SME Equipment Machinery Loans in Singapore

Equipment or machinery loan is a facility that finances your purchase of equipment or machinery such as CNC line, forklifts or an excavator.

Equipment and machinery investment for your business ties up heavy capital. Obtaining an equipment or machinery loan can help:

- Preserve working capital & cash-flow – monthly instalments match revenue generated by the asset.

- Accelerate productivity-grant deployment – many government grants (e.g. EDG, PSG) can be tapped to offset partial costs of upgrading.

- Tax advantages – you might still be able to claim capital allowances while the interest expense on the equipment loan is deductible.

What Is an Equipment or Machinery Loan?

An equipment or machinery loan is a credit facility secured against the asset you are acquiring. Unlike an unsecured SME term loan, lenders treat the machine as primary collateral, so you enjoy higher loan-to-value (LTV) and longer tenures.

Different banks use various terms to describe such SME financing facility, including: equipment financing, machinery financing, machine loan, fixed asset loan etc.

We’ll share some common financing structures banks and financial institutions typically use.

Hire Purchase (HP)

Equipment hire purchase is a credit facility that allows a business to finance and retain the right of use of an equipment over a specified period via monthly instalments payments. The business (hirer) does not gain ownership of the equipment till full repayment of the HP loan.

Legal title of the asset remains with the financier until you service the last instalment, at which point ownership automatically transfers to you. Hire purchase is one of the most common form of equipment financing in Singapore.

Using hire purchase facility would make sense to a business owner if the asset acquired has tangible resale value or long economic lifecycle.

Loan to valuation (LTV)

Banks can typically finance up to 80% to 90% of the purchase price or valuation of the equipment or machine, whichever is lower. This is for new equipment/machinery. For used equipment/machinery, maximum LTV is typically between 50% to 70%. Repayment period ranges between 3 to 8 years.

For the shortfall deposit which can’t be financed under hire purchase, you can consider using an unsecured business loan to finance, if you wish to leverage further with no cash outlay.

Hire purchase interest rate for equipment/machinery loan from banks ranges between 2.2% to 3.5% p.a. flat rate. Factors that affect interest rate quoted include the resale value of the asset, borrower’s credit profile and financing quantum.

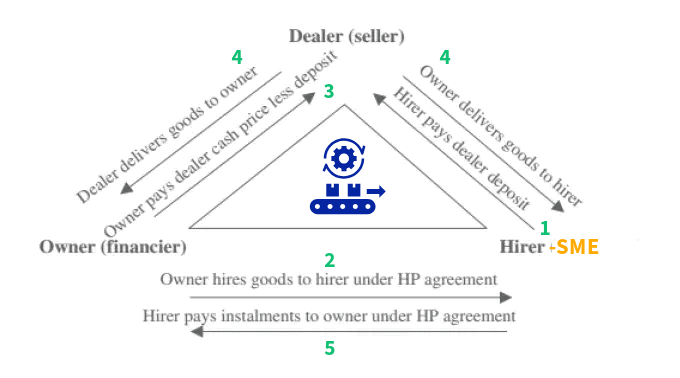

Hire purchase arrangement with supplier

Commonly, the supplier of the machine/equipment will also be involved in the hire purchase flow and arrangement. Hirer in the terms below, refers to the SME business.

- Get Quotation from supplier – Hirer chooses the machine, obtains supplier’s quotation and specifications of the machine/equipment.

- Credit Approval – Quotation and company financials sent to bank for credit assessment. Bank sets LTV, tenure, and interest rate.

- Sign Documents – Financier issues a purchase order to the supplier; hirer signs the hire-purchase agreement and any guarantees. Hirer pays supplier down-payment not covered under hire purchase.

- Financier Pays Supplier – Bank pays the net price; legal title shifts from supplier to financier immediately.

- Delivery & Acceptance – Equipment arrives at the hirer’s site. Hirer acknowledges delivery & acceptance documents and begins monthly repayments for the hire purchase.

- Final Instalment – After final instalment is paid, the financier releases its charge on the asset and transfers full ownership to the hirer.

Finance lease

A finance lease is a long-term rental arrangement where a lessor (finance company) purchases the asset you select and “leases” it to you for a fixed period. You pay predetermined rentals covering most of the asset’s cost, plus finance charges.

Unlike operating leases, the lease term covers the bulk of the asset’s economic life, and your business effectively assumes most risks and rewards of ownership, even though legal title remains with the lessor.

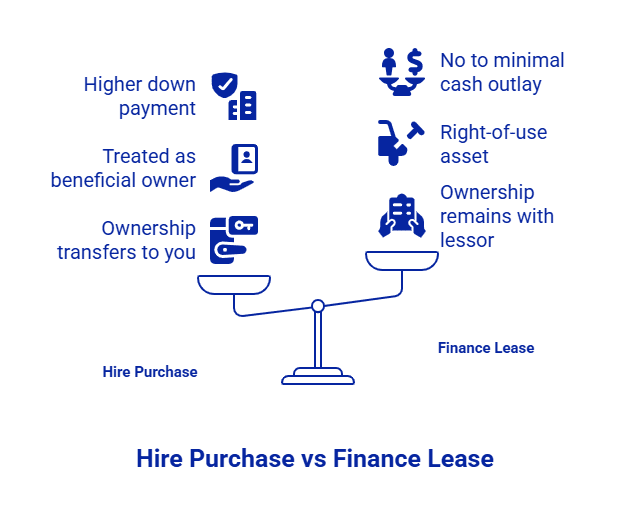

Key Differences Between Hire Purchase and Finance Lease

Hire purchase (HP) and finance lease differ fundamentally in ownership, risk allocation, and accounting treatment.

Under an HP arrangement, the financier holds legal title of the asset until you complete all instalment payments, after which the ownership of the asset automatically transfers to your business.

You’re treated as the beneficial owner from delivery, claiming capital allowances and deducting interest expense, while the financier’s interest is secured by charge or debenture on the asset. At the end of the loan term, ownership of the asset automatically vests in your business.

In contrast, a finance lease keeps legal title firmly with the lessor throughout the lease term. You pay fixed rentals that cover nearly all the equipment’s cost plus finance charges, but you never automatically become the owner.

Instead, you account for the leased asset under IFRS 116 as a “right‐of‐use” asset and corresponding lease liability on your balance sheet. Residual‐value risk lies with you if you plan to purchase at the end of lease term, for a mutually pre-agreed fee/price with the lessor.

You may bear the difference between the estimated and actual resale value. Finance leases often require little to no deposit and may include maintenance or upgrade provisions, making them well suited to assets with rapid obsolescence or unpredictable residual values.

Leaseback / sale leaseback

A leaseback arrangement is a contractual agreement where the financier purchases equipment or machinery presently owned by a business and lease the same asset back to the business. The business continues to retain right of use over the asset.

This is a less common financing arrangement for SMEs. It is more typically utilized when businesses need to unlock cash in a fixed asset they own, yet they still need the asset to operate the business.

Not many financial institutions offer such financing arrangements in Singapore. Only a handful of specialist lenders, such as Sumitomo Mitsui Finance and Leasing, might avail such leasing models.

Operating Lease

An operating lease is a rental agreement where the lessor (a finance company or leasing specialist) retains both legal title and the risks and rewards of ownership for the leased asset.

Your business, as the lessee, pay periodic lease rentals for the use of the equipment over an agreed term. This is typically shorter than the asset’s full economic life. You then return it at lease end without any obligation to purchase.

Under an operating lease, the lessor purchases and owns the asset outright and takes responsibility for residual‐value risk when you return the equipment. Your company simply recognises lease rentals as an operating expense, without adding the asset or lease liability to your balance sheet (subject to applicable accounting standards exemptions for short‐term or low‐value leases). This keeps your leverage ratios lower and preserves borrowing capacity for other purposes.

Key Characteristics

- Lease Term & Tenure

Operating leases typically run for 1 to 5 years, or a proportion of the asset’s useful life, with no ownership transfer at the end. - Rental Payments

Rentals are set to cover only a portion of the asset’s cost, plus finance and lessor overhead. Because the lessor expects to remarket or re‐lease the equipment, rentals are lower than finance lease or HP instalments. - Maintenance & Services

Often bundled into the lease package, operating leases can include service, maintenance, and repair agreements. This reduces internal overhead and maintenance risk. - Off-Balance-Sheet Treatment

For leases qualifying as short‐term (≤ 12 months) or low‐value, you can avoid capitalising the asset and liability, booking rentals directly as expenses.

Operating lease is suitable for assets with rapid obsolescence or seasonal/short‐term needs, where outright ownership is less important than flexibility. These include light office equipment such as computers and photocopiers.

Opt for an operating lease if you value lower periodic costs, service inclusions, and the ability to upgrade or return the asset at lease end without ownership obligations.

This structure preserves your balance sheet , reduces administrative burden, and offloads residual‐value risk to the lessor, making it ideal for fast‐moving technology, short‐duration projects, and non‐core assets.

Enterprise Financing Scheme (EFS) - Fixed Assets

A secured term loan backed by Enterprise Singapore’s Enterprise Financing Scheme -Fixed Assets (EFS-FA). This is a conventional loan where your business borrows a lump sum to purchase or upgrade equipment and machinery, using the asset, and often other company assets, as collateral.

Unlike the unsecured SME Working Capital Loan under EFS, this is a secured loan with collateral required.

Under EFS-FA, Enterprise Singapore provides risk sharing of between 50% to 70% to participating financial institutions, incentivizing banks to finance SMEs that might traditionally be viewed as higher credit risk.

- Loan Structure

• You apply to a participating bank for a term loan sized to cover up to 100 % of the equipment cost (subject to bank credit assessment).

• The asset and, in many cases, a company debenture secure the facility. - Tenure & Pricing

• Tenure: Up to 15 years, matching the useful economic life of heavy machinery and fixed assets.

• Interest Rate: Floating or fixed, often benchmarked to SORA + bank’s spread/margin. - Use of Proceeds

- Purchase of new or used machinery

- Installation, commissioning, and ancillary costs

- Factory or workshop expansion directly tied to the equipment

Key Advantages

- Lower Collateral Requirement: With Enterprise SG providing co-sharing risk guarantees, banks may not require further collateral aside from the asset being acquired.

- Longer Tenures: Align repayments with long depreciation cycles, preserving cash-flow.

- Competitive Pricing: Government risk-share might enable tighter interest spreads versus unsecured or standard fixed-asset loans.

| Ownership Legal Title | Financier holds title until final instalment, then transfers automatically to hirer. | Lessor retains title throughout; no automatic transfer (purchase option may be available at lease end). | Lessor retains title during and after term; lessee never owns the asset. |

| Funding Ratio (LTV) | Up to 90% for new equipment; 70% – 80% for used. | Up to 100% (including installation & residual value coverage) | Typically 80% – 90%, depending on asset age and lessor policy. |

| Tenure | 3 – 8 years (new); 3 – 5 years (used). | 1 – 5 years, often aligned to most of the asset’s useful life. | 1 – 5 years (shorter than full economic life); can be as short as project duration. |

| Accounting Treatment | On-balance-sheet: asset + liability; claim capital allowances; deduct interest expense. | On-balance-sheet “right-of-use” asset + lease liability. No capital allowances; lease rentals expensed over term. | Off-balance-sheet for short-term/low-value leases (rental expense only); otherwise under right-of-use accounting; rentals expensed. |

| Residual Value | No residual | Set by lessor (typically 5% – 20 %); lower rentals but lessee bears residual-value risk if purchasing | Lessor bears full residual-value risk; lessee returns asset with no further obligation. |

| Flexibility | Low: fixed term and instalments; early settlement allowed with interest rebate. | Medium: some lessors allow mid-term upgrades or swaps; limited flexibility on term changes. | High: ability to upgrade, add services, or return equipment at end without purchase; often include maintenance. |

| Best For | Vehicles, heavy plant, manufacturing machinery, F&B automation | IT hardware, medical/lab equipment, specialised manufacturing tools | Short-lived or project-specific assets |

Key Lending Metric and Terms

These are some of the core and common terms you’ll see in equipment and machinery financing contracts/agreements in Singapore. Understanding these metrics and terms will help you compare offers and structure deals that fit your cash-flow and growth plans.

- LTV - The percentage of the equipment’s purchase price that the financier agrees to fund. Determines the maximum amount of financing.

- Residual Value (RV)- The estimated asset value at the end of a lease term. Lowers your periodic rentals but leaves you exposed to market-value risks if you plan to purchase or return the asset.

- Effective interest rate - Compare apples-to-apples across flat-rate, variable-rate, and lease-rental structures. Note HP interest rates are expressed in simple flat rate, not effective rate.

- Debenture/charge - A security instrument registering the financier’s charge over your asset until final repayment. Registration timelines can affect your project kick-off lead time.

- Retention of title - A clause in HP and lease contracts where the financier retains legal ownership until all payments are made. Ensures you have right-of-use over the equipment immediately, but you can’t sell or refinance it until full settlement.

Keeping these metrics front of mind will empower you to negotiate terms that match both your financial situation and operational needs.

Common Equipment Banks & Lessors Finance in Singapore

Banks and specialist leasing companies in Singapore offer financing for a wide range of assets across multiple industries. Below are some types of equipment commonly funded across various industries.

- Heavy Earth-Moving Machinery: Excavators, bulldozers

- Material Handling & Hoisting: Tower cranes, mobile cranes, concrete pumps, hoists

Manufacturing

- Metalworking & Machining: CNC mills and lathes, laser cutters, press brakes, EDM machines

- Injection Molding & Plastics: Injection-moulding machines, blow-moulding units, extruders

Medical & Laboratory

- Imaging & Diagnostics: MRI scanners, CT scanners, X-ray machines, ultrasound systems. Including dentistry equipment.

- Laboratory Instruments: Clinical chemistry analyzers, flow cytometers, centrifuges, mass spectrometers

Commercial Printing & Packaging

- Printing Presses: Offset printers, digital presses, large-format plotters

- Post-Press Equipment: Collators, binders, laminators, die-cutters

- Packaging Lines: Automated carton erectors, sealers, shrink-wrap machines

Logistics & Material Handling

- Warehouse Vehicles: Forklifts, reach trucks, pallet jacks

- Automation & Racking: Automated storage & retrieval systems (AS/RS), mezzanine racking, conveyor belts

Food & Beverage (F&B)

- Cold-Chain Assets: Blast freezers, walk-in cold rooms, refrigerated transport containers

- Kitchen Automation: Automated fryers, dishwashers, combi-ovens, food-prep robotics

Case Study

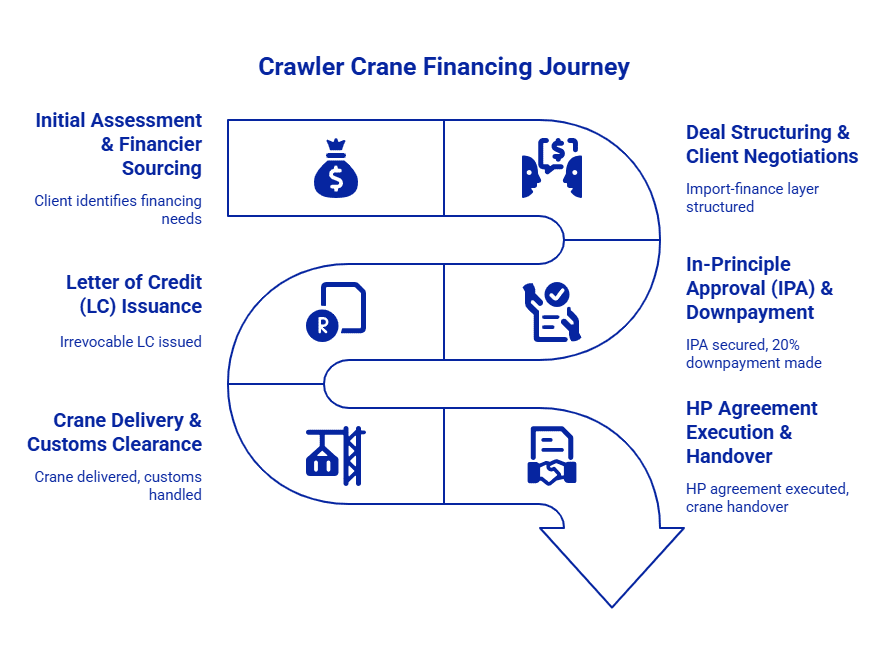

Financing of crawler crane for SME in construction industry, supplier based overseas.

Background & Challenge

- A Singapore construction SME needed a new EUR 900,000 crawler crane from a Europe-based vendor with no local branch or distributor.

- A standard hire-purchase (HP) structure couldn’t apply, since local banks couldn’t register security over an offshore supplier.

Solution Overview

- Identify Specialist Lessor

- We canvassed our network of financial institutions and selected the one offering the most competitive term sheet.

- Secure IPA & Down-Payment

- With the supplier’s pro-forma invoice in hand, we obtained an in-principle HP approval (IPA).

- The SME paid a 20 % down-payment directly to the supplier as a commitment fee.

- Layer in Import Finance via LC

- We arranged for the financier to issue an irrevocable Letter of Credit (LC) covering the remaining 80%.

- The LC guaranteed payment to the supplier once compliant shipping documents were presented.

- Execute HP Agreement & Customs Clearance

- Upon container arrival, the financier cleared customs and retained legal title.

- The SME and financier signed the formal HP agreement for the financed 80 % balance.

- Delivery & Handover

- The crane was delivered to the SME’s site.

- The SME signed a delivery-and-acceptance certificate and took possession immediately, while title remained with the financier until final payment.

Key Takeaways

- Cross-border capability: Layering an LC within the HP deal bridges jurisdictional gaps when suppliers lack local presence.

- Risk mitigation: The down-payment and LC structure protect both supplier and financier, ensuring smooth fund flow and asset security.

- Speed to deployment: From IPA to on-site handover, the entire arrangement completed within 2 months, letting the SME mobilize the crane rapidly for project work.

Hire purchase typically requires a deposit of between 10% to 20%, so 100% financing isn’t available. You can access full financing via a finance lease if you accept a residual-value payment at lease end. Certain commercial vehicle schemes also offer full funding.

Yes. Banks and lessors will finance used equipment up to maximum 70% of a professional valuation. Eligibility generally requires the asset to be ≤ 10 years old and in good working condition. You must provide the machine’s age, serial number, and a valuation report.

Most lenders require ≥ 1 year operating history for asset-backed financing. If your business is under 1 year old, begin with an unsecured business term loan to acquire the equipment. After trading for 12 months and building a track record, it’s easier to obtain equipment financing.

No, most financiers are not able to finance machinery or equipment that's not located in Singapore. They are not able to lodge a charge or debenture on overseas asset. Unless the financial institution has presence in the country the asset is in, and willing to conduct cross border financing.