successful in securing financing, which types of lenders were they turning to?

This leads us into the shifting landscape of SME loan origination in the next section.

Loan Origination by Lender Types

The evolving lending environment in 2024 didn’t just affect the amount of credit SMEs can avail to, it also reshaped where they sourced their loans from.

As mainstream banks turn more conservative in their risk appetite, many SMEs began turning to alternative options: foreign banks with smaller SME franchise footprint in SG, newer digital banks, and non- bank alternative lenders.

Our internal data shows that local banks remained the dominant source of SME financing, accounting for 59% of total approved loans originated within our platform. However, this represents a gradual decline from 61% in 2023 and 70% in 2022.

Meanwhile, foreign banks increased their loan origination share to 26%, up significantly from 19% the year prior. This rise suggests that foreign lenders may be more willing to compete for market share in Singapore’s SME segment, potentially offering differentiated underwriting approaches compared to domestic incumbents.

Digital banks, once touted as a game-changer [2] in SME finance, saw their share dip to 8% in 2024, down from a high of 17% in 2023. We believe this could be partly due to a recalibration after early aggressive acquisition push and early-stage credit tightening as digital banks mature and optimize their portfolio risk.

Recent changes in top leadership, with new appointed CEOs for Anext [3], GXS [4] and Maribank [5] could also point to new strategic shifts and directions.

Digital banks remain a critical part of the ecosystem—particularly for smaller loan sizes and underserved borrower profiles.

Meanwhile, “Other” lenders, including non-bank financiers and P2P lending platforms, gained a modest foothold, growing from 3% in 2023 to 7% in 2024.

These players often serve niche segments or operate with more flexible credit models, attracting SMEs who fall outside traditional banking credit parameters.

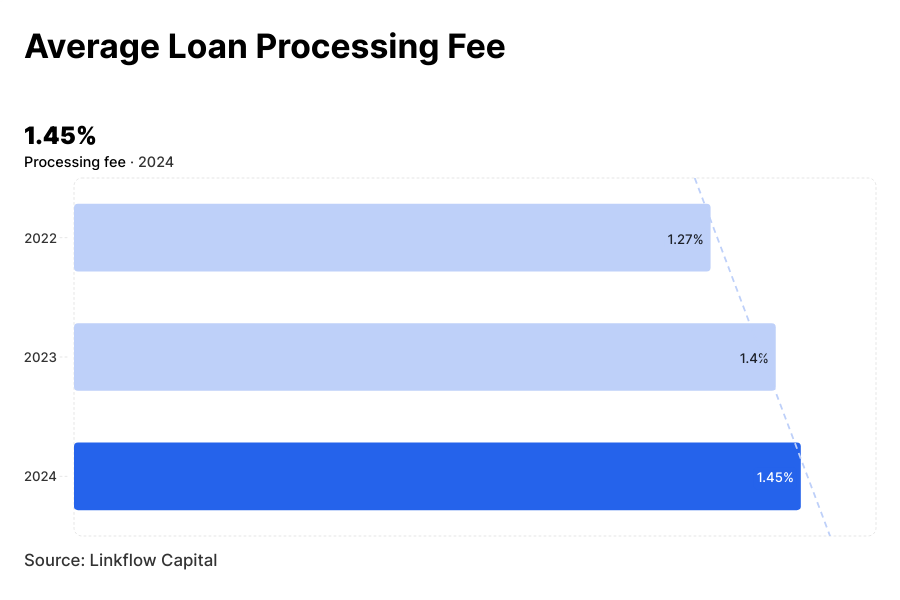

Banks’ loan processing fee

As lenders recalibrated their risk models, loan processing fees continued to creep upward. Our data indicated a slight upward pressure on costs from banks, with an average processing fee of 1.45% in 2024, up from 1.40% in 2023 and 1.27% in 2022.

While marginal in absolute terms, this trend reflects the higher cost of capital across the board and tighter risk-adjusted pricing mechanisms employed by lenders.

Together, these developments suggest that SMEs today must be more strategic not just in preparing their loan applications, but also in choosing the right lending partner—balancing approval likelihood, cost of borrowing, disbursement speed, and long-term financing flexibility.

Having examined the shifting landscape of lenders, let's turn our attention to the profile of the SMEs themselves who were actively seeking financing in 2024. What does the profile of these businesses tell us about credit demand across different stages and sectors?

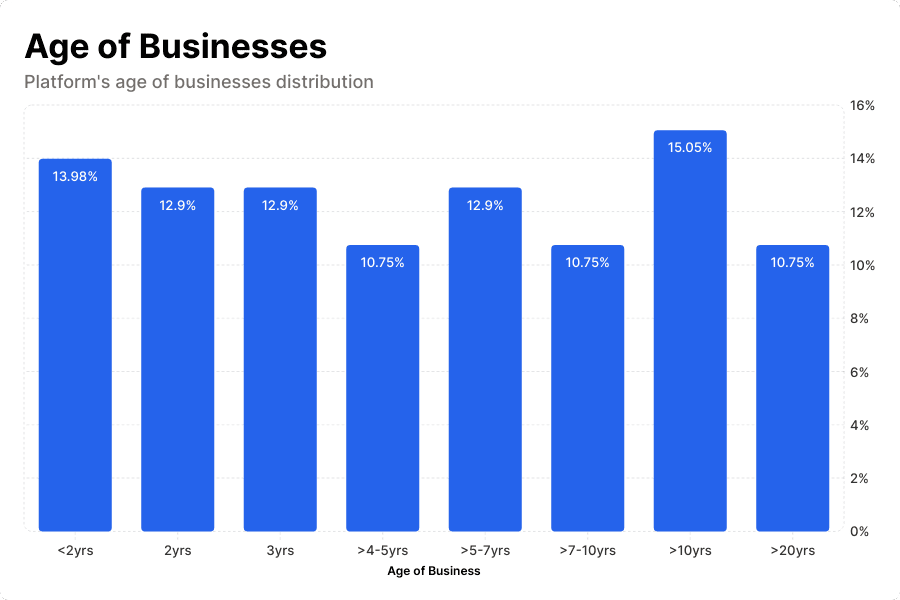

Age of SMEs seeking financing

Our data shows a broad range of SME profiles accessing financing, with no clear dominance by any specific stage of business maturity.

In 2024, the distribution by business age was relatively even, indicating that both younger and established businesses were active loan seekers. This contradicts the notion that only startups or new companies drive financing demand.

Instead, SMEs across all life cycle stages continued to engage lenders for working capital or growth needs, albeit cautiously.

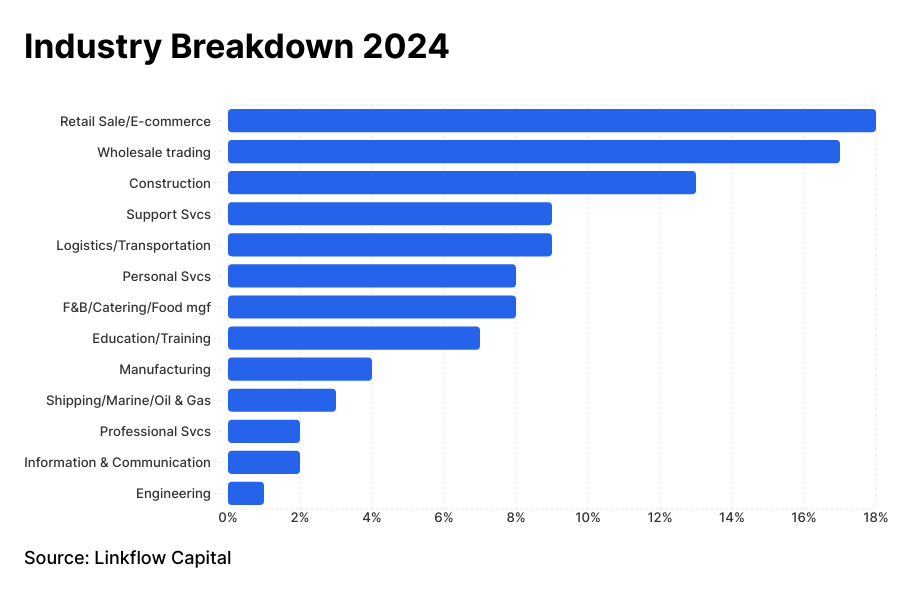

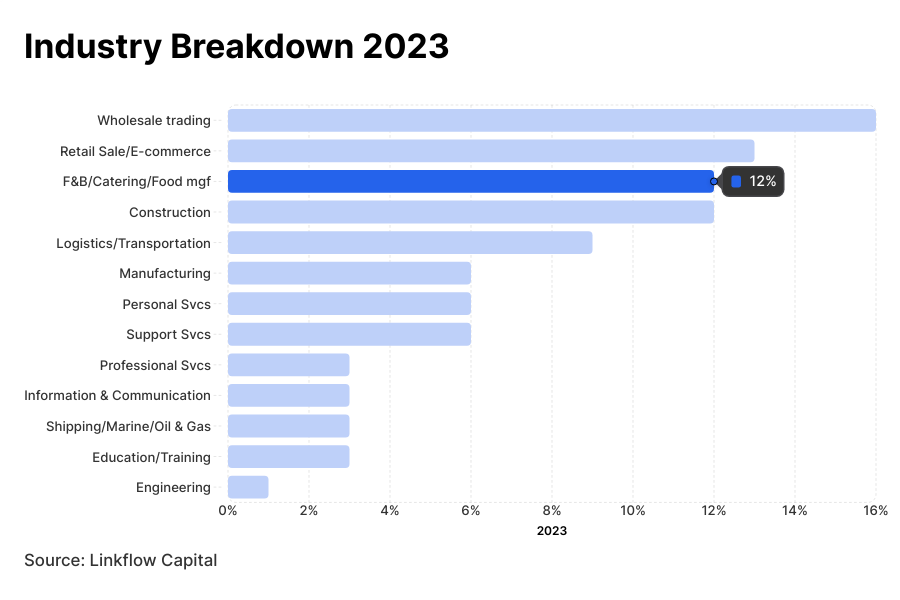

Industry segments breakdown

The Retail and Wholesale Trading forms the two largest industries within our platform. SMEs in the construction industry also grew in segment share vs 2023, driven by resumed infrastructure and building projects.

In contrast, F&B experienced a significant drop, falling from third highest segment in 2023 (12% of clients) to sixth in 2024 (8% of clients). This aligns with industry reports indicating rising closures among restaurants and cafes in Singapore.

Over 3,000 F&B establishments shut down [10] in 2024, marking a two-decade high, as many struggled with high operating costs, tight labour shortages, and fierce competition.

Other sectors such as logistics, professional services, and education held relatively stable demand, with minor shifts year-on-year.

The varying credit activity levels across industries underscore how sector-specific economic health directly influences financing decisions. While some sectors demonstrated resilience, the pronounced difficulties within F&B industry highlight the vulnerability of certain segments.

This leads us to the consideration within the broader picture of business distress and cessation across the economy.

Rising Business Closures Amid Financing Constraints

The sector-specific pressures observed in the F&B sector were part of a broader trend of rising business closures and possible sprouts of financial distress across the SME landscape in 2024.

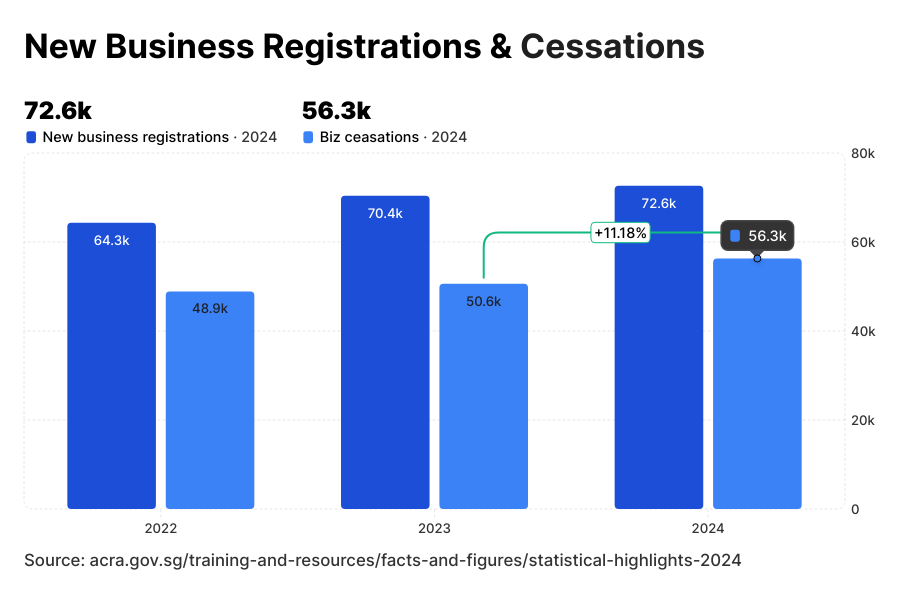

In 2024, business cessations rose to 56,291, marking an increase from 50,630 in 2023. This is an increase of about 11% in business cessations, compared to an increase of about 3% in new business registrations from 2023 to 2024. [5]

While the registration and cessation of businesses is part of normal economic churn in any functioning market economy, the spike in companies facing compulsory liquidation in 2024 could be a concern.

The Ministry of Law reported a record number of 307 Singapore registered companies forced to wind up in 2024 [6]. This is a jump of 53% from 2023 and the highest number recorded in the past 15 years.

MinLaw also reported a 24% increase in total bankruptcy applications filed in 2024 (4,925 cases). 59% of these applications were initiated by the debtors themselves, continuing a five-year trend. [7]

"Slightly more than two-fifths of bankruptcy orders in the first half of 2024 were due to business failures."

- Mr Alvin Tan, Minister of State for Trade & Industry

The rise in business cessations (both voluntary and compulsory) coincides with higher bankruptcy rates, higher debt servicing burdens, and elevated interest rates. Many SMEs who are not as well capitalized as larger firms may have chosen to exit the market.

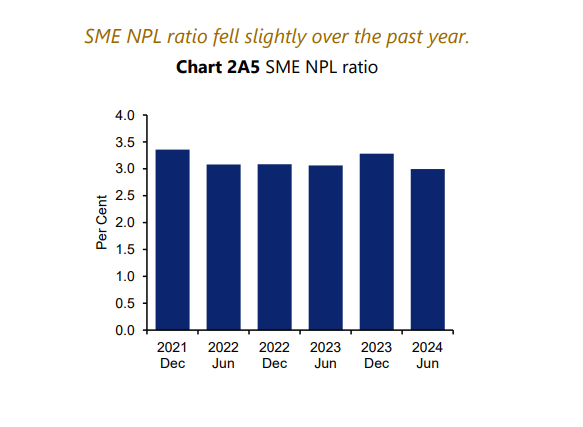

We would have expected the uptick in bankruptcies and winding ups in 2024 being translated into higher NPL (non-performing loans) in the banks’ loan books. This was surprisingly not the case.

SME NPL (non-performing loans) ratio

The aggregate Non-Performing Loan (NPL) ratios for SMEs reported by MAS [1] declined in 2024 from 2023 and remained relatively contained, at about 3%.

However, the rise in both corporate cessations and bankruptcies signal potential underlying stress. These metrics suggest mounting pressure on segments of the SME sector, potentially serving as leading indicators of financial vulnerability that may not yet be fully captured in lagging NPL statistics.

On the ground, from late Q3 2024, we have been hearing from many of our banking partners on potential concerns of NPL ratios trending up. We anticipate the SME NPL ratio inching above 3% in 2025.

The rise in business exits reflects the tangible consequences of the tougher operating and financing conditions faced in 2024.

This challenging backdrop sets the context for examining the forward-looking sentiment influencing the SME financing outlook in the year ahead.

Outlook for 2025

We see glimmers of stability in the financing landscape after a period of tightening conditions and elevated interest rate. While lending remains cautious, the outlook for the remainder of 2025 points toward a modest easing in borrowing costs.

Business sentiment surveys reflect this cautious optimism. Both the SBF National Business Survey 2024 [8] and the CPA Australia Small Business Survey (Singapore) 2024-2025 [9] indicate improved growth expectations among SMEs, although anticipation of easy credit access has moderated.

Source: SBF National Business Survey 2024

Source: CPA Australia Small Business Survey (Singapore) 2024-2025

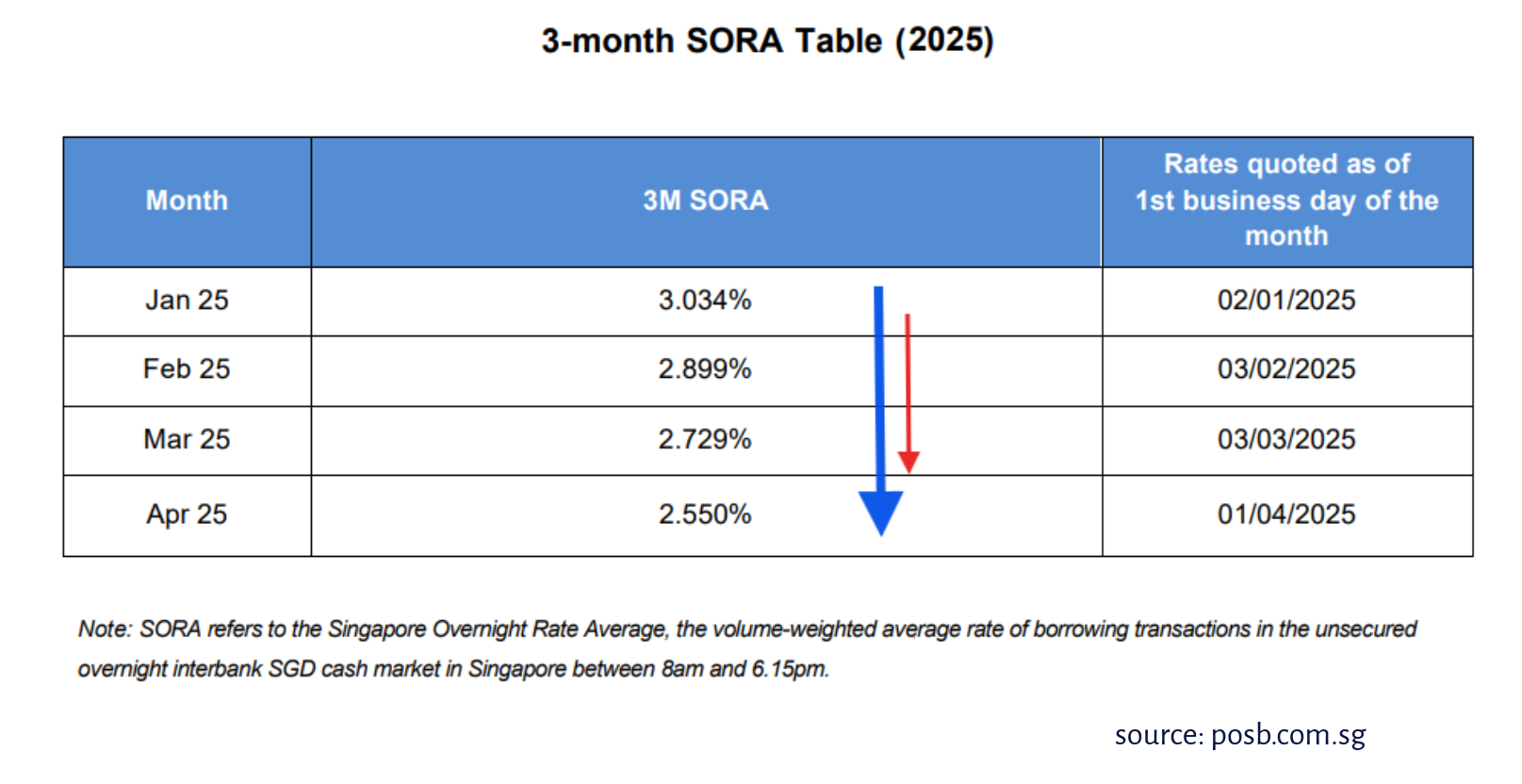

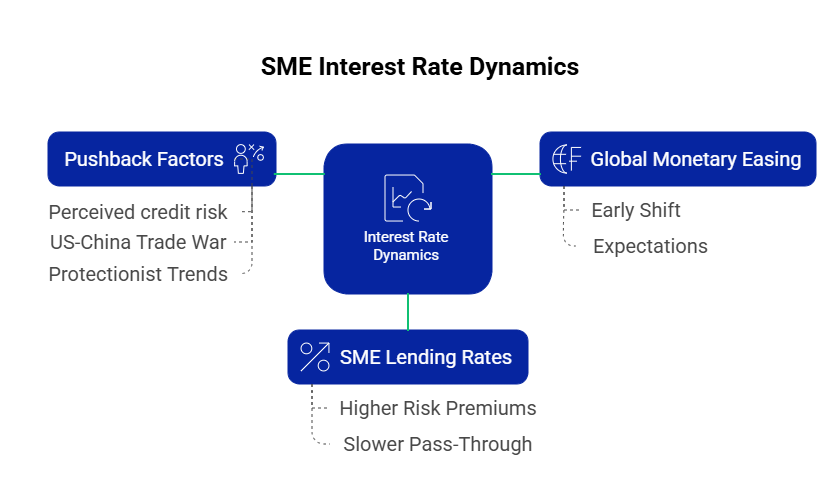

One encouraging trend is the steady decline in the 3-month SORA, which dropped from 3.034% in January to 2.550% in April 2025.

This signals an early shift in interest rate direction, aligning with expectations of global monetary easing.

However, SME lending rates are generally stickier compared to mortgage or consumer rates, often reflecting higher risk premiums and slower pass-through.

Any decline in business loan interest rates is likely to materialize only from Q3 2025 onwards, and even then, we expect the reduction, if any, to be limited.

Pushback factors remain. Any downward pressure on rates might be counteracted by factors increasing perceived lender risk, including heightened caution stemming from the volatile global environment.

Geopolitical tensions, the US-China trade war, and protectionist trends globally could further restrain lenders’ risk appetite.

Ground feedback from lenders indicates that SME non-performing loan (NPL) ratios are starting to creep up, particularly in sectors facing persistent costs inflation or oversupply (F&B).

On a more optimistic note, policy support is expected to play a key role in cushioning access to credit. Budget 2024’s announcement of the permanent increase in the SME Working Capital Loan cap to $500,000 is a positive structural enhancement.

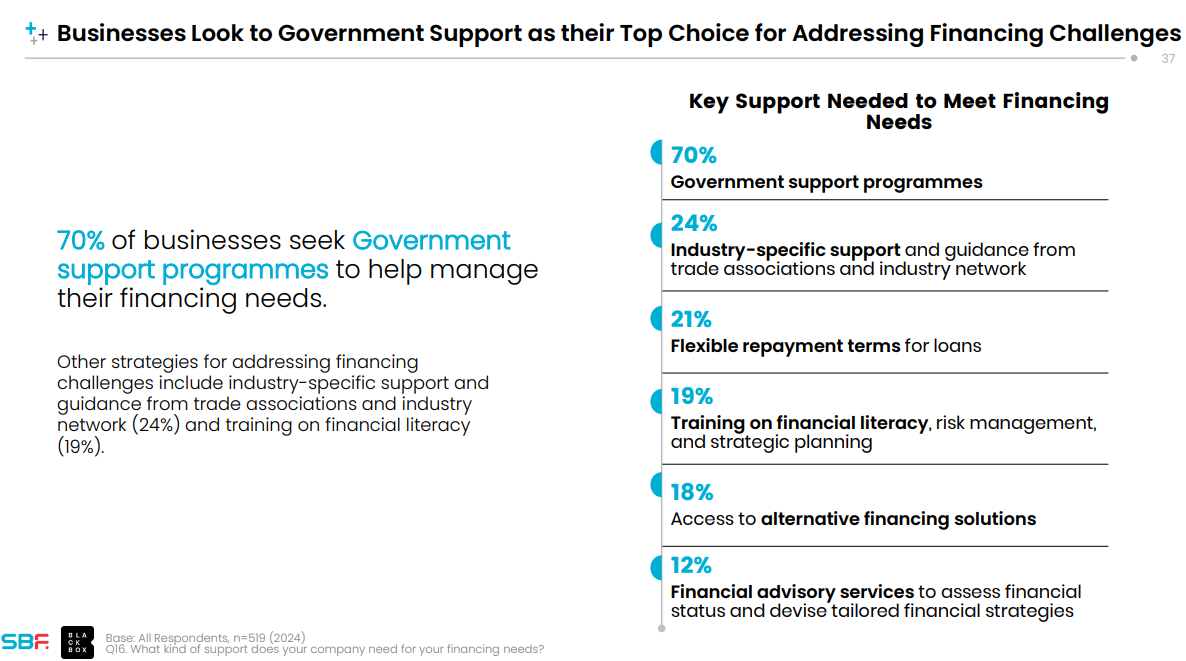

According to the 2024 SBF National Business Survey, 70% of businesses cited government financing schemes as their primary source of support to navigate credit challenges. These programmes remain a key source of liquidity for cash-strapped SMEs, especially amid tightening bank credit.

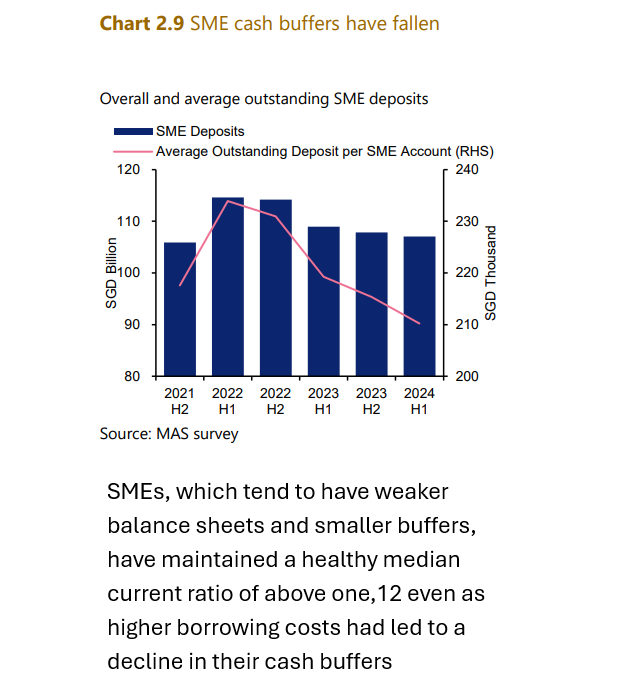

Nonetheless, liquidity concerns persist. MAS data [1] reveals a consistent decline in average SME cash deposits per account since 2022, pointing to thinning cash buffers. The median current ratio for SMEs remains above 1.0, but the trend is weakening.

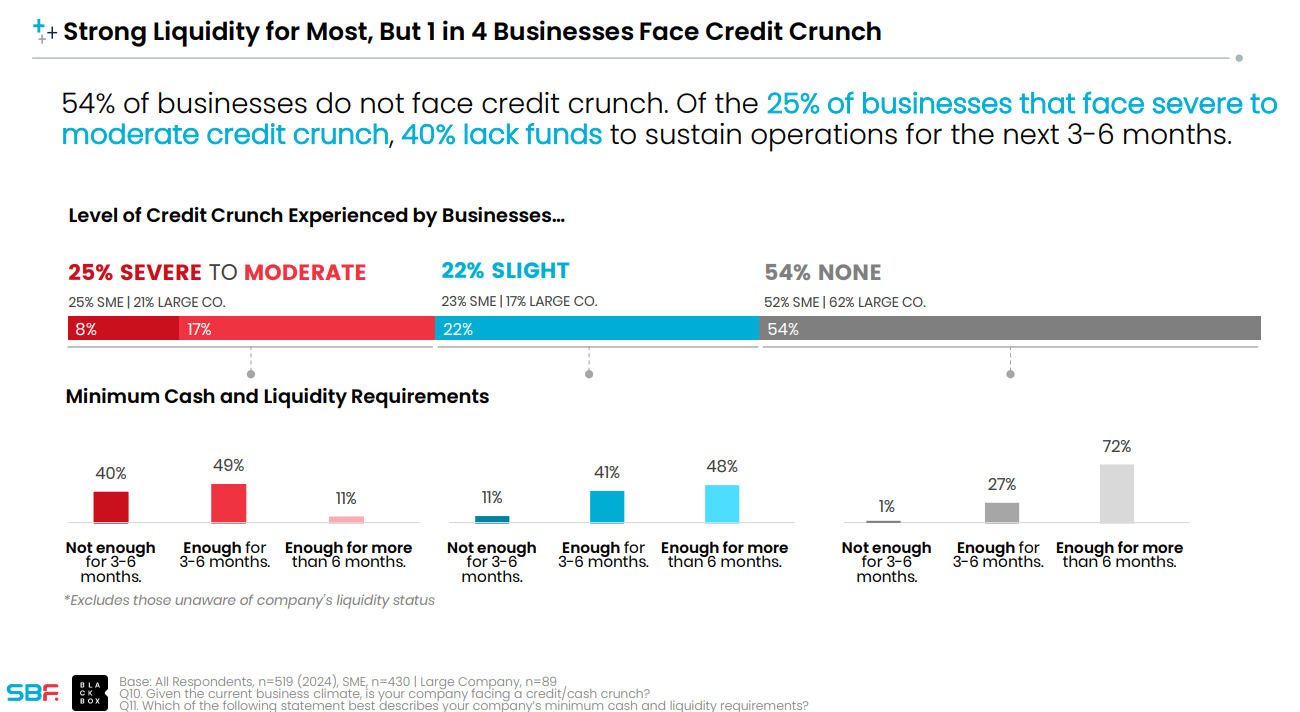

This aligns with the SBF survey finding that 1 in 4 businesses faces a severe or moderate credit crunch, with 40% of these companies lacking sufficient funds to sustain operations beyond the next 3–6 months.

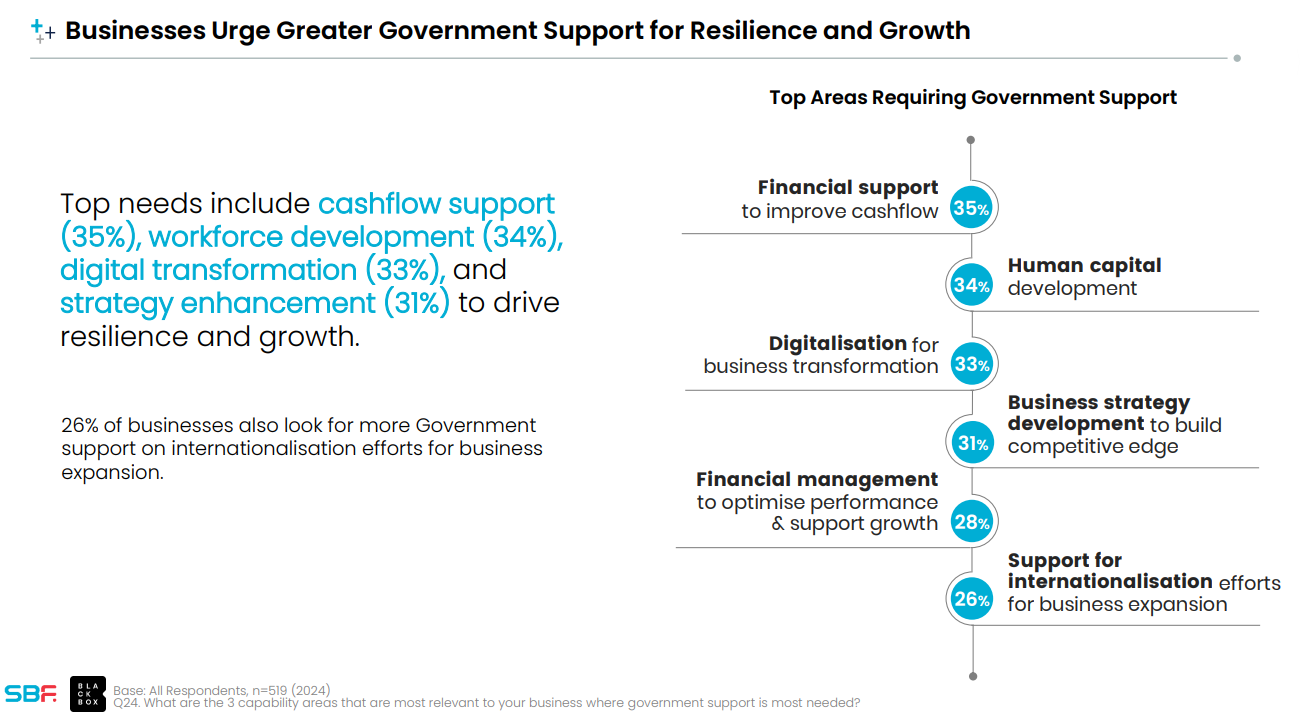

Businesses are seeking help to bridge these cash flow gaps. The number one need businesses indicated needing government intervention with is financial support to improve cashflow, followed closely by workforce and digitalization support.

Final Note

In the current volatile economic environment, it is critical for SMEs to prioritize cash flow management and pre-emptively strengthening liquidity buffers.

Where viable, locking in affordable financing now can offer breathing room in the event of delayed receivables, inventory write-downs, or unexpected supply chain shocks.

Given Singapore’s high trade dependence, three times the size of its GDP, and the uncertain geopolitical environment caused by US tariff war, SMEs remain especially vulnerable to external disruptions.

The trickle-down effect in the event of a prolonged global trade slow down will hurt almost all industries, including domestic facing service-based SMEs.

Prudent credit planning will be essential to navigating the uncertain quarters ahead. For SMEs who do not require to load up on credit facilities right now, we advise being mindful of cash flow.

SME business owners are encouraged to keep a constant eye on the books. Maintaining healthy free cash flow and sufficient cash buffers will improve chances of obtaining financing approvals from banks. These are critical credit metrics banks assess on.

Our mantra has never changed for SMEs, on financing; always apply from a position of strength. Banks and lenders will always extend financing to borrowers who can prove they don’t need it.

Research methodology

This study employs a quantitative approach based on data collected from our SME financing comparison platform. The methodology encompasses the following key aspects:

- Data Collection: We aggregated data from 2,216 unique users of our SME loan portal between January and December 2024. We also included internal data from clients’ financing engagements within our platform for the same period.

- Data Cleaning: To ensure data integrity, we implemented a rigorous process to remove duplicate entries and filter out spam/unverified submissions from the database.

- Sample Characteristics: The dataset comprises self-reported information provided by SMEs seeking financing options. It's important to note that the data was used "as is" without manual verification of individual entries.

- Data Analysis: We conducted statistical analysis on anonymized and aggregated data of our internal financing applications to derive insights into SME financing trends, loan approval rates, interest rates, and sector-specific patterns.

- Anonymization and Aggregation: All internal statistics were anonymized and aggregated to generate summarized insights, ensuring the privacy and confidentiality of individual user information, while adhering strictly to the Personal Data and Protection Act 2012 (PDPA).

- Limitations: While this methodology allows for a broad overview of SME financing trends, it relies partially on self-reported data and may not capture the full spectrum of SME financing activities in Singapore.

This approach enables us to compile a comprehensive snapshot of the SME financing landscape in Singapore for 2024, offering valuable insights for stakeholders as well as SMEs.

Sources and References

[3] https://www.straitstimes.com/business/singapore-digital-bank-anext-announces-new-ceo

[5] https://www.acra.gov.sg/training-and-resources/facts-and-figures/statistical-highlights-2024

[6] https://www.businesstimes.com.sg/companies-markets/number-compulsory-wind-ups-rise-more-50-2024

[10] https://www.channelnewsasia.com/commentary/singapore-fb-restaurants-food-industry-closures-4930471